Bitcoin, Best In Play

The “risk-on” market sentiment is typically good for bitcoin investments. Bitcoin’s most significant price up moves in 2011, 2013, 2017, and 2020 manifested in economic acceleration periods. Gold is generally doing very well when stocks sell off, and investors run for shelter to bonds in a “risk-off” environment. What we find different this time around is that we see so many possible six sigma event scenarios, that margin calls will quickly absorb bond and gold holdings. While this is also a threat to bitcoin, there are good reasons why bitcoin might be the first to bounce back from such a black swan event. We find the most significant risk is that a series of events could significantly diminish the trust in leadership and the financial system. At this time, people might be most willing to accept the relatively new bitcoin, stirring away from classical banking, especially if the purchase of physical gold is either due to regulation or availability impossible. Bitcoin, best in play.

The Covid environment brought an additional variant risk factor to the table, especially when it comes to investor psychology.

Our last weekly chart book publication made a case for positioning one’s risk hedge plays this year when equity markets most likely trade in a volatile sideways range. We also spoke of a proper wealth preservation strategy, holding both bitcoin and gold within a hedged risk reduction approach for your monies. With our primary focus on risk, the next question is allocation size between bitcoin and gold. As mentioned in the intro, it feels intuitively natural to have significant exposure to the gold side from a cycle history. Yet, insurance seems essential at this time, and as such, we tend to be a bit more aggressive towards bitcoin allocations.

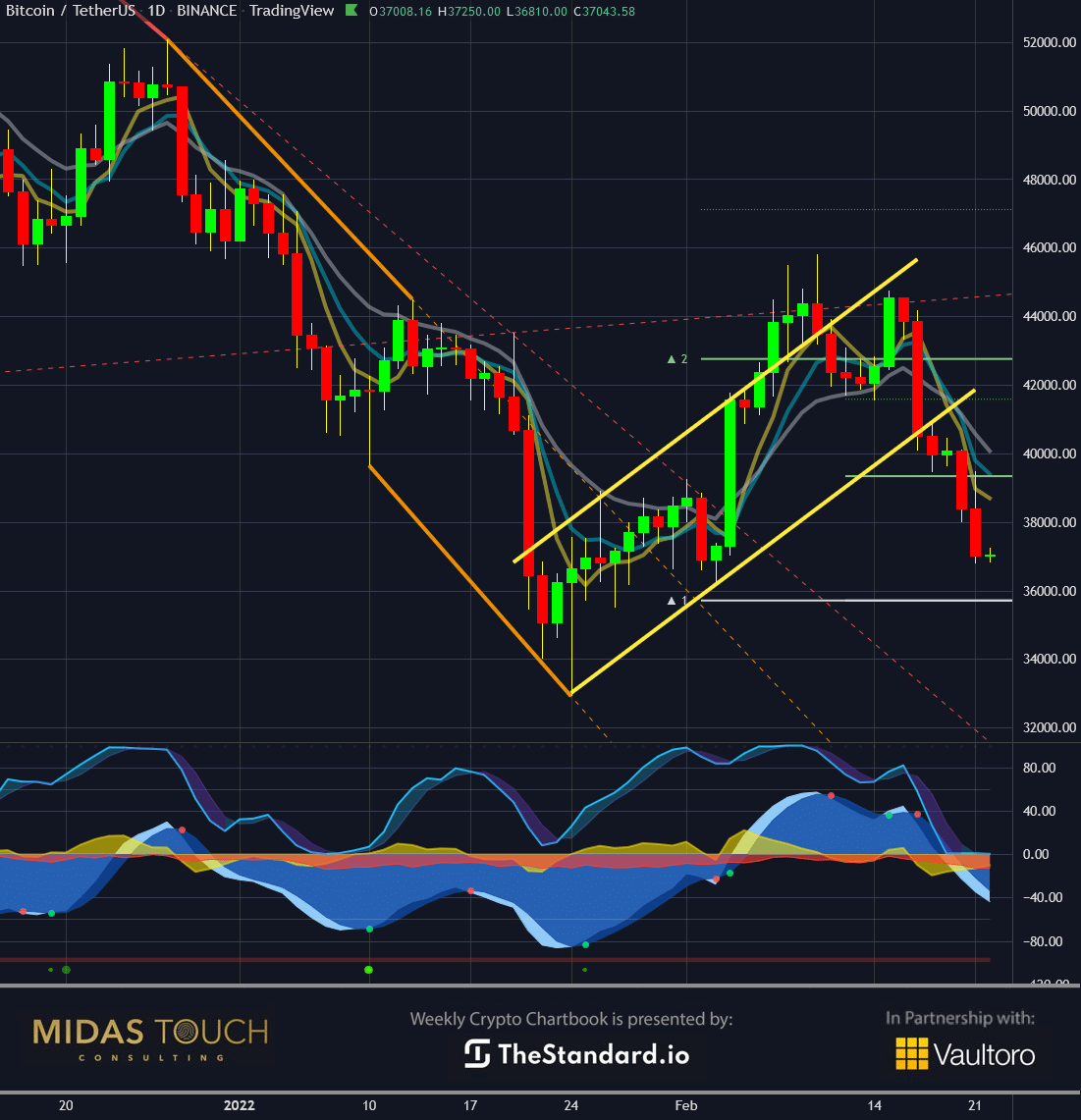

Bitcoin, daily chart, not just yet:

(Click on image to enlarge)

Bitcoin, daily chart as of February 22nd, 2022.

