Auto-Loan Rates From Credit Unions Are "Well Below" Rates Being Charged By Banks

We have been extensively covering the upcoming blowup in the automotive lending area for months now. To us, it seems like only a question of "when" and not "if" large looming defaults and delinquencies will begin their deluge in the auto sector.

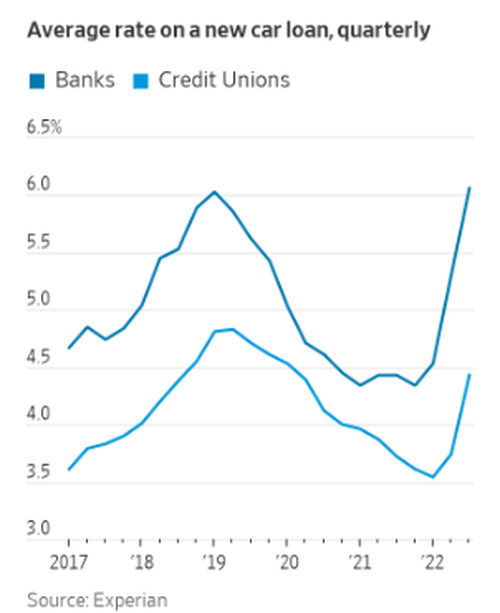

But while lending rates are skyrocketing, there has been one secret corner of the financial world that hasn't seemed to notice the distress that consumers are under: credit unions. Credit unions are offering some of the lowest rates on auto loans of anyone, a new report in the Wall Street Journal revealed this week.

They are "undercutting banks and other lenders by a wide margin", the report says. In fact, in Q3, "credit unions charged an interest rate of 5.94% on average for used cars, well below the 8.36% on offer from banks," it continues.

(Click on image to enlarge)

This marks the widest gap in at least 5 years. Credit unions have offered a rate of 4.43% for new cars, versus 6.6% for banks, the report continues. John Toohig, who trades credit unions’ auto loans as head of whole-loan trading at Raymond James, told WSJ: “They kept rates low when the rest of the market just exploded.”

Mike Schenk, chief economist at the Credit Union National Association, a trade group, added: “In a market where interest rates are going up, credit union loan rates will lag the market up, and then on the other side of the coin, savings yields will lead the market up.”

Keeping rates low has allowed some credit unions to add "billion of dollars" worth of auto loans to their books over the year. For example, the Journal noted:

SchoolsFirst Federal Credit Union grew its total auto loans by 29% in the first nine months of the year. Navy Federal Credit Union’s auto loans rose by 13% and Golden 1 Credit Union’s climbed by 18%, according to financial disclosures.

Capital One Chief Executive Richard Fairbank said this past fall: “Many auto lenders appear to have reflected rising interest rates in their marginal pricing decisions, but others have not, and they have gained market share and pressured industry margins.”

But one thing is clear to us - no matter what rate you get currently, the industry appears to be in distress. This lengthy writeup from days ago details how a "perfect storm" is brewing in autos and how a "massive wave" of repos and loan defaults are likely on their way.

For almost a year now, we have been dutifully tracking several key datasets within the auto sector to find the critical inflection point in this perhaps most leading of economic indicators which will presage not only a crushing auto loan crisis, but also signal the arrival of a full-blown recession, one which even the NBER won't be able to ignore, as the US consumers are once again tapped out. We believe that moment has now arrived.

But first, for those readers who are unfamiliar with the space, we urge you to read some of our recent articles on the topic of car prices - which alongside housing, has been the biggest driver of inflation in the past 18 months - and more specifically how these are funded by the US middle class, i.e., car loans, and last but not least, the interest rate paid for said loans. Here are a few places to start:

- Are We Headed For An "Auto Loan Crisis" As Delinquencies Begin To Rise? - July 7

- A Flood Of Repossessed Vehicles Poised To Hit The Used-Car Market - July 25

- American Drivers Go Deeper Into Debt As Inflation Pushes Car Loans To Record Highs - Aug 29

- Credit Card Rates Just Hit A Record As The Average Car Loan Rises To Fresh All Time High - Oct 9

- New-Car Loan-Rates Set To Hit 14-Year High As Affordability Crisis Worsens - Nov 3

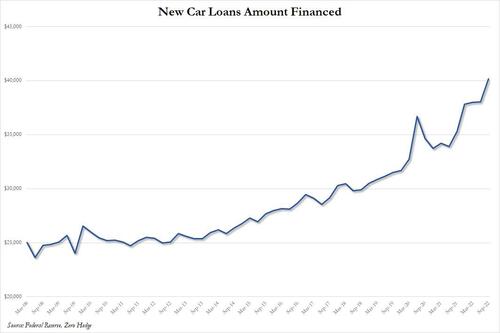

So while the big picture is clear - Americans are using ever more debt to fund record new car prices - fast-forwarding to today, we have observed two ominous new developments: the latest consumer credit report from the Fed revealed a dramatic spike in the amount of new car loans, which increased by more than $2,000 in one quarter, from just over $38,000 (a record), to $40,155 (a new record).

(Click on image to enlarge)

As Twitter's CarDealershipGuy - who claims to be an anonymous auto-industry CEO and whose analysis has been featured in places like the NY Post and who frequently Tweets about the state of the auto market - laid out a long thread on Thursday, all of the above may end up being an overly optimistic assessment of the perfect storm that's about to hit the auto sector:

"This morning I discovered something *extremely* alarming happening in the car market, specifically in auto lending. I'm now convinced that there is a massive wave of car repossessions coming in 2023," he wrote.

Recapping much of what we said above, he noted that over the past 2 years, many people took out exorbitant loans on cars and while car values were inflated (and still are) but many people simply had no choice and bought an overpriced a car. Then, echoing the Fitch assessment, he notes how those buyers are underwater: "Car valuations are now plummeting. Some cars have declined in value as much as 30% y/y. And these same people that took out these big loans are now 'underwater'. Basically, they owe banks more on these cars than they are worth. And the banks are well-aware of this."

The punchline is his personal experience from late last week. "This morning, one of our General Managers opened up DealerTrack — a portal that dealers use to communicate with auto lenders — and highlighted something very concerning. 9 of our lending partners have started WAIVING 'open auto stipulations' for consumers."

What this means, he explained, is that once consumers are stuck with a vehicle they paid too much for, they can't trade it in without putting some money up front to cover the difference of what is owed on it versus what it is worth. At that point, he notes, "Dealer can't sell consumer a car, Consumer can't buy a car, And, you guessed it, lender can't finance a car!"

The lender then knows that most consumers are stuck and waives the open auto stipulation - meaning they allow the consumer to buy the new car with a second loan knowing they already have a first one. But the lender does it because they know that the buyer will default on the old, other car.

Cue default avalanche: "This is NOT normal. But it's the only way lenders can finance cars and dealers can put cars on the road. And the implications of this will be tons of repossessions," the CEO wrote.

He concluded: "I've been a doubter, but after what I saw this morning, I'm now FULLY convinced that a wave of car repossessions will hit in early/mid 2023. If lenders are willing to backstab each other in order to put more loans on the road, we're in trouble."

More By This Author:

Housing Supply Jumps Most On Record As Market Freezes

Chicago PMI Bounces But Remains Worst December Since 2015

Futures Slide On Final Trading Day Of 2022

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more