5 Reasons Bitcoin Will Climb To $200,000 In The Coming Months

The Bitcoin price bottomed around $16,000 near the start of 2023, after correcting for a little over a year. The price has since gone up over 10x to $124,000 in 2.5 years. before pulling back and settling around $113,000 today. That is quite an impressive return, considering that the S&P 500’s own powerful bull cycle went up 73% in the same time period. Even gold, which has been enjoying one of its strongest bull cycles ever, is only up roughly 100% since the start of 2023. Bitcoin has outperformed other investment classes by a wide margin.

Still, I believe the Bitcoin price has much higher to run in the coming months and will lay out my argument for higher prices below.

Bitcoin’s 10x move involved a steady climb from $16,000 to $30,000 over 10 months in 2023 and then a $5,000 pullback over 6 months. Next came a powerful spike from $25,000 to $73,000 (192%) from mid-October of 2023 to mid-March of 2024. This second move heading into the 2024 halving in April was more than three times as large in absolute terms and more than twice as large in percentage terms as the prior advance, yet took half the time (5 months versus 10 months).

The chart below shows that Bitcoin remains volatile, but is still generating eye-popping gains nearly 17 years after launch.

(Click on image to enlarge)

Bitcoin then spent around 6 months chopping lower and consolidating the massive gain, before once again doubling in just 3 months from around $54,000 in early September to $108,000 in mid-December.

The price started 2025 with another significant correction from $108,000 back down to $75,000 in mid-April (-$33k or 30%). This was once again followed by another massive surge to new highs around $124,000 in mid-August of 2025.

Bitcoin is currently in the process of consolidating this latest spike higher, but has not hit the top of the trend channel as it typically does before turning lower. This latest move higher is also much smaller in percentage terms than prior bull waves, so I suspect we likely will see another major move higher in the near-term. A move toward the top of the trend channel by year-end would correlate with a price of roughly $150,000.

5 Reasons Bitcoin Will Continue Climbing

#1 Reduced Significance of the 4-Year Cycle

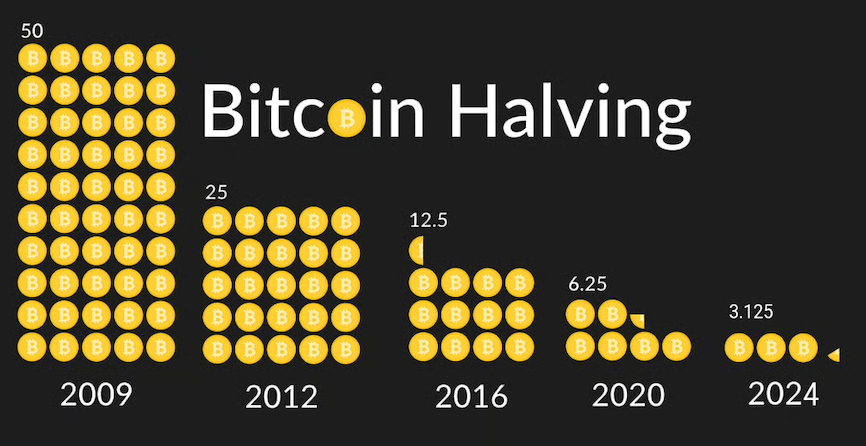

Many analysts will point to the fact that Bitcoin will hit 18 months post-halving in October, which has historically marked a top and end of the post-halving bull cycle. But I believe the 4-year cycle is losing relevance as each halving cycle is less significant than the last, as it is halving output numbers that are down significantly from a decade ago.

In other words, the impact of the block reward falling from 6.25 BTC to 3.125 BTC per block, effectively halving the inflation rate from approximately 1.67% per year to 0.83% per year, is much less significant than the 2016 halving that went from 25 to 12.5 BTC per block (8.8% to 4.4% inflation). The 2024 halving brought Bitcoin’s inflation rate down by less than 1%, whereas the 2016 halving brought it down by 4.4%.

The bottom line is that the 4-year halving is less likely to be a key driver of Bitcoin’s price moving forward. And this means that predicting a top based on this cycle is going to be much less accurate than it had been in the past.

#2 Expanding Global Liquidity

Past halving cycles happened to line up with periods of increased global liquidity, which has the higher correlation to the move in the Bitcoin price. In fact, roughly 90% of Bitcoin’s price movements are driven by global liquidity, which has been expanding to record levels.

