8 Top Beverage Stocks For 2019, Ranked In Order

This article examines the investment prospects of 8 of the top beverage stocks in detail.

The companies analyzed sell a mix of alcoholic and non-alcoholic beverages. We rank these 8 companies by our expected total annual return estimate over the next 5 years, which is a combination of estimates for earnings growth, the current dividend yield and multiple expansion/reversion.

Table of Contents

- Brown-Forman (BF-B)

- Coca-Cola (KO)

- PepsiCo (PEP)

- Diageo plc (DEO)

- Ambev SA (ABEV)

- Constellation Brands (STZ)

- Molson Coors (TAP)

- Anheuser-Busch InBev NV (BUD)

Top Beverage Stock #8: Brown-Forman

- Estimated total return through 2024: 3.9%.

Brown-Forman is headquartered in Louisville, KY and was founded in 1870. This alcoholic beverage industry company manufactures and markets a wide variety of whiskeys, vodkas, tequilas and wine. Some of its products include Jack Daniel’s, Finlandia Vodka and Old Forester. The company has a market cap of more than $22 billion.

Brown-Forman reported financial results for the second quarter of fiscal 2019 on December 5th.

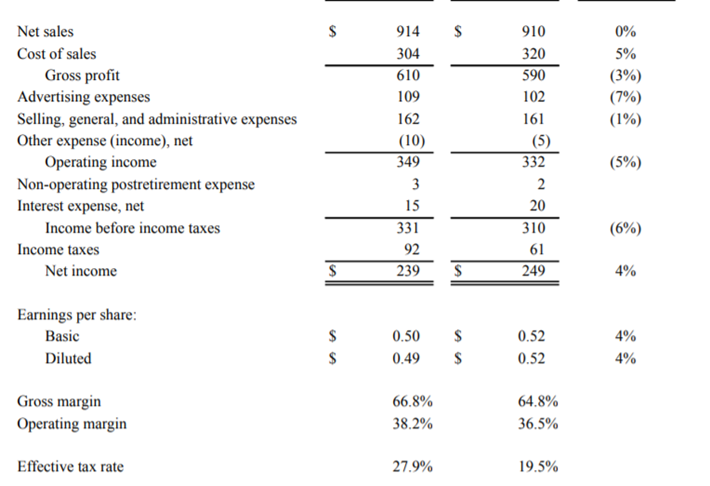

Source: Brown-Forman’s Second Quarter Results Release.

Brown-Forman had earnings-per-share, or EPS, of $0.52 during the quarter, a 4% increase from the previous year. Revenues were down 0.4% to $910 million. The rare decline in revenues was due to tariffs placed on whiskeys and other products by countries retaliating against the U.S.’s own tariffs. This led to customers purchasing more product than usual in the first quarter. Brown-Forman’s first quarter sales were up 5% year-over-year. The company expects fiscal 2019 revenues to be up 6%-7%, which would be a strong showing given the slight decline that occurred in the second quarter.

Brown-Forman expects to earn $1.80 per share in fiscal 2019. This would represent 7.8% growth over the previous year. We expect earnings to grow at a rate of 8.8% through 2024, slightly below Brown-Forman’s five-year average growth rate of 9%. We should note that while most companies saw EPS decline during the last recession, Brown-Forman’s EPS results improved nearly 16% from 2008 to 2009.

Brown-Forman has paid a dividend for the past 35 years, making the company a Dividend Aristocrat. The company has increased its dividend:

- By an average of 7.4% per year over the past three years.

- By an average of 8.9% per year over the past three years.

- By an average of 8.5% per year over the past three years.

The company’s most recent dividend increase occurred in November, when Brown-Forman gave investors a 5.1% raise. Based off of the annualized dividend of $0.66 per share, the stock offers a current yield of 1.4%. This is below the 2.1% yield of the S&P 500 and the 2.8% yield of the 10-year Treasury bond.

Brown-Forman has a dividend payout ratio of 36.7%. This is a very conservative payout ratio and below the ten-year average payout ratio of 37.3%. This makes it likely that Brown-Forman will be able to continue to pay and raise its dividend even if earnings decline.

Brown-Forman has paid a special dividend of $1 per share in two out of the last three years. Prior to this, the last time the company paid a special dividend was in 2013. While not a given to occur each year, this potential for a special dividend is an added bonus for investors.