The daily chart reflects the common notion of bitcoin trading alongside PMI numbers and the market as a whole. With the recent break of the modest bounce from the US$33,500 level up leg (yellow up-channel), no immediate low-risk entries for longer-term exposure seems in play.

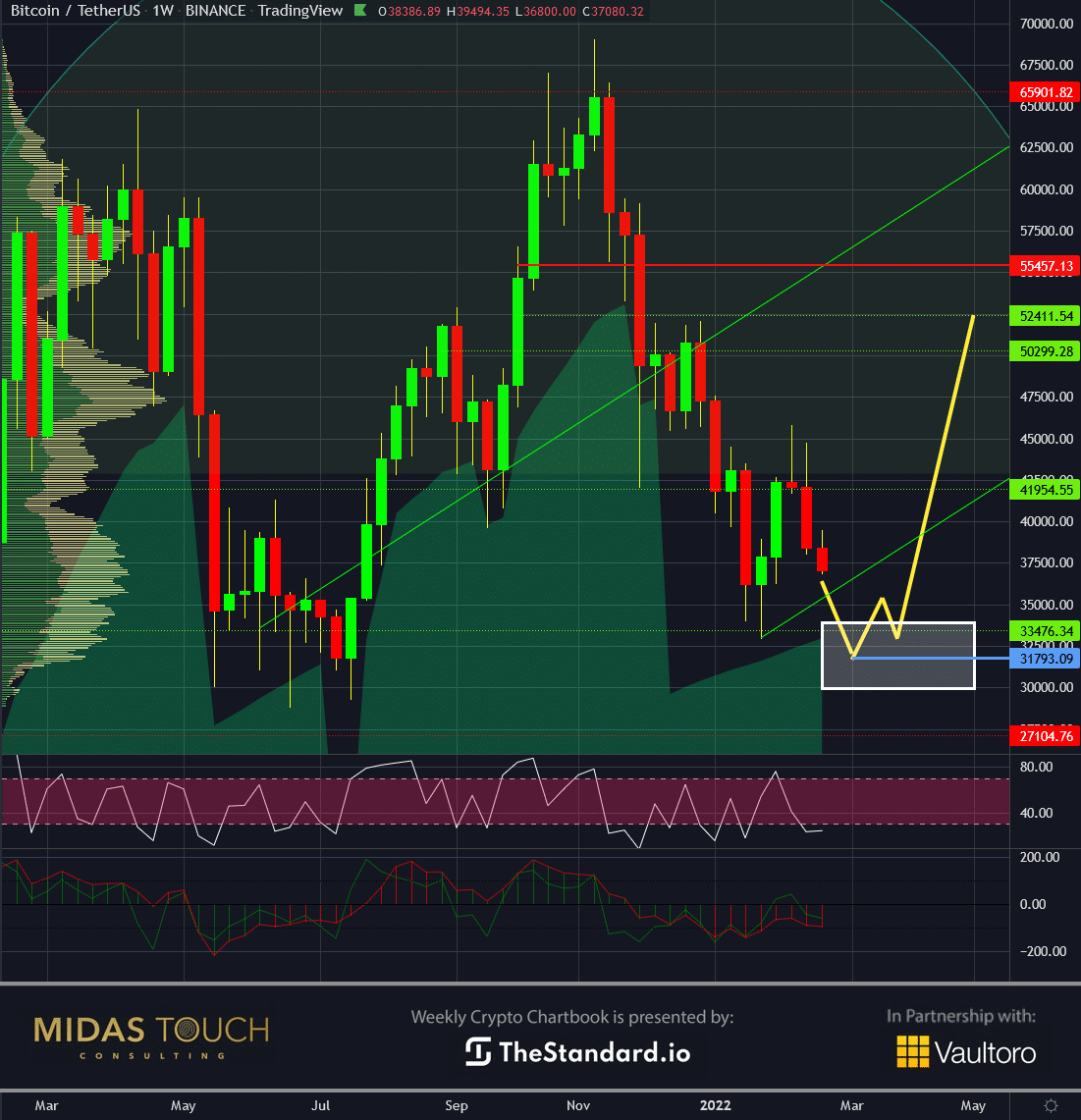

Bitcoin, weekly chart, great setup, bitcoin, best in play:

(Click on image to enlarge)

Bitcoin, weekly chart as of February 22nd, 2022.

Nevertheless, we find now zooming out to the weekly time frame a quite interesting entry zone (white box) between the levels US$30,000 to US$34,000. We identified by stacking multiple edges that an entry near US$31,800 would provide the most low-risk entry profile. However, it will depend on how prices will arrive at these levels.