Liquidity expansions often precede BTC rallies by 2 to 4 months. And with liquidity expanding to new records in September, we should expect at least another few months of higher prices for Bitcoin. In 2025, easing signals from the US, ECB and China suggest a continuance of positive liquidity ahead. As you can see from the chart above, Bitcoin has diverged a bit from global liquidity and has some catching up to do in order to return to trend correlation. This suggests a move toward $200,000 for Bitcoin by year-end.

#3 Stablecoin Supply Growth

Another factor with an even higher correlation to the Bitcoin price is stablecoin issuance at around a 95% correlation. When new stablecoins are minted, crypto prices rise in lock step.The global stablecoin supply has surged to an all-time high of $293 billion as of September 21st. This is up from just $130 billion at the start of 2024 and $205 billion at the start of 2025. Over the past year, the supply of stablecoins circulating has shot up by 70%!

Central bank estimates do not usually include stablecoins. They are still a small percentage of the overall money supply and depending on how they are issued/backed, we would not always want to include them in the total. But the high correlation between the stablecoin supply and Bitcoin price, plus the rapid growth of stablecoins, makes their supply metric one worth monitoring.

#4 Institutional Demand Growth

There are three major institutional components to Bitcoin demand growth that I expect to push the price much higher over time. These include exchange-traded funds (ETFs), Bitcoin Treasury companies and sovereign nations purchasing as part of strategic reserves.

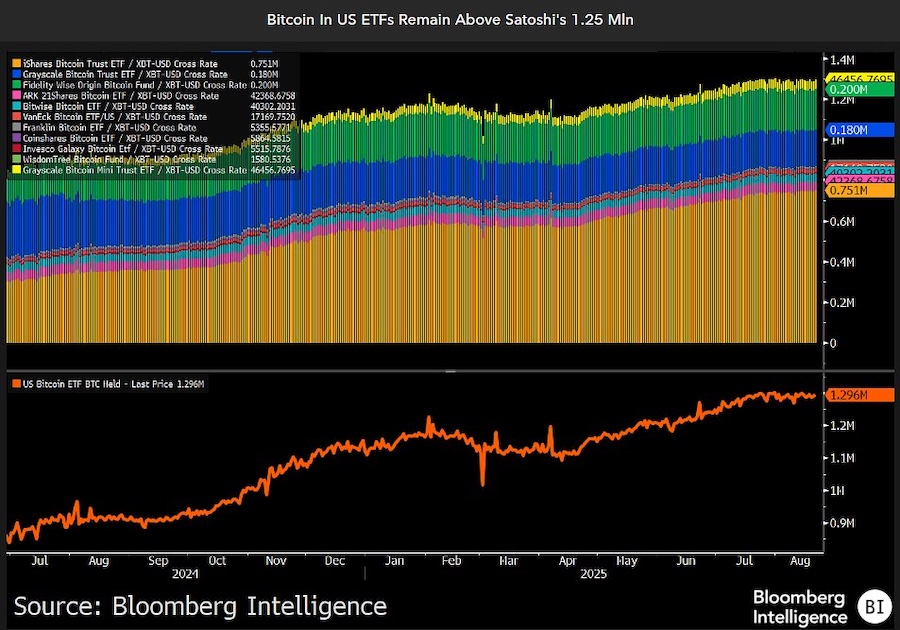

The amount of Bitcoin held in spot ETFs has been increasing rapidly since they were approved in January of 2024, reflecting institutional demand. In fact, the number has recently eclipsed 1.3 million, which is more Bitcoin than Satoshi Nakamoto himself holds. This is significant because ETFs alone are buying more Bitcoin than are produced/mined each day. ETFs alone are absorbing all of the new supply. To give some perspective on investor appetite for Bitcoin ETFs, consider that BlackRock’s spot Bitcoin ETF is the fastest-growing and most profitable of all the 460 BlackRock ETFs. A total of 44 different ETFs and funds hold Bitcoin.