Brown-Forman’s stock has a current price of $46. Using estimates for fiscal 2019 EPS of $1.80, the stock has a price to earnings ratio, or P/E, of 25.6. This is one of the highest valuations found on this list of companies. We have a 2024 target valuation of 19.5x EPS. If shares were to reach this valuation, annual returns would be reduced by 5.3% over the next five years.

We believe Brown-Forman can offer a total return of 3.9% per year through the fiscal year 2024. The company’s earnings growth rate (7.8%) and dividend yield (1.4%) are offset by our expected valuation decline (5.3%). While the company’s dividend growth streak is impressive, we feel that the total expected return is too low for investors to consider the company for purchase. Even with a year-to-date decline of 15%, we suggest investors either wait for a further pullback in Brown-Foreman or put their investment dollars in a different stock.

Top Beverage Stock #7: The Coca-Cola Company

- Estimated total return through 2023: 5.6%.

With a market cap of $197 billion, Coca-Cola is the world’s largest beverage company. The company owns or licenses more than 500 non-alcoholic beverage brands around the world, including more than 20 billion dollar brands. Coca-Cola is now present in almost every country on earth and its products are consumed nearly two billion times per day. Coca-Cola has more than $35 billion in sales in 2017.

Coca-Cola reported financial results for the third quarter on October 30th.

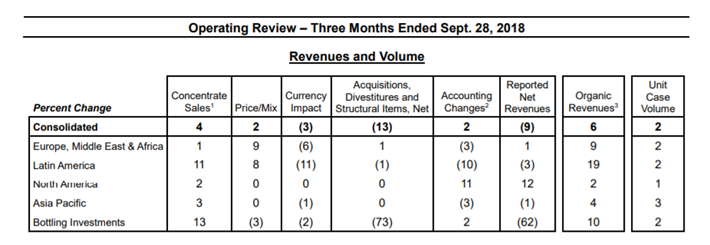

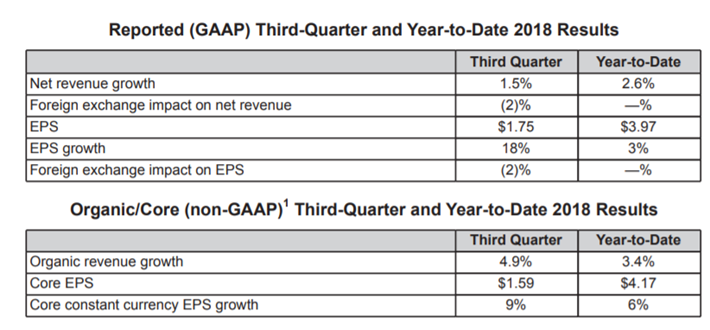

Source: Coca-Cola’s Third Quarter Financial Results Release.

Earnings-per-share increased 16% to $0.58. This was $0.03 above estimates. Revenue of $8.2 billion was $20 million above the market’s expectations. On a year-over-year basis, revenue was down 9.5% due to Coca-Cola’s bottler refranchising efforts.

Organic growth increased by 6%, as Coca-Cola’s focus on non-core brands such as Fuze and smart water appears to be paying off. Unit volume was higher by 2% as was sparking soft drinks. Juice and plant based beverages hurt by a tough economy in the Middle East and North Africa. This group was down 3% from the prior year. Water and sports drinks volumes were up 5% due to growth of single-serve products in China and Mexico.

By regions, North America improved just 2%, but Latin America saw 19% organic growth in constant currency. Coca-Cola gained market share in North America and strong pricing helped drive growth in Latin America. Developed markets in Europe, Middle East and Africa help lead this region’s 9% organic growth.

Coca-Cola saw EPS increase during the last recession. This combined with a lengthy dividend track record (see below) makes Coca-Cola one of our favorite recession resistant stocks to own. The company had an annual average earnings growth rate of 4.3% from 2008 to 2017. Coca-Cola is expected to earn $2.10 per share this year. This would be a 10% increase from the previous year. Due to company restructuring, improvements in unit volumes, we expect EPS to grow at a rate of 6.7% per year through 2023. A lower effective tax rate of ~22% in 2018 compared to 31% in 2017 will also contribute to this expected growth.

Coca-Cola has increased its dividend for the past 56 years, making the company a Dividend King. Only 10 other companies can match or exceed this streak. The company has increased its dividend by:

- By an average of 6.2% per year over the past three years.