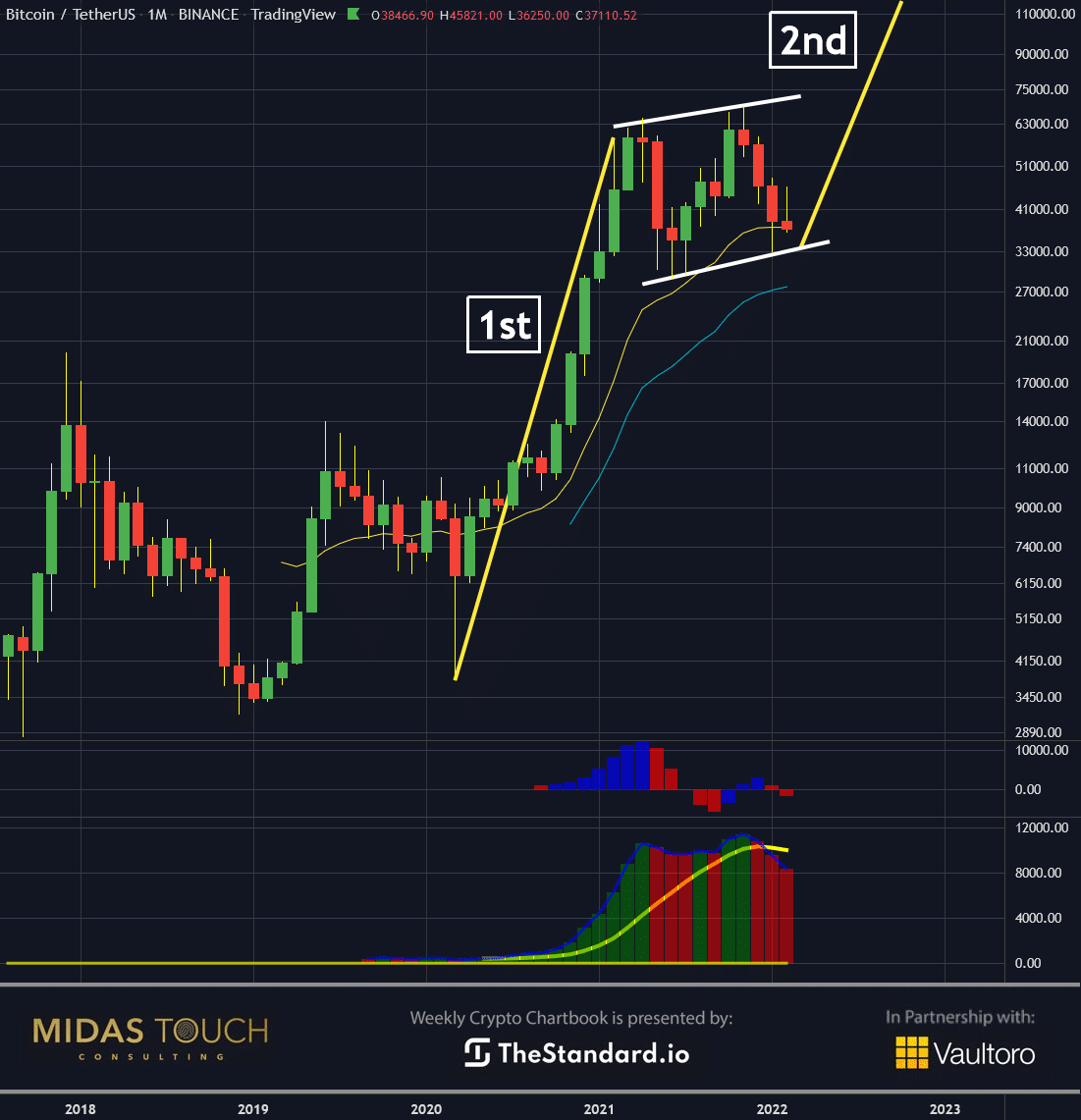

Bitcoin, monthly chart, amazing potential:

(Click on image to enlarge)

Bitcoin, monthly chart as of February 22nd, 2022.

Where matters become more transparent and our headlines supported is at a view of the monthly chart. The first leg up was nothing short of a 1,600% advancement. Now we have been trading for a year in a bullish up-sloping sideways channel. With a possible entry at the lows of this channel, a long-term investment provides for a stellar risk/reward ratio. The second legs are typically longer than the first legs! But that is not all; bitcoin has a higher probability of four-leg moves versus three-leg moves. Consequently, this trade could turn out to be highly profitable after some time.

One aspect of risk is the relationship between the size of a potential down move of price and the size of a likely up move. We find bitcoins’ upward potential much more significant than gold for its fundamental characteristics and stellar outperforming history percentage-wise.

Bitcoin, best in play:

Summing it up, bitcoin might not be at its lowest retracement levels yet. Still, its powerful potential in risk/reward ratio and as an overall risk hedge makes it best in play.

Disclaimer: All published information represents the opinion and analysis of Mr Florian Grummes & his partners, based on data available to him, at the time of writing. Mr. Grummes’s ...

more