A Simple Way To Reduce Seed-Stage Risk

The allure of early investing comes from seeing the companies you invest in reach valuations of hundreds of millions of dollars and/or eventually go public.

But seed-stage investors have more immediate concerns.

It’s so obvious that I think many early investors lose sight of its importance. It’s simply this: Seeing your startup get to the next fundraising round.

Or put another way: NOT seeing your startup run out of money.

Three Questions You Need to Answer

Is your startup putting itself in the best position to reach a Series A round of fundraising in the next 12 to 18 months? Some questions you need good answers to…

- Are projected expenditures in line with a startup’s deck? For example, if you’ve been told that the company’s product is finished and ready for rollout, but that the bulk of your money is being used for development, something is wrong.

- Is the company raising enough? This has two components. Are projected costs realistic? And how long are the funds expected to last? (If it’s 15 months or less, you may want to suggest an 18-month runway to the next round. Money is getting tight.)

- Is its use of funds consistent with your comfort zone? For example, some investors wouldn’t mind if their seed money is used to hire a “Digital Prophet” or “Fashion Evangelist” (real job titles at Silicon Valley companies!). Some (like me) would.

David Shing: AOL’s Digital Prophet

The good news: There’s a shortcut to understanding how the next 12 to 18 months could play out.

A Good Starting Point

You can find the information you need under a category known as “use of funds” or “use of proceeds.”

Sometimes a company will show you what percentage of funds will be used by category. Here’s an example from one of our Startup Investor portfolio companies, MST.

- R&D: 40%

- G&A: 11%

- Regulatory: 16%

- Sales & Marketing: 33%

Here’s another from a startup we’re putting into our portfolio this week (which is why I can’t reveal its name).

- Development: 30%

- Operations: 20%

- Inventory: 20%

- Sales & Marketing: 15%

I suggest you use these numbers as a starting point and dig deeper. To see why, we’ll take another look at the above two sets of numbers.

The first company is putting more emphasis on sales, right? The numbers seem to say that, but it’s not the case. Both companies sell to hospitals. But the first company’s marketing is global and requires a longer and more involved sales cycle than the second company’s.

So don’t go strictly by the numbers. And don’t be afraid to ask questions – the more specific, the better.

For “sales & marketing,” for example, how do they plan to market? Have they done this kind of marketing before? If not, who’s going to do it?

I followed this very line of questioning with a founder recently. It became apparent that his first major hire was going to be a marketing director. I asked, did he have anybody lined up? What characteristics was he looking for? How soon would the hire take place?

I wanted to make sure the intent was real. It was a priority. And that the founder was going after a top-tier marketer. When I was satisfied on all three counts, I told him we were inclined to add his company to our portfolio.

And the following week we did.

Some startups simply state what their “use of funds” is. Some more examples from our Startup Investor portfolio …

- “Using funds raised, the company plans to increase dramatically its sales and marketing budget.”

- “The money will almost entirely be used by us to bolster sales and marketing.”

- “The money raised will go to hiring people and to building out their supply chain [and] also go toward a marketing budget so they have the infrastructure to scale the brand and gain market share.”

- “That’s when the company moves into several West Coast cities and uses the money it will be getting in its current raise to hire more sales and marketing people.”

As you see, I lean toward companies gearing up for major marketing pushes. I especially like providing “product rollout” capital. Because when revenue metrics are about to surge, it often elevates valuations too.

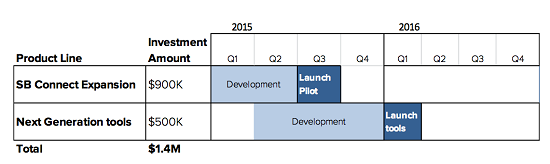

This company’s “use of funds” explanation was exceptionally detailed …

The company (also from our portfolio) added that it was going to hire two people to help launch these projects. Great transparency here.

One Victory at a Time

From what I’ve observed, roughly half of startups that get angel or venture seed money make it to the next round.

We’re doing pretty good so far. About 75% to 80% of our holdings in our Startup Investor portfolio are on track to reach their next rounds at higher valuations.

It doesn’t get any easier for these companies. They have a long way to go. But reaching Series A is certainly better than the alternative. Seed stage investors’ biggest and most immediate risk comes off the table.

And by paying attention to a startup’s “use of funds,” you can make that risk substantially smaller.

Disclosure: None.

This was very useful, thank you.

As an aspiring entrepreneur, where can I learn more about getting funded? And am I better off trying to get funding before launching a product, or should I risk it all trying to launch a beta version on my own first? That would take longer and mean spending my life savings to prove I can do it, but then if I don't get funded right after, I'm in major trouble. Thanks!

Fascinating. What does a "digital prophet" do?