Assuming Away The Can And...

There is an old joke which pokes fun at economists that I think applies to the current state of the stock market. It goes something like this...

An economist, a chemist, and a physicist are stranded on an island with nothing to eat but a can of beans.

The chemist says, "Hey, there's a small tide pool of saltwater over there. If we set the can in it the salinity will cause the can to rust/disintegrate and we can eat the beans."

The physicist laughed and said, "You moron, by the time the salt eats through the can, we will have died of hunger. We must make a fire with that dried grass and wood over there. We can heat the can until the pressure builds and it will explode, allowing us to eat the beans."

At this, the economist laughed, "You're a moron too if the can explodes, the beans will shoot everywhere and we'll have none to eat." So, the physicist and the chemist, both tired and hungry asked, "Ok, if you know what to do, please tell us."

To which the economist replied, "It's simple really, we assume away the can and eat the beans."

Putting this into context, I feel like the stock market is assuming away the virus, the likely protracted damage to the economy and industries, and simply looking ahead to better days. You know, when things get back to normal.

How else can we "esplain" the fact that the S&P 500 was down less than 10% on the year at the end of April? Or that the QQQ actually sported a GAIN of +3% in 2020 as of the end of last month.

This despite the reality that until a vaccine/drug therapy is widely distributed to the populations of the world, consumers are simply NOT going back to what had been considered normal a few short months ago.

Expectations V. Reality (Again)

Yes, I know that stocks look ahead. And that typically the stock market tends to "discount" expectations of what will transpire six to nine months ahead. And yes, I agree that science is likely to come up with a solution in that time frame. And that stocks tend to "sniff out" a turn in these situations before the news is actually out. Which in this case would be the vaccine/drug therapy solution. And we definitely got some good news on the science front this week from Oxford, Pfizer (PFE), Gilead (GILD), and others. Thus, I must agree that a rally in stocks makes sense here.

But the question is, how long will it take for the economy to "re-open" and more importantly, get back to normal? While this can likely be placed in the "duh" category, my thought is it will be much longer than six or nine months before the majority of the 7.5 billion people who call planet Earth home will be vaccinated.

There is also the narrative that the current joyride to upside is being driven by the hope related to the economies of the world beginning to re-open. To be sure, this is good news. News that will put a floor under the amount of economic damage that will be done. Couple this with the "floor" that the Fed and Congress have pledged to provide and the idea that some semblance of normalcy is about to return is good news indeed.

Yet, a pesky little detail in the current re-opening scheme is that social distancing rules must remain in place until that vaccine is widely distributed in order to try and keep as many people safe as possible. And it is important to remember that restaurants and shops will have limited capacity. For example, with restaurants, this means 25% of "normal."

But how does 25% capacity work for a restaurant's bottom line? Some will be creative and move to an online ordering/delivery model in an attempt to move back toward the old normal revenue streams. Others will be lucky enough to move tables/sales racks outside.

And if there is anything that Corporate America is good at, it's finding creative ways to make money. As Warren Buffett noted this weekend, "nothing can basically stop America."

So, as a card-carrying member of the-glass-is-at-least-half-full club (a club whose membership roles have also been dropping lately), I "get" why stocks deserved to rally. However, I don't really "get" how stocks can rally much further from here. Can the outlook for the companies that make up the QQQ really be better than they were on January 1st?

I also see some serious divergences between the "messages" coming from the Nasdaq/S&P 500, small caps, and the bond market.

A Tale of Two (or Three) Markets

In my humble opinion, the message from the bond market is currently wildly divergent from the stock market. While the S&P 500 and the Q's are looking hopeful, the yield on the U.S. 10-Year remains near its panic-induced nadir seen in early March.

US 10-Year T-Note Yield - Weekly

And from my seat, the messaging from bond market tends to be a lot less emotional than that of the stock market, and again, from my point of view, more closely correlates to the state of the economy.

In short, bond traders are not looking at growth and/or inflation ANY TIME soon. And with rates near all-time lows, one can argue that the bonds remain worried.

The message from small caps also appears to diverge greatly from that of the winners in the stock market (aka the QQQ). The two charts below make the point abundantly clear.

Invesco QQQ Trust (QQQ) - Weekly

iShares S&P Small-Cap Fund (IJR) - Weekly

While the QQQ is lucky enough to house the COVID darlings such as AMZN, MSFT, NFLX, ADBE, NVDA, AAPL, GILD, CTXS, SHOP, and AKAM, the small-caps are dominated by companies such as banks and oils, whose futures are, well, less rosy. As such, the "messages" from these two charts are quite different.

When a ginormous divergence such as we're seeing here exists, one of two things tends to happen. Either the areas beaten down and lagging experience a reversion to the mean and improve, or the areas that are leading stall out.

But in this case, it is hard to see how this divergence is going to correct itself in the near term. For example, I own a bunch of COVID darlings. And no, I don't plan on selling any of them anytime soon in favor of energy stocks, airlines, hotels or banks! (Although I did start nibbling at Bank America - BAC - last week.)

In closing, I guess my point is that while I understand that there are many strong reasons for hope and that America WILL win out, I also believe the win (i.e. a return to pre-COVID growth) is going to take a while (many respected analysts are talking a couple years). As such, I'm not sure just assuming away the recovery process is appropriate in the near-term.

However, I'd love to be wrong and see the stock market in the black by the end of the year!