- By an average of 7.4% per year over the past five years.

- By an average of 7.9% per year over the past ten years.

Coca-Cola increased its dividend 5.4% for the payment made last April. Shares currently offer a 3.3% yield, higher than both the yield of the S&P 500 and the 10-year Treasury bond. Coca-Cola paid out $1.56 in dividends during 2018. Using our expected EPS for the year of $2.10, Coca-Cola pays out 74.3% of earnings in the form of dividends. This is above the company’s average payout ratio for the last decade of 64%, but below the payout ratios of 2014 to 2017. We find that Coca-Cola’s dividend is safe despite its high payout ratio.

Coca-Cola has a current share price of $47.5. Using our EPS estimate, the stock has a P/E ratio of 22.6. From 2008 through 2017, the average P/E ratio was 18. If the stock were to decline to this average valuation by 2023, then the multiple would contract 4.4% per year.

We see shares of Coca-Cola offering a 5.6% return per year through 2023. This estimate is derived from growth (6.7%), dividends (3.3%) and multiple reversion (4.4%). Coca-Cola’s organic earnings growth was solid in the most recent quarter. The company appears to be performing well in all geographies that it operates, which is more than 200 countries around the world. Coca-Cola’s dividend growth streak is second to almost none and the current yield is above that of the market. Shares of the company are up 0.25% this year, a better performance than that of the S&P 500 and many of the stocks on this list.

Still, Coca-Cola is trading at a higher valuation than its peers in the industry. We rate shares as a hold and suggest investors wait for a pullback before adding Coca-Cola to their portfolio.

Top Beverage Stock #6: PepsiCo

- Estimated total return through 2023: 7.6%.

Pepsi is a global food and beverage company that has been in business for 120 years. The company generated more than $63 billion in sales last year. Pepsi has 23 brands that produce at least $1 billion in annual sales. This list includes: Pepsi, Frito-Lay chips, Gatorade, Mountain Dew and others.

While mostly known for its carbonated beverages, Pepsi’s food and snack make up slightly more than half of sales each year. Products with less than 70 calories from added sugar make up ~45% of sales. The company has a current market cap of nearly $150 billion.

Pepsi reported financial results for the third quarter on October 2nd.

Source: PepsiCo’s Third Quarter Financial Results Release.

Pepsi earned $1.59 per share during the quarter. This was $0.02 above the average estimate and a 7.4% improvement from the previous year. The company has topped EPS estimates in 18 out of the last 19 quarters. Revenue increased 1.5% to $16.5 billion. This was $130 million higher than analysts expected.

Pepsi’s organic growth was 4.9% while currency rate negatively impacted sales results by 2%. North American Beverage, or NAB, posted revenue growth of 2% to $5.5 billion. While this growth may not seem like much, NAB had sales declines of 6% in the fourth quarter of 2017. Sales were flat for NAB in last quarter. In this context, 2% growth for this segment is a positive sign. Frito-Lay North America generated $3.9 billion in sales, a 3% gain from the third quarter of last year.

Pepsi saw volume gains in all divisions and all geographies. International markets, led by 10% organic growth from Latin America, continue to be strong. Asia, Middle East and North Africa contributed 9% sales growth while Europe and Sub-Saharan Africa grew 8%.

Pepsi did lower its EPS guidance for 2018 to $5.65, down from $5.70 previously. The decline in the midpoint for earnings was attributed to unfavorable currency rates. Achieving the company’s guidance would mean that Pepsi increased earnings by 8% from the previous year. The company still expects cash from operating activities will be approximately $9 billion and free cash flow will be around $6 billion.

Pepsi actually saw EPS improve nearly 16% from 2008 through 2009, so the company can be considered relatively safe to own in a recession. We expect earnings to grow at a rate of 4% annually over the next five years.

At 46 years and counting, Pepsi has one of the longest dividend growth streaks available to investors. Only 42 other companies have a streak at least this long. Pepsi has increased its dividend:

- By an average of 7.7% per year over the past three years.

- By an average of 8.5% per year over the past five years.

- By an average of 8.9% per year over the past ten years.

