AI And Stock Market Valuation

In this article, we assume that AI, which we recognize has many different forms, will be a major economic success in that it will lead to greater productivity and rising GDP in the United States. The question for investors is how will it affect stock prices? That depends on whether you are talking about the stock prices of selected individual companies or the value of the aggregate market. We start first with the aggregate market and then turn to individual stocks.

Technological breakthroughs, of which we assume AI will be an example, increase social wealth by increasing the goods and services that can be produced from a given set of resources. This is measured by the growth rate in productivity. Productivity growth is a key determinant of real GDP growth per capita which determines the standard of living. The primary source of productivity growth is technological innovation.

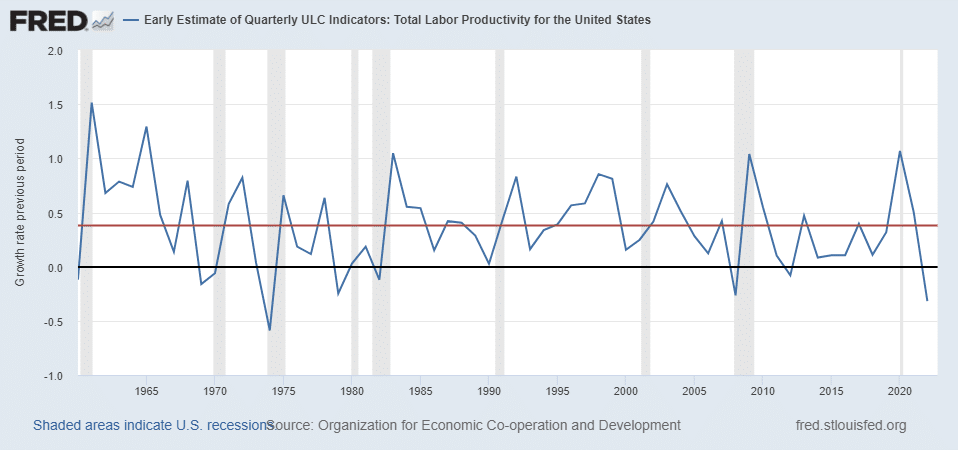

The chart below plots annual productivity growth from 1960 through 2022. The first thing to note is that the rate of increase is not large, averaging only 0.38% per year. The second thing to note is that the growth rate was variable, falling in recessions and rising in recoveries. Finally, it is difficult to tie productivity growth to specific innovations such as the rise of computers and the development of the internet. Back in 1987, Nobel Prize winning economist Robert Solow famously noted that “You can see the computer age everywhere except in the productivity statistics.”

Considering the chart, even if the impact of AI is great, greater than that of the internet, U.S. productivity growth may accelerate to something like 0.50%, However, the growth will remain bumpy as it always has been. Whereas AI will make people more productive, on average, many people will lose their jobs and others will have their lives upended. This will lead to costly political battles that are likely to make the acceptance of AI uneven.

(Click on image to enlarge)

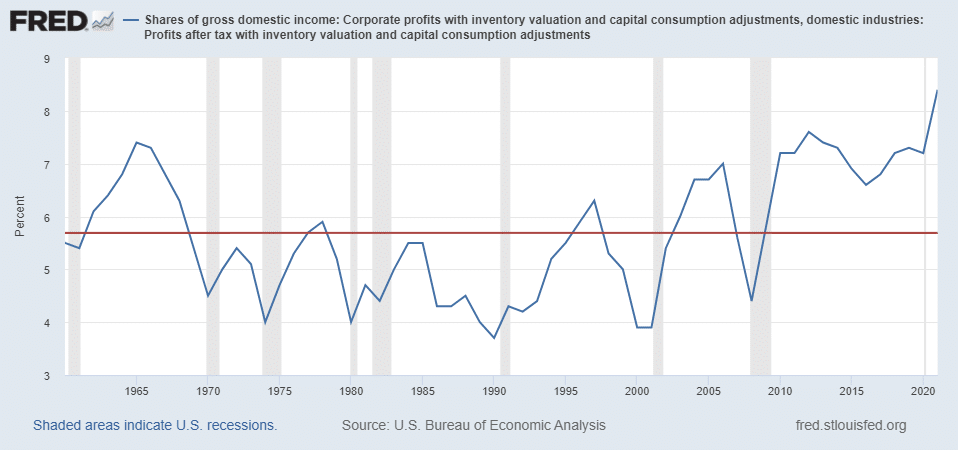

But stock prices do not depend on the social wealth a technology creates, they depend on corporate profits. As shown in the following chart, corporate profits have averaged slightly less than 6% of GDP from 1960 to 2022, although the fraction has been closer to 8% in recent years. At best companies can expect to capture about 8% of the wealth created by AI.

