Why Wages Have Lost Ground In The 21st Century

One of the enduring mysteries for conventional economists is why wages aren't rising for the bottom 95% even as unemployment is low and hiring remains robust. According to classical economics, the limited supply of available workers combined with strong demand for workers should push wages higher.

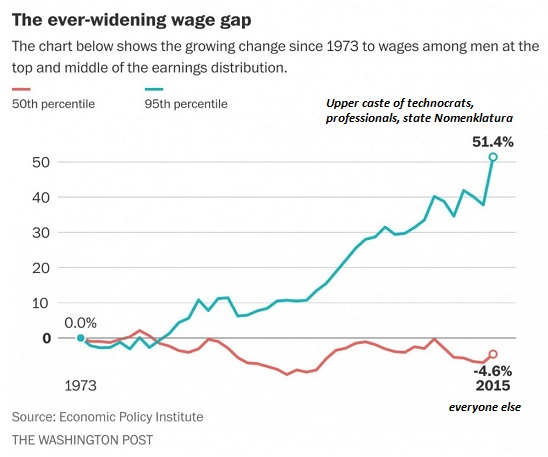

Why have wages for the bottom 95% lost ground in an expanding economy? We can start our search for answers by looking at a chart of wages going back 44 years to the early 1970s. Note that the top 5% began pulling away in the 1980s, when financialization and globalization took off, and accelerated in the 1990s tech boom and the early 2000s housing bubble. The bottom 95% benefited from these booms, but at a much more modest level: wages for the bottom 95% almost returned to 0% gain as opposed to actual declines.

But after the wheels fell off the bubble in 2008/09, the "recovery" since then has seen wages for the top 5% soar and the wages for the bottom 95% crater. (This chart is for males; the next chart reflects family income.)

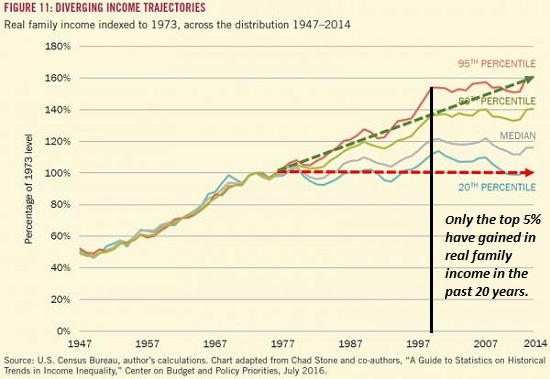

Here's family income going back to the postwar boom of the late 1940s and 1950s. Note the structural change in the early 1970s and the stagnation in all income levels since 2000:

The forces that gathered steam in the 1970s, 80s and 90s that pressured wages are well-known: financialization, which benefited the top echelons at the expense of the increasingly burdened debt-serfs; globalization, which pitted American workers against an ever-expanding global work force of low-paid employees, and automation/software, which expanded from the factory floor into service sectors.

Those workers with the skills required by financialization, globalization and automation--the technocrat and managerial classes--benefited mightily, while those who could not add enough value at the top of the chain saw their wages stagnate.

But these structural forces don't explain all the stagnation of wages for the bottom 95%. There are three other equally powerful structural forces at work:

1. Zero interest rates and abundant liquidity have kept zombie firms alive, bloating supply. In sector after sector, there is an oversupply of everything: too much retail space, too many fast-food outlets, etc. Marginal enterprises have been able to continue as zombies, skimming just enough income to borrow more money and roll over existing debt.

In an environment of historically normalized rates, i.e. 6% mortgages and higher rates for other debt, these zombie firms would be shuttered and the oversupply would diminish, enabling the survivors to regain pricing power and thus the wherewithal to pay higher wages.

2. Revenue that could have gone to wages has been siphoned off by soaring labor overhead: healthcare premiums, higher workers compensation taxes, etc. When an employer has to pay $500 more per month for an employee's healthcare insurance premium, that's $500 that could have gone into a fatter paycheck; instead, it disappeared into the insatiable maw of U.S. healthcare.

3. Many if not most employers can't afford to pay higher wages regardless of the labor market. Most employers are facing ever-higher costs while their pricing power (ability to raise prices) is effectively zero due to the oversupply of virtually everything.

The only sectors with the ability to raise prices at will are cartels that pass their profiteering onto the general populace with the protection of the federal government: higher education, Big Pharma, etc.

Faced with zero pricing power and higher costs, employers either add hours to existing employees' schedules or hire no-benefit part-time employees. This is the reality for most small businesses.

The problem with stagnant wages is our socio-economic system requires ever-higher incomes to function. Stagnant wages kill pay-as-you-go social programs such as Medicare, local governments dependent on income taxes, and of course the consumer sectors that rely on the spending of the bottom 95%.

As I have noted many times, filling the gap between stagnant wages and higher expenses with more debt works for a while, but it isn't a permanent solution, as eventually the costs of servicing the higher debt eats the borrower alive--and when he defaults, the bad debt eats the lender alive, too.

Disclosures: None.

This is a great article, an outstanding article, except that the Fed does not want wages to go higher and is part of the problem, not the solution. So, will the Fed break our socio-economic system? That becomes the real question. I wrote about Fed behavior and obvious culpability in forcing this downward pressure on wages. www.talkmarkets.com/.../kashkari-reveals-dark-secret-fed-plan-for-wages