Pepsi last increased its dividend by 15.2% for the June payment. Shares have decreased 11.6% year-to-date and now yield 3.5%. For context, Pepsi’s average yield over the last decade is 2.9%. Like its main competitor Coca-Cola, Pepsi’s yield is above the S&P 500 and 10-Year Treasury bond. Pepsi paid out $3.47 in dividends-per-share in 2018. Using expected EPS for 2018, this equates to a payout ratio of 61.4%. The average payout ratio from 2008 through 2017 is 51.2%. We believe that the company’s dividend is quite safe.

Pepsi currently trades at a price of $106. Based off of expected EPS for the year of $5.65, the stock has a P/E of 18.8. This is slightly below the stock’s 10-year average P/E of 18.9. If shares were to expand to meet this P/E by 2023, this would add 0.1% to annual returns.

We estimate that Pepsi can offer a total annual return of 7.6% through 2023. This is based on a combination of growth (4%), dividends (3.5%) and multiple expansion (0.1%). Though Pepsi offers a fairly low growth rate, the company has an incredible dividend growth streak going and just gave investors a dividend increase that is nearly double that of the three-year average. Pepsi’s business performed fairly well in the most recent recession. We encourage investors to use the recent market wide sell off to add some Pepsi to their portfolio.

Top Beverage Stock #5: Diageo plc

- Estimated total return through 2023: 7.9%.

Tracing its existence all the way back to the 17th century and to the oldest family of Scotch whisky distillers, Diageo is one of the largest producers and distributers of alcoholic beverages. Diageo, which is headquartered in Park Royal, London, manufactures brands such as Johnnie Walker, Smirnoff, Captain Morgan, Guinness, Crown Royal and many more. In the spirits category, the company has 20 of the top 100 brands in the world. Diageo has a current market cap of $84.4 billion.

Unlike many companies, Diageo reports financial results twice per year, initially in January and then at the conclusion of the company’s fiscal year in July. Diageo reported financial results for fiscal 2018 on July 26th.

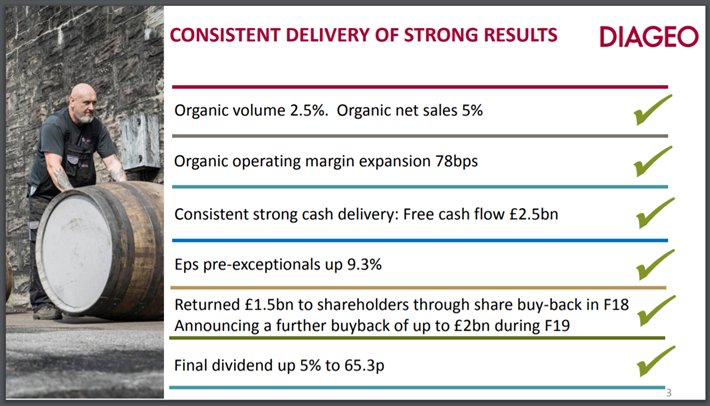

Source: Diageo’s Fiscal 2018 Presentation, slide 3.

Diageo saw operating income increase 3.7% while revenue was higher by 0.9%. Adjusting for currency exchange, the company had 5% organic growth split evenly between volume growth and price increases. The company bought back $1.5 billion worth of its own shares in fiscal 2018. All of the geographies experienced sales growth during the year. These factors helped lead to a 9.3% increase in adjusted EPS. EPS for each share traded on the New York Stock Exchange was $6.20 for the fiscal year. We forecast that shares can achieve an annual growth rate of 8% through fiscal 2024. We see the company earning $6.70 per share in fiscal 2019.

Diageo pays a dividend twice per year, first a smaller payment in April and then a larger payment in October. Because dividends have to be converted from the British pound to dollars, the dividend that U.S. investors receive depends on currency rates. That being said, U.S. shareholders of Diageo have only seen the dividend decline in the years 2015 and 2016. Every other year over the past decade has seen a higher dividend for the stock than the previous year. The company has increased its dividend:

- By an average of 5.1% per year over the last three years.

- By an average of 0.4% per year over the last five years.

- By an average of 4.3% per year over the last ten years.

Shareholders received $3.48 per share in fiscal 2018. This equals a payout ratio of 56%, one of the lower payout ratios on our list of top beverage companies. This is very much in line with the company’s average payout ratio of 56%. Diageo’s management has been very good at forecasting its business performance and keeping its dividend payout ratio within a very tight range, generally between 50%-56%. Shares have a yield of 2.5% at the moment.