Putting the pieces together, the development of AI is unlikely to have a pronounced impact on the level of stock prices generally and, given that the market is forward-looking, much of that impact has likely already been incorporated into prices. However, what is true in the aggregate need not be true for individual companies which may potentially reap large profits from AI. However, in the case of individual companies another problem arises.

(Click on image to enlarge)

As stressed by Cornell, Cornell, and Cornell (2021), a new technology does not translate into value creation for a company that adopts it unless it produces returns on invested capital (ROIC) in excess of the cost of capital. To earn excess returns, there must be barriers to entry that prevent competitors from adopting the technology, entering the business, and driving down the ROIC to the cost of capital. For instance, two of the great technological innovations of the 20th century were automobiles and airplanes. In tandem, they produced a vast amount of social wealth. Unfortunately, neither produced much wealth for investors because competition was brutal. Virtually every American car company and airline went bankrupt, some more than once. Regarding airlines, Warren Buffett quipped, “if a far-sighted capitalist had been present at Kitty Hawk, he would have done his successors a huge favor by shooting Orville down.” The wealth that was created by automobiles and airplanes flowed to consumers, not investors. The fact that AI appears to be a general tool means that barriers to entry are likely to be limited. If so, it will be difficult for individual companies and their investors to reap much in the way of rewards.

Of course, there will be exceptions. While a majority of the startups that arose during the internet boom around 2000 failed, a few Amazons did emerge and produce great investor wealth. But there were few Amazons, whereas at the height of the boom virtually every company and their investors in the emerging internet space believed that it was going to be a big winner. This is an example of what Cornell and Damodaran (2020) call a big market delusion. The hallmark of a big market delusion is when all the stock prices of firms employing a new technology rise together even though many are in direct competition with each other and with established firms in the industry. Investors become so enthusiastic about the new technology that each firm is priced as if it will be a major success story. As a result, the aggregate value of stocks of companies employing the technology exhibit a fallacy of composition in which the sum of the parts (the sum of the market values of the individual firms) exceeds any reasonable estimate of the total value of the new business.

In our view, a big market delusion is emerging in the case of AI. There is a cute meme of Google (GOOGL) CEO Sundar Pichai repeatedly using the word AI in his presentation at Google’s 2023 worldwide conference. He is hardly alone. Virtually any company that plans to use AI in any way is talking up the opportunity. Because of its vast financial resources and technological know-how, Google may be able to construct barriers to entry regarding its application of AI, but this is likely to be the exception not the rule.

Another company that has an advantageous position in the AI market is Nvidia (NVDA) because it designs chips used in AI systems. For investors, however, Nvidia comes with a major asterisk. Following a bullish earnings announcement on Thursday, May 25, 2023, the company’s market capitalization rose by more than $180 billion, the second-largest increase in history for any company. The one-day increase was well more than the entire market capitalization of Disney. The market capitalization then rose another $50 billion through the close on Tuesday, May 26, 2023. In total, the company’s market capitalization increased more than $230 billion to approximately $1 trillion. At that level, the stock was trading at a price to earnings ratio of 210 and a price to revenue ratio of 22. To provide context, Intel has revenues 2.3 times that of Nvidia, but Nvidia’s market cap is almost 9 times that of Intel. Although Nvidia does have barriers protecting its budding AI business, the market is pricing the company as if those barriers were high walls indeed. Finally, the impact of AI on Nvidia’s stock price has not been lost on the company’s CEO, Jensen Huang. In a recent speech he put Sundar Pichai’s repetition of the phrase AI to shame leading to another humorous meme.

