Beware The Equity Crater

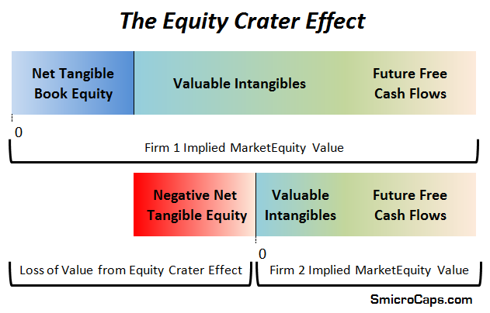

In a class early last academic year, I drew a quick diagram for students to summarize valuation between the balance sheet and income/cash flow statements: simply three blocks making up a horizontal bar. The first block was net tangible equity, the second was intangibles that added value to the company and the third represented the future cash flows that the company was likely to produce according to reasonably constructed financial models.

As we move from the left to the right, things change. Net tangible book equity is on the balance sheet right now and can, assuming financial statements are represented fairly, be valued rather easily. Intangibles are more difficult to measure as some, such as goodwill, are effectively worthless while others are intertwined with future cash flows and can not be liquidated easily. Certainty increases moving from right to left and upside for investors changes in the opposite direction. Future negative cash flows would eat away at tangible assets (cash hemorrhaging or "right folding" effect) and would therefore easily explain why many unprofitable public companies are priced at discounts to tangible equity.

With so many companies leveraged to the tilt, there's an "equity crater" that needs to be filled by future cash flows and/or valuable intangible assets. Many public equities are, on a pure balance sheet basis, worth less than nothing. As a shareholder with limited liability, an investor is not on the hook for that negative equity, but the overall market equity value of the firm, which depends on those future cash flows, is effectively in a hole. Let's try a simple example with two firms with the same estimated amount of valuable intangibles and identical future free cash flows. One has positive net tangible book value of equity and the other has a negative amount with the same absolute value. All things being equal, the value of firm two is less than firm one by two times the net tangible book equity value in question. It's simple to understand but has important consequences, particularly in a market when access to capital is not as easy as it once was.

Disclosure: The author does not have positions in any of the mentioned securities at the time of this writing.