Investors can buy shares of Diageo at the current price of $140 per share. We expect shares to earn $6.70 per share in 2019, giving the stock has a P/E multiple of 20.9. Over the last decade, shares of Diageo have traded with a valuation of 18.3x earnings. If the stock were to revert to this long term average, then shareholders would see annual returns reduced by 2.6% through 2024.

Adding it all up, we expect that Diageo will produce a total return of 7.9% per year over the next five years. This is based off of growth assumptions (8%), current dividend yield (2.5%) and multiple reversion (2.6%). This total is solid and Diageo is a relatively safe company with consistent earnings growth. The dividend is fairly stable unlike many international companies on this list.

Investors looking for exposure to an international alcoholic beverage company that offers more stable earnings and dividend growth are advised to consider purchasing Diageo. Illustrating our point that Diageo is a safe stock to own is the fact that the company’s stock has only lost 4.1% this year. Those willing to take on more risk for the chance at more return are encouraged to consider the other international names on our list.

Top Beverage Stock #4: Ambev SA

- Estimated total return through 2023: 9.1%

Ambev SA is a producer and distributor of alcoholic beverages, primarily beer. The company is headquartered in Sao Paulo, Brazil. Ambev is the successor of Companhia Cervejaria Brahma and Companhia Antarctica Pualista Industria Brasileria de Bebidas, two of the oldest breweries in Brazil. Brahma was created in 1888 while Antarctice was founded in 1885. The two companies merged in 1999. Ambev’s brands include Skol, Labatt, Brahma, Antarctica, Presidente to name just a few. Ambev merged with Anheuser-Busch in 2008.

Ambev has operations in 16 countries, the majority of which are in Latin America. U.S. investors can own shares of Ambev through its American Depositary Receipt, or ADR, listed on the New York Stock Exchange. Ambev has a market cap of $60 billion.

Ambev released third quarter financial results on October 25th.

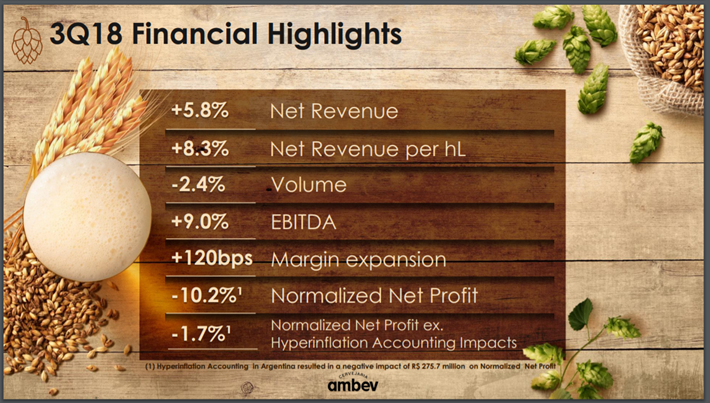

Source: Ambev’s Third Quarter Financial Results Release, slide 3.

Net revenues improved 5.8% in the quarter. Price increases more than offset a volume decline of 2.4%.

Earnings before interest, taxes, depreciation and amortization, or EBITDA, was up 9%. Gross margins improved 130 basis points to 60.5%. Company expenses were higher by 4.5%, but below the company’s weighted average inflation of 7.6%. This was due to much of Ambev’s advertising taking place during the 2018 FIFA World Cup that occurred during the company’s second quarter. EPS for the company’s ADR in 2018 is expected to be $0.18. We expect that Ambev will be able to deliver 5% growth per year through 2023.

Due to currency fluctuations, Ambev’s dividend has varied from year to year. The following is the company’s dividend history since 2013:

- 2013: $0.06 in dividends per ADR.

- 2014: $0.31 in dividends per ADR.

- 2015: $0.21 in dividends per ADR.

- 2016: $0.19 in dividends per ADR.

- 2017: $0.17 in dividends per ADR.

Ambev will pay $0.16 in dividends per ADR this year. At the current price, shares yield just over 4.1%. Using expected EPS, this results in a payout ratio of 89%. The average payout ratio over the past five years is 76.2%. Investors should be aware that dividends from Ambev will likely fluctuate from year to year due to exchange rates between the dollar and the Real.

Ambev’s stock has a recent share price of $3.87. Based off expected EPS of $0.18 for the year, the stock’s P/E ratio is 21.5. The current valuation equals the five-year average valuation for the ADR.