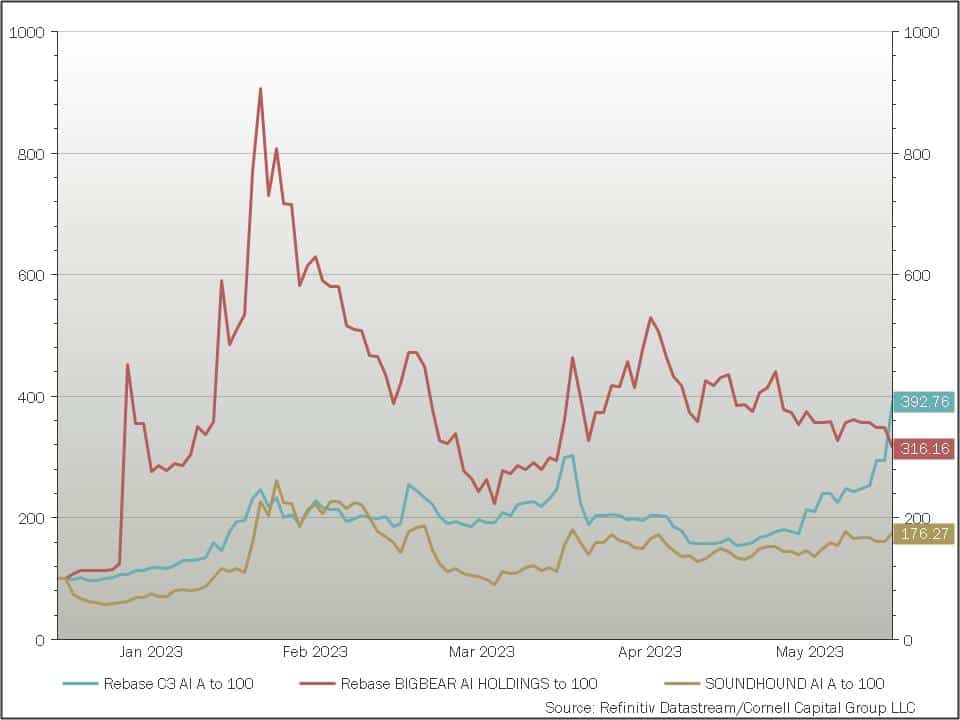

During the maximum craziness of the 2000 internet boom, companies saw their stock prices jump if they changed their name to something implying “internet” or “dotcom,” even without an alteration in the underlying business. There is some preliminary evidence that this phenomenon is making a comeback in the AI era.

C3.ai is a good example. The company was founded as C3 in 2009. In 2012 they changed their name to C3 Energy, likely in part to booming oil prices and production. Then in 2016, after oil prices dropped significantly and “Internet of Things” (IOT) became the new buzzword the company changed its name to C3 IOT. Finally, in 2019, they changed the name once again, this time to C3.ai, which turned out to be fortunate foresight. C3.ai’s stock price has risen dramatically since the release of ChatGPT and the current excitement around the potential of AI. In addition, companies such as BigBear.AI and Soundhound AI have also seen their stocks surge seemingly due to the simple fact that they have “AI” in their name. Eerie similarities to 2000 are emerging.

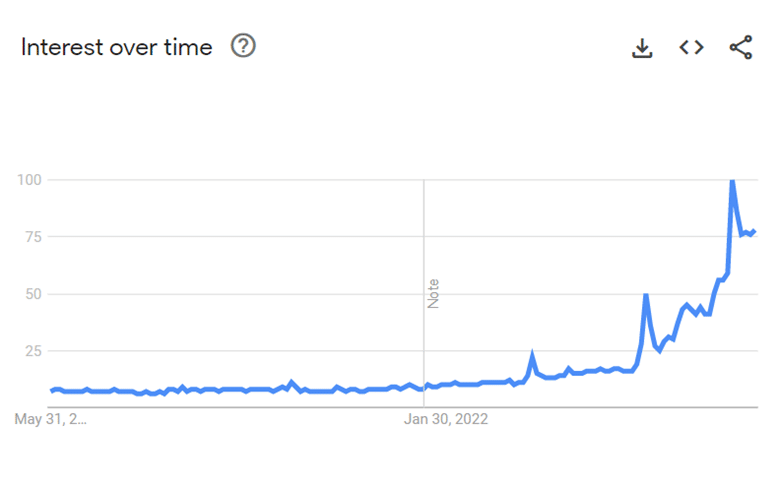

More generally, the financial media is gushing about all the new doors that AI will open. A good indicator of the recent enthusiasm in AI is Google Trends, which measures relative the level of search interest for a particular topic. The chart below shows the recent surge in searches for the term “AI”.

