Bitcoin At $19,000: How To Trade The Pause

Bitcoin (BITCOMP) has been testing the previous top around $19,000 for 10 daily candles in a row. But so far, the bulls have not succeeded to break it.

Image Source: Pixabay

Will price be able to break above the key resistance? Or is the uptrend over and ready for a reversal?

Price Charts and Technical Analysis

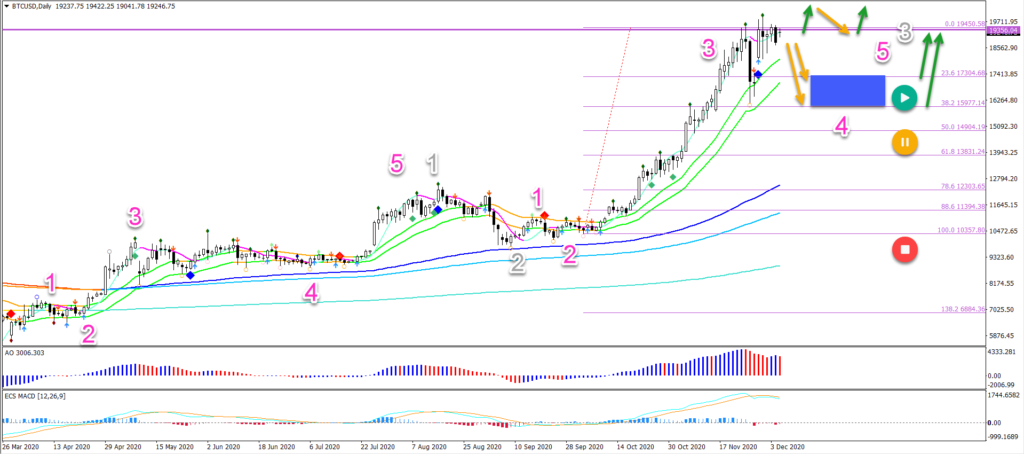

(Click on image to enlarge)

The BTC/USD’s hesitation to break could indicate an extended wave 4 (pink). In that case, price action is expected to test the shallow Fibonacci retracement levels.

A bullish bounce is expected at those Fibs and support zone (blue box). This is a significant confirmation… Why?

- Because it would indicate the development of a larger wave 3 (grey) and uptrend continuation.

- A break below the 50% Fibonacci level would pause (yellow circle) the trend temporarily and a very deep reversal would invalidate it (red circle).

The other likely scenario is an immediate breakout above the previous top. In that case, it would be good to see a break, pullback and continuation. This pattern helps avoid false breakouts. Plus there is also a round level resistance at the $20,000 mark.

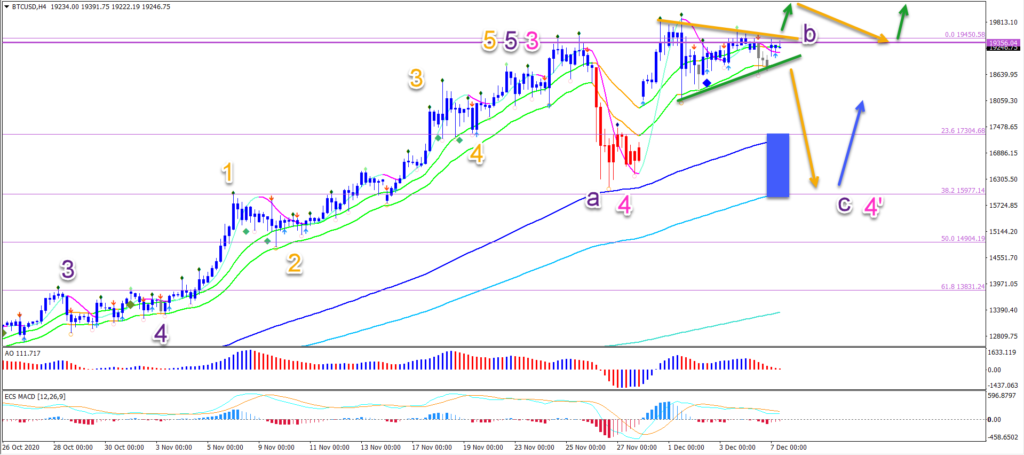

On the 4 hour chart, a break below the support trend line (green) confirms the extension of the wave 4 (pink 4’). The pattern is then completing a bearish ABC pattern (purple).

A bullish breakout should see a break, pullback, and continuation pattern. Otherwise the break remains vulnerable to a deeper retracement.

(Click on image to enlarge)

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit ...

more

I am frequently reminded that "past performance does not guarantee future performance" for stock pricing. That does seem like a very reasonable presumption, especially as it seems that the market in general seems to be driven at least partly by emotions, mostly greed and fear. Then I see postings that appear to represent that an individual has been able to assemble a collection of logic that will predict future behavior. Often the appearance is that they do have something that works.

My thinking is that the truth is different, that rather some individuals have both the talent and insight to perceive accurately the near future, rather than having come up with a procedure to do an analysis.

This may or not be a correct assumption, but it seems reasonable to me.