Weekly Market Model Review

Each week we do a disciplined, deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay "in tune" with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

The Major Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

There are three changes to report on the Primary Cycle board this week. But first, it is worth noting that there are no longer any buy signals on the board and that the historical return of the S&P 500 when the models are in their current states has is now negative at -3.66%. The first change was the NDR Risk/Reward Model moving from neutral to negative. On the other side of the coin, the Global Risk Model upticked into the neutral zone. And finally, our Fundamental model slipped from positive to neutral. So, unless there is a medical breakthrough in the near-term, it is probably best to curb one's enthusiasm about the upside potential of the stock market.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

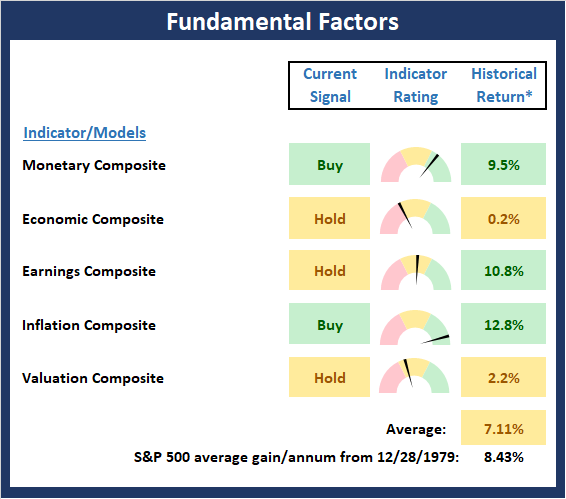

The State of the Fundamental Backdrop

Next, we review the market's fundamental factors in the areas of interest rates, the economy, inflation, and valuations.

There are no changes to the Fundamental Factors board this week. Overall, the board remains on the high side of neutral with an historical average return below the market's mean. But, as I've been saying, the Economic Composite is clearly out of sync with reality as most of the indicators are longer-term and only updated monthly and/or quarterly. The same can be said for the Earning Composite. So, I think it is safe to say that the fundamentals suggest that risk remains elevated.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of the Trend

After looking at the big-picture models and the fundamental backdrop, I like to look at the state of the trend. This board of indicators is designed to tell us about the overall technical health of the current trend.

There are no changes to the Trend board this week. And while the market enjoyed serious joyride to the upside in April, the trend indicators suggest that all is not well. This would appear to support the theme that stocks have decoupled from economic reality at this stage and may have a little too much "hope" priced into the indices.

NOT INDIVIDUAL INVESTMENT ADVICE.

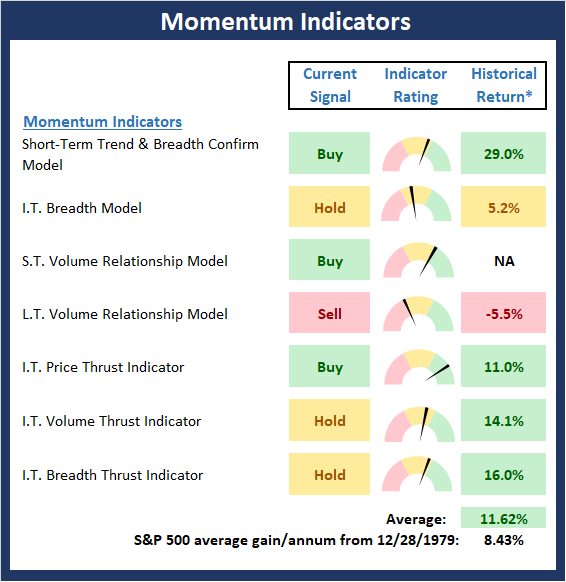

The State of Internal Momentum

Next, we analyze the "oomph" behind the current trend via our group of market momentum indicators/models.

When compared to last week's readings, it appears that there was some slippage on the Momentum Board. While the Short-Term Trend & Breadth Confirm model upticked to a buy, both the Volume and Breadth Thrust indicators fell from positive to neutral. The good news for the bull camp is that the market still has some "mo" behind it. So, if our heroes in horns can stave off the current bear attack, momentum could carry stocks higher - especially in the small- and mid-cap areas.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

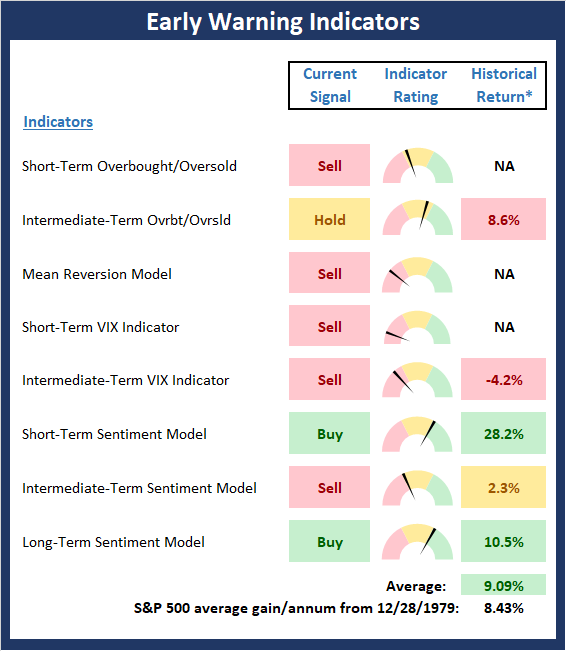

Early Warning Signals

Once we have identified the current environment, the state of the trend, and the degree of momentum behind the move, we then review the potential for a counter-trend move to begin. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

The bad news is the Early Warning board is now lining up for the bears. While two of the three sentiment models continue to suggest that there is still too much negativity in the market, the rest of the board argues that the table is now set nicely for a reversal. As such, some downside testing would not be surprising in the near-term.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more