At the Cornell Capital Group we fear that one of the doors that AI will open is an opportunity for investors to lose a lot of money. As was the case for electrical vehicle stocks in 2021, companies in the AI space are beginning to be priced as if they will all be big winners. Because it is not that difficult for companies to adopt AI, competition is likely to rear its head preventing most of those companies from producing future cash flow sufficient to justify their valuations. Unfortunately, there is no way for Warren Buffett to protect investors by shooting down AI.

What then are investors to do if they are considering AI-related stocks, or at least stocks that are being touted as AI-related even if the intended use of AI remains nebulous? At the Cornell Capital Group, we suggest using discounted cash flow (DCF) analysis to reverse engineer the stock price. By reverse engineering we mean estimating the future cash flows necessary to justify the market price. If those estimated future cash flows imply an implausible run-up in the company’s performance that is a major warning sign. As an example from the EV world, when Rivian was trading at approximately $130 following its IPO in November 2021 our reverse engineering indicated that the price required a rapid ramp in production with sales at high margins. Given the nature of the automobile industry that did not seem plausible, even though we loved the vehicles and were considering ordering one. Since then, the market’s assessment of Rivian’s future cash flows has become much more realistic and the stock price has dropped to $15. We suspect that the enthusiasm for AI will produce quite a few similar episodes. While reverse engineering is not a panacea, we think it is a necessary first step when considering investment in stocks related to AI.

Finally, to tip our hat to AI, we provide a summary of our article generated by Google’s Barb.

- Artificial intelligence (AI) is a major technological innovation that is expected to have a significant impact on the economy.

- While AI is likely to lead to increased productivity and economic growth, it is not clear how it will affect stock prices.

- Some experts believe that AI could have a positive impact on stock prices, as it could lead to increased profits for companies that adopt AI technologies.

- However, other experts believe that AI could have a negative impact on stock prices, as it could lead to increased competition and lower profits for companies that do not adopt AI technologies.

- Ultimately, the impact of AI on stock prices is uncertain and will depend on a number of factors, including the pace of technological adoption, the level of competition, and the overall state of the economy.

Here are some additional points from the article:

- AI is a general-purpose technology, which means that it can be used in a wide variety of industries. This could lead to increased competition in many industries, as companies that do not adopt AI technologies could be at a competitive disadvantage.

- AI could also lead to job losses in some industries, as machines become capable of performing tasks that were previously done by humans. This could lead to lower profits for companies in these industries, which could in turn lead to lower stock prices.

- However, AI could also create new jobs in other industries, as companies develop new products and services that are enabled by AI technologies. This could lead to increased profits for these companies, which could in turn lead to higher stock prices.

Overall, the impact of AI on stock prices is uncertain and will depend on a number of factors. However, it is clear that AI is a major technological innovation that is likely to have a significant impact on the economy. Investors who are considering investing in AI-related stocks should carefully consider the risks and potential rewards before making any investment decisions.

References

Cornell, Bradford, and Aswath Damodaran, 2020, The Big Market Delusion: Valuation and Investment Implication, Financial Analysts Journal, 76 (2), 15-25.

Cornell, Bradford, Shaun Cornell, and Andrew Cornell, 2021, Valuing the Automotive Industry, Cornell Capital Group, November 11, 1-14.

Cornell, Bradford, Shaun Cornell, and Andrew Cornell, 2021, Big Market Delusion: The Case of Electric Vehicles, Journal of Investing, forthcoming.

More By This Author:

Reflections On Investing: US Tech Stocks – The Big Get Bigger

Reflections On Investing : Back To The Future – The Automotive Industry

Investor Memo Q1 2023: Banks, Interest Rates, And Debt

Disclaimer: Cornell Capital Group LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or ...

more