Combing our expected growth rate (5%) and dividends (4.1), we forecast shares of Ambev can offer a total annual return of 9.1% over the next five years. Ambev is one of the top beer producers in Latin America and offers an attractive dividend. Because of the company’s headquarters and business operation, shareholders of Ambev SA will have to contend with changes in currency rates. Because of these factors and a high dividend payout ratio, Ambev is likely best for investors looking to exposure to international markets who don’t mind some variance in dividend payments.

Top Beverage Stock #3: Constellation Brands (STZ).

- Estimated total return through 2023: 13.3%

Constellation Brands, which was founded in the mid-1940s, is a producer and distributor of alcoholic beverages. The company produces and distributes beer, wine and spirts. Constellation Brands is currently the #3 beer company in the United States. The company’s brand of beers include Corona, Modelo Especial, and Pacifico. Unlike other alcoholic beverage companies on this list, Constellation Brands was quick to the craft brewery market, offering consumers brands such as Ballast Point and Funky Buddha Brewery. The company also offers wine brands like Robert Mondavi and Black Box and spirits brands including SVEDKA Vodka and Casa Noble Tequila. The company has a market cap of $30.6 billion.

Constellation Brands released financial results for the second quarter of fiscal 2019. EPS increased 16% to $2.87. Earnings figures beat estimates by $0.27. Revenues of $2.3 billion were higher by 10% and also topped estimates by $50 million. Constellation Brands also increased the midpoint for EPS guidance for fiscal 2019 to $9.68 from $9.55. This is also above the street’s estimate of $9.30 per share.

Constellation Brands may not yet hold the top spot in the beer category in the U.S., but it is gaining ground on the competition.

Source: Constellation Brands’ Second Quarter Earnings Release Presentation, slide 14.

Over the last year, Constellation Brands has seen its market share increase dramatically. In addition, the company holds the top spot in both the high-end and imported beer categories in the U.S. Moving beyond beer, Constellation Brands has the top selling imported vodka in the U.S. in its SVEDKA. The company is the world’s leading premium wine distributor and has roughly 20,000 acres of vineyard.

Constellation Brands is also entering the marijuana market. On August 15th, Constellation Brands increased its stake in Canopy Growth (CGC) to 38% from 9.9% with a $4 billion dollar investment in the company. Constellation Brands has warrants that could allow Constellation Brands to take its stake to 50%. With legalized marijuana starting to gain traction in the U.S. (10 states have legalized the drug for recreational use), this investment could become a major boon for the Constellation Brands.

The company saw earnings grow 13% during the last recession. Given the company’s performance in its core business and venture into marijuana, we believe that earnings can grow at 10% annually over the next five years.

Constellation Brands began paying a dividend in 2015. Based on the current annualized dividend of $2.96, the dividend has grown by an average of 19% per year over the past five years. Shares offer a current yield of 1.8%, below that of the S&P 500. This is the lowest yield on our list, but also one of the highest dividend growth rates on our list. The company also has the lowest dividend payout ratio as we project just 30.5% of this year’s earnings will be consumed by the current dividend.

Constellation Brands has a current share price of $161.50. Using the company’s earnings guidance, shares have a P/E ratio of 16.7. A nearly 30% decline in share price this year has brought the valuation down to a more reasonable level. We estimate that Constellation Brands’ stock should trade with a P/E ratio of 18. If the valuation reached our target, this would add 1.5% to annual return over the next five years.

We feel that Constellation Brands can offer shareholders a total annual return of 13.3% over the next five years. This estimate is based off of our earnings growth estimate (10%), dividends (1.8%) and multiple expansion (1.5%). The company is making solid gains in its businesses. Shares of Constellation Brands offer a very solid potential total return. We feel that investors looking to gain indirect access to marijuana should consider adding Constellation Brands to their portfolio.

Top Beverage Stock #2: Molson Coors Brewing Company (TAP)

- Estimated total return through 2023: 15.2%.

Molson Coors Brewing Company was founded in 1873 and has grown to be one of the largest brewers in the U.S. The company offers a wide variety of brands, including Coors Light, Coors Banquet, Molson Canadian, Blue Moon Crispin Cider and others. The company also provides Miller Lite through a joint venture called MillerCoors. Molson Coors has a current market cap of nearly $12 billion.

