Artificial Intelligence, Textual Analysis And Hedge Fund Performance

Photo by Steve Johnson on Unsplash

Artificial Intelligence (AI) offers the intriguing potential to revolutionize investment decision-making by providing important advantages such as:

Enhanced Data Analysis: AI can process and analyze vast amounts of data from various sources, including financial news, market trends, and company fundamentals, at a speed and scale far surpassing human capabilities. This enables investors to identify patterns, correlations, and anomalies that may be difficult for humans to detect.

Improved Prediction Accuracy: AI algorithms can leverage historical data and machine learning techniques to build predictive models that forecast future market movements, asset prices, and investment returns with greater accuracy than traditional methods (avoidance of cognitive biases to which humans are susceptible—AI is more rational).

With all the hype around AI, it remains to be seen whether it might outperform benchmark indices – something human active managers have persistently failed to accomplish. According to BlackRock CEO Laurence Fink, “The likely reason for the relative underperformance of active equity funds and the resulting outflows is the fallacies inherent in human discretion in active portfolio management and stock‐picking.”

According to him, the democratization of information has made it much harder for active management. We have to change the ecosystem – that means relying more on big data, AI, factors and models within quant and traditional investment strategies.

BlackRock executive Mark Wiseman added, “The old way of people sitting in a room picking stocks, thinking they are smarter than the next guy – that does not exist anymore.” (FIU, n.d.)

Kiplinger provided another example of the hype (and hope) surrounding AI: “Artificial intelligence leveraging the raw power of Big Data might just be the edge tactical investors and traders need to navigate an increasingly uncertain market.”

To answer the question as to AI’s ability to add value, as always, we turn to the empirical research findings.

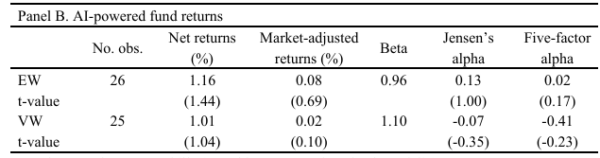

Empirical research on the performance of AI funds

Rui Chen and Jinjuan Ren, authors of the study “Do AI-Powered Mutual Funds Perform Better?” published in the August 2022 issue of Finance Research Letters, evaluated the performance of AI-powered mutual funds. Their data sample was from the CRSP Survivor-Bias-Free U.S. Mutual Fund Database and covered the 26-month period November 2017-December 2019. They labeled AI-powered funds (15) as those that use machine learning technologies to actively select stocks in portfolio choice; quantitative funds (300) as those that use fixed rules and numerical methods to generate computer-driven models and make investment decisions; and discretionary funds (611) as those traditional funds that select stocks and make investment decisions mainly through human judgment.

The following is a summary of their findings:

- The performance of AI-powered funds was statistically indistinguishable from the aggregate market in 25 out of the 26 months in the sample period.

- AI-powered mutual funds did not generate significant risk-adjusted returns and showed only marginally superior stock-selection skills (only by equal weight) and no market timing skills.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

- AI-powered mutual funds did outperform their human-managed peers due to lower turnover—31 percent versus 72 percent—resulting in lower transactions costs and marginally superior stock selection skills.

- AI funds held fewer stocks (149 versus 197)—their portfolios were more concentrated.

- AI-powered funds avoided some prevalent behavioral biases (such as the disposition effect).

Their results are supported by those of Wojtek Buczynski, Fabio Cuzzolin and Barbara Sahakian, authors of the study, “A Review of Machine Learning Experiments in Equity Investment Decision‑Making: ,” published in the April 2021 issue of the International Journal of Data Science and Analytics. They analyzed 27 peer-reviewed articles published by academic researchers between 2000 and 2018 describing experiments in AI market forecasting. Among their findings was that from January 2011 to January 2020, the Eurekahedge AI Hedge Fund Index substantially underperformed two global benchmark indices, S&P 500 and MSCI World, with cumulative returns of 115%, 210% and 133%, respectively.

New Research

Sipeng Zeng and Kuo Zhou, authors of the December 2023 paper “ Textual Analysis by Hedge Funds,” combined hedge fund quarterly position information with their access records on the SEC’s EDGAR server and examined whether hedge funds proactively gather and analyze the textual information within 10-K filings that correspond to their stock holdings, and how these behaviors might affect their positions.

They began by noting that Alan Crane, Kevin Crotty, Tarik Umar, authors of the 2023 study “Hedge Funds and Public Information Acquisition” found that hedge funds that actively acquire publicly available financial disclosures subsequently earned 1.5% higher annualized abnormal returns than nonacquirers, and that those that systematically scrape large volumes of information, specialize in certain filing types, acquire filings with more content changes, or access information immediately outperformed other funds.

Because the text in the annual report not only provides relevant explanations of digital information, but also contains rich information about the business environment, operating conditions, and development prospects, Zeng and Zhou hypothesized that a comprehensive analysis of the textual information in the annual reports could at least partially explain how hedge funds that actively obtain 10-K filings outperformed their peers. Their database included 678 hedge funds in the Thomson Reuters 13F database from the beginning of 2000 through the end of 2022.

