2024 Closes With Strongest 7 Year Auction On Record

Image Source: Unsplash

The final coupon auction of 2024 is now the history books and on the day yields blew out to 6 months highs and just shy of the highest level of 2024, it is probably not a surprise that demand was stellar.

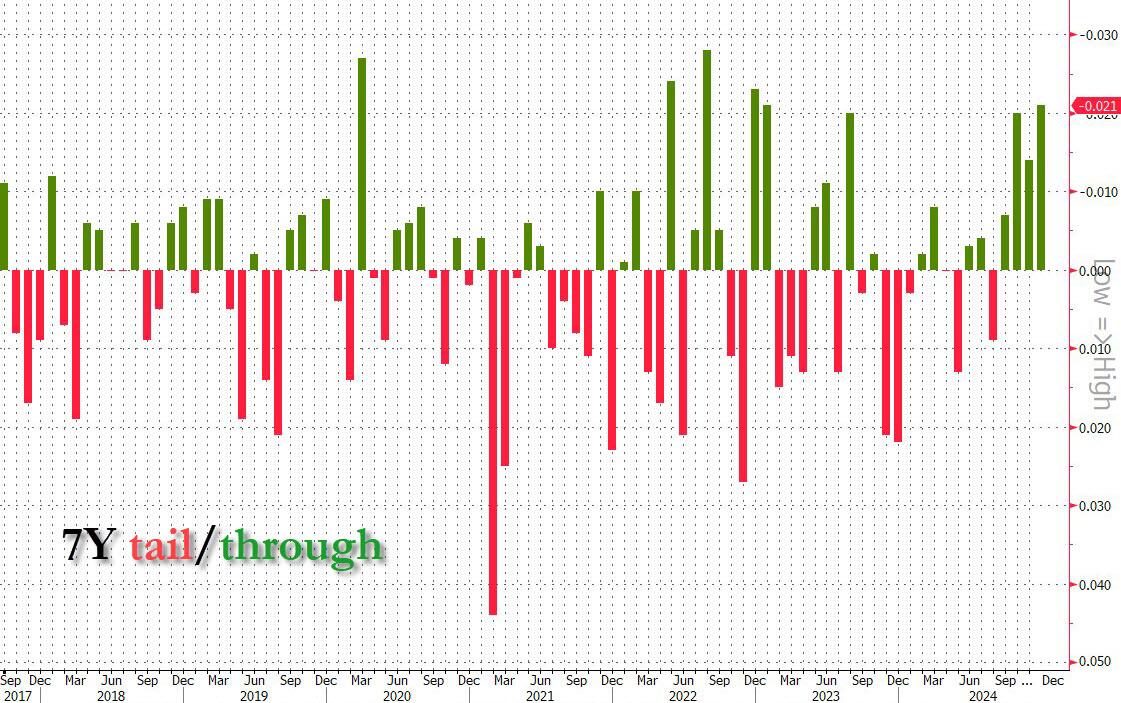

Stopping at a high yield of 4.532, this was - not surprisingly after the Fed's hawkish pivot - the highest yield since May. It also stopped through the When Issued 4.532 by 2.1bps, the biggest stop through since January 2023. It was also the 4th consecutive stop for the 7 year tenor, the longest such stretch on record.