Molson Coors released third quarter financial results on October 31st.

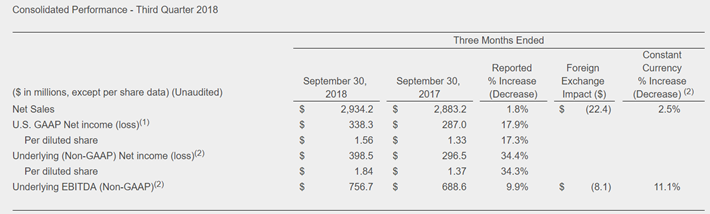

Source: Molson Coors’ Third Quarter Results Release.

Adjusted earnings-per-share increased 34.3% to $1.84. This beat estimates by $0.25. Revenue in the quarter was $2.9 billion, a 2% increase year-over-year and $10 million above expectations.

Sales in the previous quarter had been flat, so a return to growth in the most recent quarter are a very good sign. Breaking sales down by region, the U.S. saw 2.3% growth. Canada sales declined 0.3% in constant currency while Europe and the rest-of-world saw revenues increase by 3.8% and 4.4%, respectively. U.S. volumes declined 3.3% due to the premium light segment, but sales to wholesalers was up. Canada sales were down primarily because of lower volumes in the Western portion of the country. Sales in Ontario and Quebec were up from the previous year. Europe saw higher volumes along with better pricing mix. The rest-of-the-world had strong volume growth of nearly 14%.

Molson Coors generated $1 billion in free cash flow during the quarter, $189 million more than the prior year’s third quarter. We expect that the company will earn $4.89 per share in 2018, which would represent 8.2% growth from last year.

Molson Coors had been slow to adjust to the craft brewing industry. As a result, earnings declined more than 37% from 2013 to 2015 before returning to growth the past two years. Beer consumption remains down among younger generations, but Molson Coors is attempting to catch up with some of its product offerings in the craft beer category.

Like Constellation Brands, Molson Coors is also getting into marijuana. Molson Coors is teaming with The Hydropothecary Corporation (HEXO), a Canadian cannabis producer, to develop non-alcoholic, cannabis-infused beverages. With marijuana becoming legal in Canada, this partnership has the ability to help Molson Coors sales grow in the future.

Molson Coors saw EPS grow during the last recession, so we rate the shares as fairly recession proof. From 2008 through 2017, EPS grew at a 5% annual clip.

Though Molson Coors hasn’t reduced its dividend from 2008 through 2017, the company has often paused its growth. Over this time frame, the dividend has been increased six times and paused four times. The pauses occurred in 2013, 2016, 2017 and 2018. As you can imagine, this has reduced the average annual rates. The company has increased its dividend by:

- 0% per year over the past three years.

- By an average of 5% per year over the past five years.

- By an average of 8% per year over the past ten years.

Molson Coors’ stock yields almost 3%. The company paid out $1.64 in dividends in 2018. Using our expected EPS, the payout ratio stands at 33.5%. The 10-year average payout ratio is 44% while the five-year average payout ratio is 54%. The current ratio is very favorable against its historical average. Though this low payout ratio means that the dividend is likely safe from being cut, investors shouldn’t expect dividend growth every year given Molson Coors’ track record in this area.

Molson Coors had a recent share price of $55.50. Using our expected EPS of $4.89, the stock has a P/E of 11.3. The decline in earnings a few years ago resulted in very high valuations. We expect the stock’s valuation to hit 16 by 2023. This would add 7.2% in annual returns if the stock hits our target P/E. Molson Coors has not been immune to the sell offs the market has seen as shares are down 32% this year.

We forecast that Molson Coors can offer a total return of 15.2% per year over the next five years. This is due to growth (5%), dividends (3%) and multiple expansion (7.2%). Molson Coors offers our highest expected multiple expansion among the beverage stocks in our coverage universe. Though there is no promise of dividend growth from year to year, the company still managed to maintain its dividend even as earnings-per-share fell apart from 2013-2015. Molson Coors offers a nice mixture of growth, yield and expansion. We rate the shares as a buy.