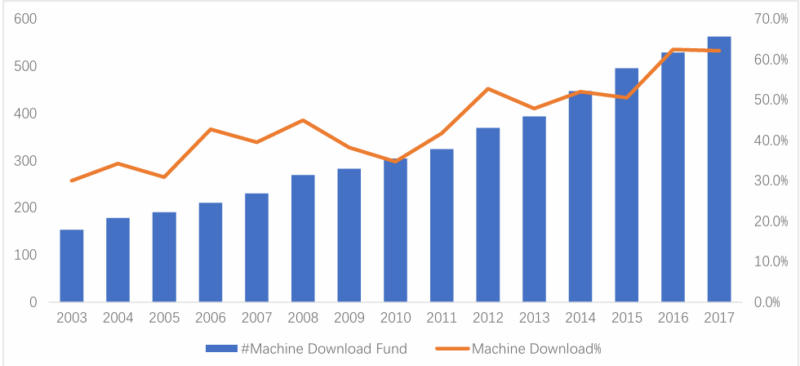

They first identified the machine download activities of hedge funds concerning 10-K filings. “Considering that hedge funds must first download the annual report to a local or cloud server before analyzing the text of the annual report, we adopt the precondition of text analysis as the identification strategy, i.e., using crawlers and other tools to download a large number of filings.” Applying a machine download identification method, they identified funds that use programs to batch download 10-K filings from the SEC EDGAR website as machine download funds. They then matched the fund’s access records on the SEC EDGAR website with the fund’s holding filings and then looked at changes in the machine-download funds’ holdings in that company’s stock during the quarter in which they downloaded the company’s 10-K filing. For example, “if the sentiment in the annual report drops by 1 standard deviation, the machine-download fund will reduce the position of the stock by 2% on average.” Here is a summary of their key findings:

- Only 24 hedge funds out of 678 never used crawlers to download fillings.

- The percentage of annual reports downloaded by these funds as a percentage of the number of stocks held grew from 30% in 2003 to 62% in 2017.

- Hedge funds adjust their positions according to the text of the annual reports they download.

- On average, machine-download funds were more diversified, holding 65 more stocks than non-machine-download funds.

- Analyzing textual information in annual reports helps hedge funds generate excess returns.

- The effect of text sentiment on hedge fund position changes mainly comes from hedge funds selling stocks with more negative words rather than buying stocks with more positive words, consistent with research demonstrating that investors tend to focus on negative language in texts and less on positive language.

- Changes in hedge fund positions were more closely correlated with stock excess returns over the next year in those subsamples where the text index was in the top decile and bottom decile of that quarter, suggesting that textual information in annual reports plays a role in capturing excess returns for machine-download funds.

- Download funds were smaller than non-machine-download funds. At the same time, the stocks held by machine-download funds were more growth-oriented and with larger market value. “This shows that machine-download funds use their unique investment strategies to obtain excess return rather than profit through more exposure to common risk factors.”

Their findings led Zeng and Zhou to conclude:

“Overall, our evidence supports that the textual content within annual reports harbors crucial company insights, prompting a subset of hedge funds engaged in bulk downloads from the SEC’s website to execute trades grounded in diligent analysis of this textual information present in 10 K filings.” They added: “The market response to the textual information in annual reports is severely underrepresented.”

Given these findings, the question is: Does it seem likely that now that Zeng and Zhou’s findings are public will the excess profits opportunities persist? David McLean and Jeffrey Pontiff, authors of the 2016 study “Does Academic Research Destroy Stock Return Predictability?” found that anomaly returns declined by about 60% post-publication.

As Andrew Berkin and I explained in our book, The Incredible Shrinking Alpha, another important issue is that while IBM’s Watson can outwit individuals (even champions in their fields, e.g., chess), individuals are not the competition when it comes to investing. Instead, Watson competes with the collective wisdom of the millions of individuals trading in stock markets each day – a much tougher competitor. In addition, as soon as new information (such as the publication of a paper revealing a profitable anomaly) is obtained, the process of acting on that information gets incorporated into market prices very quickly. Today, the competition is the collective decision making of not just humans but also machines, algorithms, and algorithms predicting what other algorithms will do next. Thus, any successful AI strategy is likely to be short lived. A perfect example of this type of evolution is that in their study Zeng and Zhou found that after the 2018 release of Google’s BERT model, machine-download funds immediately began to adjust their positions based on the sentiment index constructed by BERT.

Providing further insights into the issue, Dimensional explained in a research note: “Active investors have long attempted to get an informational edge on markets by using artificial intelligence (AI) processes to retrieve and process data. For example, tools that gauge sentiment from social media or scrape text from company financial reports predate ChatGPT by many years. Material information gleaned from running AI processes is very likely a subset of the vast information set known by the market in aggregate and reflected in market prices. If new information is obtained, the process of acting on that information incorporates it into market prices. Another reason to question AI’s role in helping with market timing is limitations with its predictions. AI’s forecasting ability fares well when assessing patterns that are relatively stable. The market is fantastically complex. So much so that no one knows exactly how much a particular piece of information impacts a price, because there are so many other simultaneous inputs. AI trying to predict market prices is like self-piloting cars trying to read stop signs with words, shapes, and colors that differ every day.”

Investor takeaways

There is no doubt that artificial intelligence has changed the way financial institutions execute trades. But the collective wisdom of the market is a powerful force that ensures that the price quoted is the best estimate of the value of a security. The market also quickly adapts to new strategies (the adaptive markets hypothesis) with competition minimizing, if not eliminating, excess profit opportunities. Thus, there’s no reason to think that the use of AI should lead to persistent fund outperformance, with any advantages gained likely being short lived.

More By This Author:

The Hidden Cost Of Index ReplicationData-Driven Approach To Clustering Similar Macroeconomic Regimes

Overvalued Or New Paradigm?