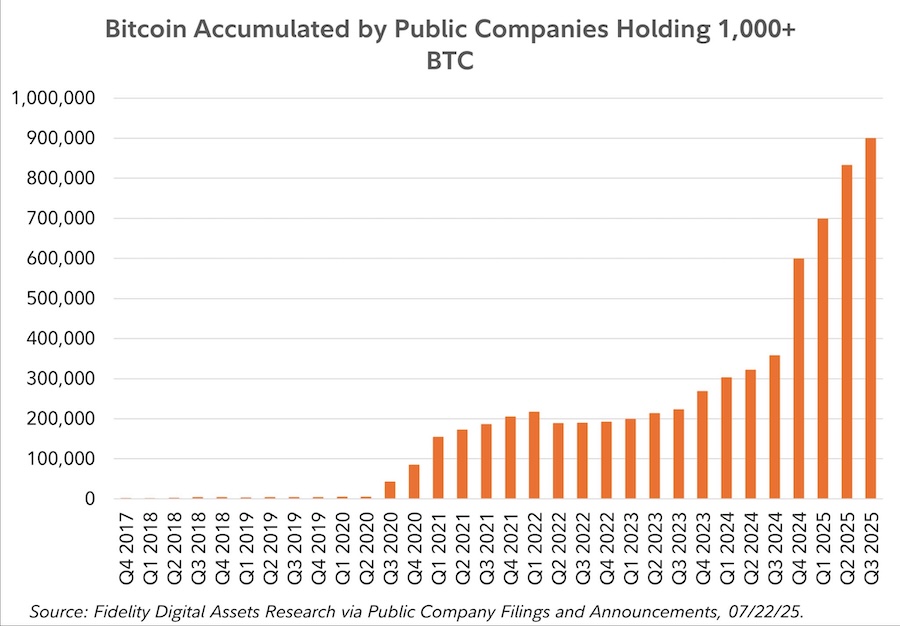

But ETFs are just one component of the growing institutional demand for Bitcoin. There are now an estimated 192 public companies and at least 68 private companies that hold Bitcoin on their balance sheets. This is a major shift from just a few years ago when there was only this lunatic named Michael Saylor buying Bitcoin for his company Microstrategy (now just Strategy). The list now includes several Bitcoin miners, but also well-known companies like Tesla, Trump Media, Coinbase, Block, GameStop, SpaceX, MercadoLibre, and Rumble. The top 100 public companies now hold around 1 million BTC or roughly 5% of the total supply.

If the growth in corporations holding Bitcoin continues, they will quickly absorb a large percentage of the total supply. Rising demand and contracting supply is an obvious recipe for much higher prices.

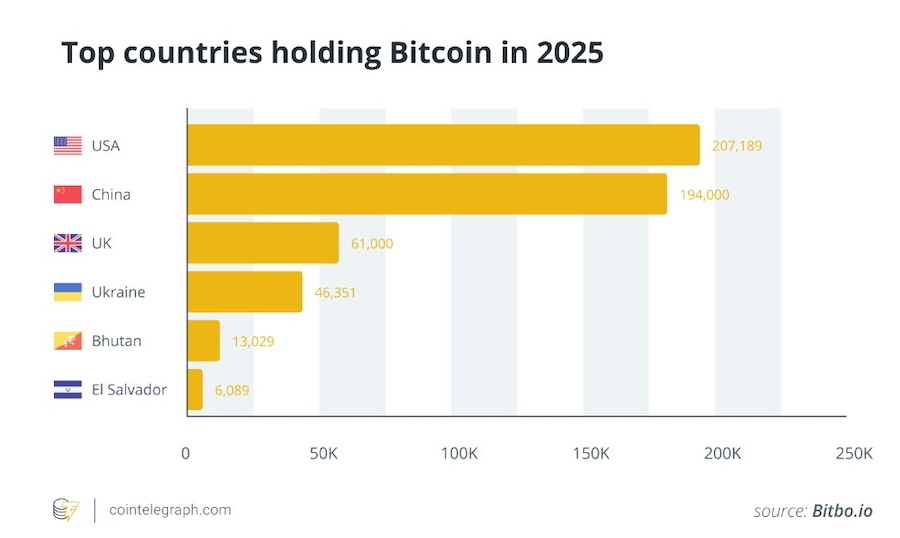

But perhaps the institutions that could make the largest impact are nation states and their sovereign wealth funds. It is now estimated that 15 different countries hold Bitcoin, including the United States, China, the UK, Ukraine, North Korea, Bhutan, El Salvador and the UAE.

Norway’s sovereign wealth fund, managed by Norges Bank Investment Management (NBIM), has significant exposure through investments in companies with Bitcoin on their balance sheets. As of June 30, 2025, NBIM’s indirect Bitcoin holdings reached 7,161 BTC, valued at approximately $844–862.8 million, reflecting a 192.7% year-on-year increase and an 87.7% rise in the first half of 2025.

Russia’s wealth fund has invested in mining infrastructure over the past few years and Russia likely holds significant amounts of undeclared Bitcoin.

Brian Armstrong was on CNBC just today saying that all G20 nations are likely to start establishing strategic Bitcoin reserves soon. Now imagine nation states with their own currencies/central banks that can essentially print infinite amounts of fiat money to acquire Bitcoin (digital scarcity). If most of the G20 nations start accumulating Bitcoin, there will be a rush not to be left behind and the spike in demand is likely to break all current price models.