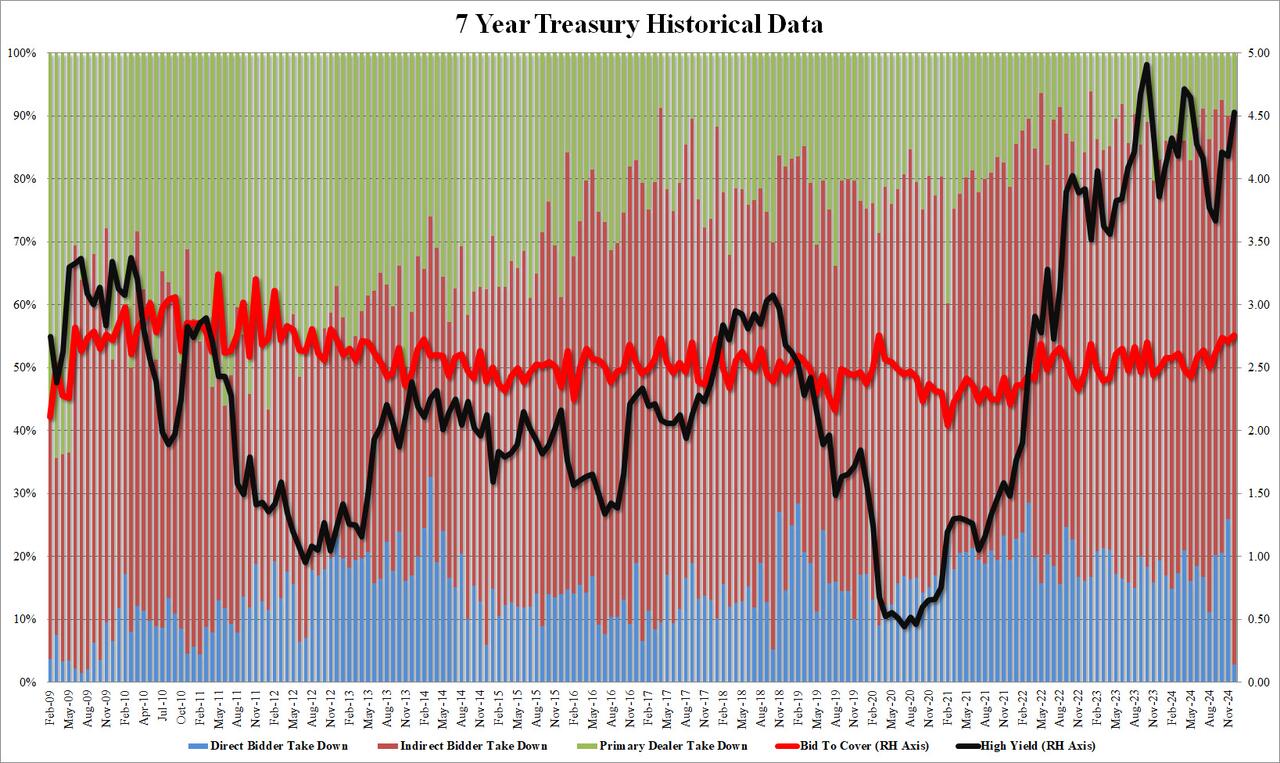

The bid to cover was also remarkable: surging to 2.758 from 2.709 in November, this was the highest bid to cover since March 2020, aka the depth of the covid crisis when everyone was fleeing into TSYs.

And while this metric was remarkable, the internals were absolutely off the charts, with indirects exploding higher to 87.9% from 64.1%, the highest on record by a long shot. This left virtually nothing for Directs who took down just 2.85%, a record low, while Dealers were awarded 9.3%, the lowest since October.

Overall, it is somewhat fitting that in this upside down market, where "investors" are dumping value energy names trading at single digit PEs to buy megashoter, garbage "AI story" stonks which will never not survive more than a year or two, let alone make a profit, that the final auction of the year would also be the best 7Y auction on record.

It is also not a surprise that with the market positioned extremely bearishly, that there was another round of short covering which sent 10Y yields from day highs of 4.64% around noon to just around 4.57% after today's blowout auction as the name of the game in this "market" is just to squeeze as many shorts as possible.

More By This Author:

Futures Slide As Bond Yields Jump To 6 Month HighContinuing Jobless Claims Hit 3-Year-Highs As Initial Claims Hold Near 7-Month-Lows

Too Much Tesla Hype From Wedbush's Daniel Ives? Deutsche Bank Sees Q4 Deliveries Missing

Disclosure: Copyright ©2009-2024 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more