Top Beverage Stock #1: Anheuser-Busch InBev NV

- Estimated total return through 2023: 16.3%

Anheuser-Busch is one of the oldest breweries in the U.S., tracing its roots back to 1852 when Eberhard Anheuser and the Busch family joined together. The company merged with InBev in 2008, creating the largest brewery company in the world. Anheuser-Busch products include the iconic Budweiser, Bud Light, Michelob Ultra, Busch, Stella Artois and Shock Top. Anheuser-Busch purchased SABMiller for US$107 billion in 2015. The company is headquartered in Leuven, Belgium. U.S. investors can own shares of Anheuser-Busch through its ADR. Anheuser-Busch has a market cap of almost $112 billion and has more than $55 billion in annual revenue.

Anheuser-Busch released third quarter financial results on October 25th.

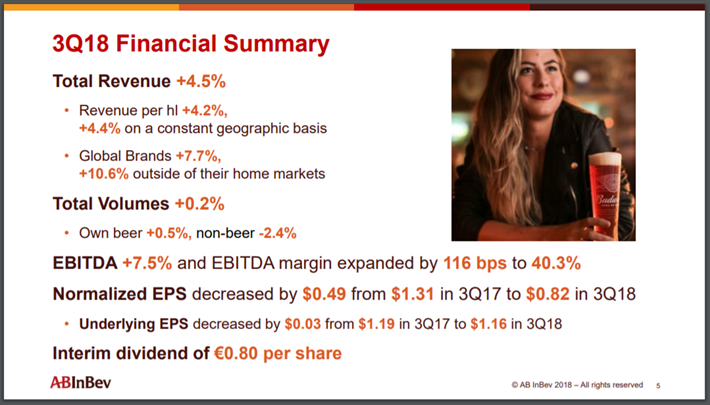

Source: Anheuser-Busch InBev NV’s Third Quarter Financial Results Release, slide 5.

Anheuser-Busch had total revenue growth of 4.5%, mostly due to higher prices. Adjusted EPS declined $0.03 to $1.16 as cost of sales increased 6%. The company’s global brands added 7.7% to revenue growth, with 10.6% growth outside of their respective home markets. This shows that Anheuser-Busch’s products are in high demand around the world. EBITDA margins improved 116 basis points to 40.3%. As a result of third quarter results, we have lowered our estimate for EPS to $4.30, down from $4.45 previously. We see earnings growth at a rate of 6.5% annually through 2023.

Anheuser-Busch pays a semi-annual dividend. The first payment is made in May with the remainder of the dividend coming in December. Shareholders of the company received a total dividend of $3.30 in 2018, down from $4.33 last year. The reason for this decline was the dividend paid to shareholders this December was well below the December 2017 payment. Based off of expected EPS for 2018, Anheuser-Busch had a dividend payout ratio of 76.2%. This is not an unusually high payout ratio for the company.

Shares of Anheuser-Busch have declined more than 41% since the first trading day of the year. Shares currently yield 5.1%, the highest yield among the stocks on this list.

Anheuser-Busch’s stock trades with a price of $65.40. Using our expected earnings total for 2018, this gives the stock a P/E ratio of 15.2. We feel that shares of Anheuser-Busch will move closer to their average valuation of 19.1. If this occurs, investors will see an additional 4.7% added to their yearly returns from the stock through 2023.

Combining earnings growth (6.5%), dividend yield (5.1%) and valuation expansion (4.7%), we feel that shares of Anheuser-Busch can offer a total annual return of 16.3% over the next five years. Anheuser-Busch’s stock has had a very difficult 2018. With this decline, shares offer a robust dividend yield. In addition, the stock could experience significant multiple expansion in the coming years. Investors purchasing the stock today could see outsized gains over the next five years. We do caution that Anheuser-Busch’s dividend is likely to vary from year to year given currency exchanges. For this reason, investors relaying on consistent dividend growth should avoid the stock. Those looking for international market exposure could see Anheuser-Busch perform very well for their portfolio.

Final Thoughts

The recent volatility in the markets have caused shares of companies to become much lower than they have been in some time. Investors with a long time before retirement should use this weakness to add shares of companies poised to grow.

In the non-alcoholic beverage sector, we prefer Pepsi to Coke, both because of total return expectations and due to Pepsi’s more diversified business model of snacks and beverages.

Those investors with appetites for more risk could be enticed by Ambev while those looking to gain exposure to the marijuana market might elect to choose Constellation Brands or Molson Coors.

Others looking for a stable international company should take a look at Diageo. Investors simply looking for the highest total annual return should consider buying Anheuser-Busch.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more