CZ recently chimed in on this topic as well, stating that “Nations will print unlimited money to buy Bitcoin.”

#5 On-Chain Metrics (CBBI)

The Colin Talks Crypto Bitcoin Bull Run Index (CBBI) aggregates the best on-chain metrics into one index. This includes the Pi Cycle Top, Puell Multiple, RHODL ratio, MVRV Z-score, Reserve Risk and more. It has consistently topped in the 97 to 100 range during past bull cycles. But during the current bull cycle, it has only reached 83 and is currently at just 76. This suggests more upside is likely before the Bitcoin price tops and begins a bear cycle.

(Click on image to enlarge)

Summary

Bitcoin has been one of the best investments any investor could have made over the past 16+ years and I believe this trend will continue into the future. As this new asset class matures, we are likely to see a decline in volatility marked by less powerful rallies and corrections, although I still believe Bitcoin will continue to outperform.

Investors have grown accustomed to watching the 4-year halving cycle closely to help get insights into price movements. But I believe this cycle is becoming less relevant and reliable as a predictor of price movements in this maturing asset. With the approval of spot Bitcoin ETFs and the near removal of regularly risk, Bitcoin became more than just a niche form of digital money used by libertarians, cyberpunks and those operating outside of the legal system. It is now mainstream and enjoying rapid adoption by both institutions and retail investors.

When looking for the main drivers of the Bitcoin price, global liquidity and stablecoin supply have been the two most significant factors. Both of these metrics are growing rapidly and hitting news record highs. The world is awash in fiat money and global liquidity is likely to continue increasing as central banks lower interest rates and pump more money into the economy. The Bitcoin price tends to follow with a 2 to 3 month lag, suggesting we have at least a few more months of upside before any signs of a top. And as long as global liquidity and stablecoin supply keeps rising, the Bitcoin price should keep rising alongside them.

Over the past few years, Bitcoin has seen increased demand from corporations. Some are simply diversifying cash reserves to protect from inflation and increase returns, while others are building their entire business model around accumulating as much Bitcoin as possible. While it has been remarkable to see the number of public companies holding Bitcoin grow from a few fringe players to around 200, this is still a very small percentage of the 50,000+ publicly listed companies globally. The number of companies holding Bitcoin will continue to grow and they will continue finding innovative ways to use both debt and equity in the capital markets to accumulate increasing amounts.

There is a growing list of nation states and sovereign wealth funds that are accumulating Bitcoin. I suspect that in addition to the public announcements, there is a significant amount of stealth strategic accumulation taking place by countries that want to own a digitally scarce asset. If most of the developed nations start accumulating as Brian Armstrong and CZ predict, there could be an overwhelming flood of new demand hitting Bitcoin soon and helping to push the price toward some of the most aggressive price predictions.

Lastly, on-chain metrics can be useful to help better understand what stage of the Bitcoin bull run and bear market cycles we are in. Aggregating the top indicators into one index helps to simplify the analysis and provide a quick insight into the current status. The CBBI index is suggesting that the current bull cycle for Bitcoin is far from over and that the price has the potential to climb much higher before signs of a cycle top.

All of these elements together point to much higher prices or Bitcoin on the horizon. Of course, there are some events that could disrupt this view such as a Depression or major economic slowdown, stock market crash, significant geopolitical events, etc. In recent months there has also been large-scale selling by early Bitcoin wallets that have not been active in over 10 years. While this initially spooked the markets, it was actually bullish to see how quickly this selling was absorbed and how brief and insignificant the impact was on the Bitcoin price.

The bottom line is that Bitcoin has come of age and is now a reputable asset that is being acquired by all types of institutions, governments and individuals that want to hold a scarce digital asset. The major influx of new investors and new liquidity in the markets is likely to disrupt the traditional 4-year cycle and prolong the current bull cycle. I think the Bitcoin price is likely to hit $150,00o by the end of 2025 and climb above $200,000 over the next 6 months. And I would not be surprised to see Bitcoin trading near $1 million at some point within the next 5 years.

“Buy Bitcoin before governments adopt, prices may escalate significantly.”

– Adam Back, CEO and co-founder of Blockstream and HashCash in 1997, a proof-of-work system that became a foundational component of Bitcoin’s mining process, as cited in Satoshi Nakamoto’s Bitcoin whitepaper.

More By This Author:

Cryptocurrency Memecoins Are Dying – Enter AI AgentsGold Shortages, Gold Standard, Gold Price Record

Bitcoin Price Surge Driven By Strategic Reserve Accumulation

Nicoya Research LLC is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities customers should buy or sell ...

more