Amusing Pavlov’s Dog Market Response To The Fed’s Perceived Message

Image source: Wikipedia

The market somehow misinterpreted the Fed’s initial statement. Then Powell poured cold water on the idea of March rate cuts. But wait, it gets more interesting ….

Treasury and S&P reaction to FOMC meeting.

I was watching CME Fedwatch to see the market’s reaction to the FOMC statement “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

I was surprised to see the odds of a March rate cut rise. Apologies offered but I failed to catch a screenshot until after the press conference but the above chart explains.

The yield on the 10-year note rose in a worry over future inflation if the Fed cut too soon. Powell took care of that at the press conference (Or did he? updated charts below).

The Fed Intends to Move Carefully on Interest Rate Cuts

I noted pertinent press conference clips in my previous post The Fed Intends to Move Carefully on Interest Rate Cuts

- “The Committee Intends to move carefully,” and the Fed is data dependent. “It depends on the economy. The Fed will react to the data.”

- In one of his more accurate assessments “consumers are right to be unhappy [about inflation],” said Powell.

- In the key moment at the press conference, Powell stated “Based on the meeting today, I would tell you that I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March is the time to do that.”

March Cut Not the Base Case

A March cut is “probably not the most likely or what we could call the base case,” said Powell.

The rate cut odds changed noticeably.

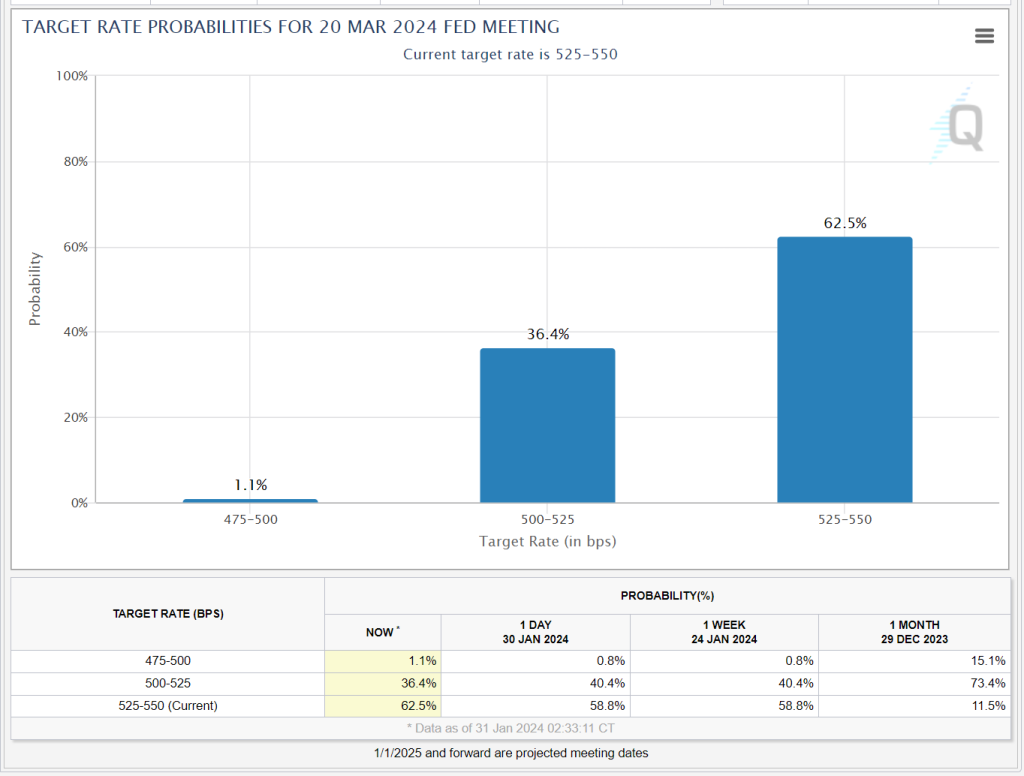

Rate Cut Odds for March as of 2:33 PM CT

CME Fedwatch Chart for March

I failed to capture the pre-press conference image but I recall seeing rate cut odds near 50 percent. That would be consistent with the lead image reaction.

A month ago, the odds of a rate cut were 73.4 percent. Now they are down to 36.4 percent.

Well strike that. Pavlov must be ringing a bell somewhere. The above image is as of 2:33 CT.

Rate Cut Odds for March as of 6:37 PM CT

Poof. The market has already given up on the pause through March theory.

And treasury yields confirm.

Yield on the 10-year note again rose in a worry over future inflation if the Fed cut too soon. If someone has a different interpretation I am willing to consider it.

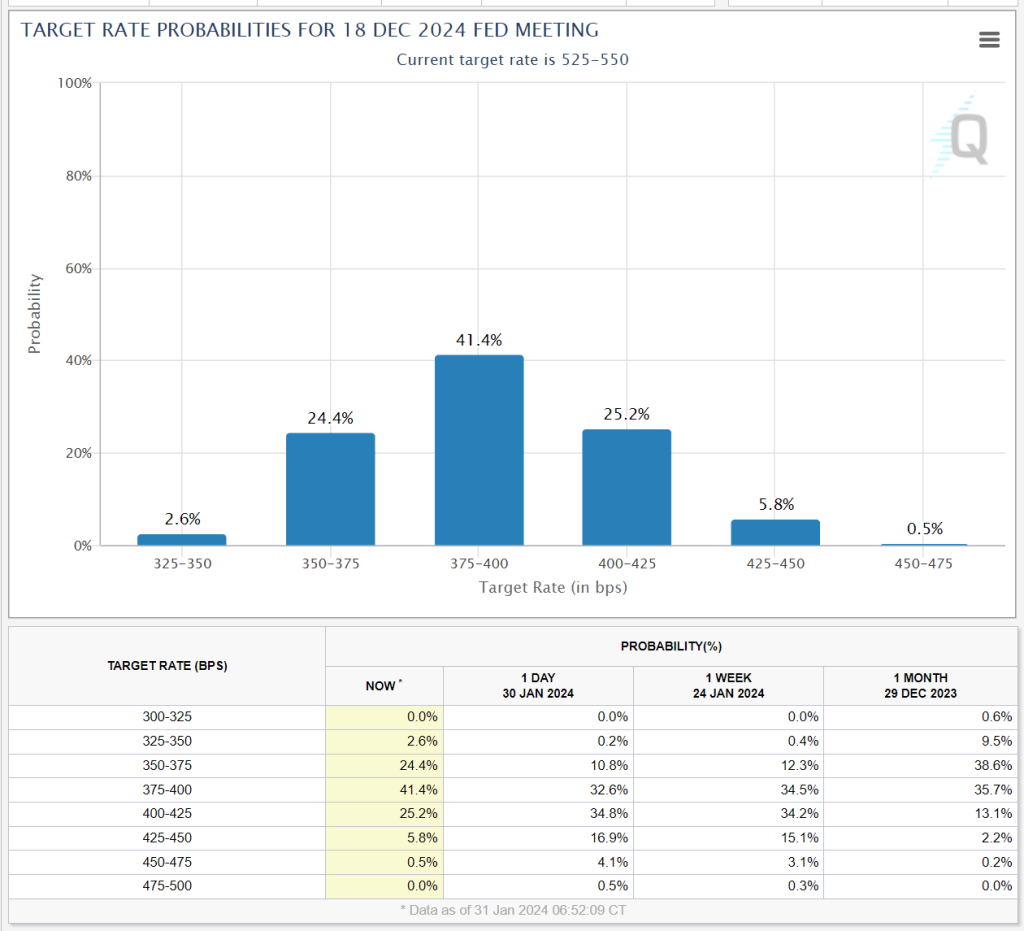

December is even more amusing.

Target Rate Probabilities for December 2024

Yesterday, the weighted average rate for December was 4.03 percent.

Now, the weighted average rate for December was 3.89 percent, pricing in about half of an additional rate cut, in the range 3.75 to 4.00 percent.

In total, the market now expects six full rate cuts. The Fed thinks it will be three!

The market refuses to take Powell at his word for more than a few hours. And long duration bonds are not happy with the idea of rate cuts.

Why the Solid Disbelief in Powell?

One possible explanation is the market expects a miserable jobs report on Friday. We will see.

ADP Reports an Increase of 107,000 Private Payrolls

The hiring slowdown of 2023 spilled into January, and pressure on wages continues to ease. The pay premium for job-switchers shrank to a new low last month.

On the jobs front, ADP Reports an Increase of 107,000 Private Payrolls, BLS Reports Friday

ADP reports the premium for job switching is dropping rapidly. That show up in the huge slide in quits.

In advance, I commented Job Openings Rise in December But Quits Tell the Real Story

Meanwhile, the Fed wants more data. We will have that on Friday.

More By This Author:

The Fed Intends To Move Carefully On Interest Rate CutsADP Reports An Increase Of 107,000 Private Payrolls, BLS Reports Friday

Companies Turn To AI Because Real Intelligence Is Hard To Find

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more