Why Tactical Isn’t Working – Part IV (QE-Infinity And Beyond!)

<< Read More: Why Some Tactical Strategies Aren’t Working Very Well – Part I

<< Read More: Why Some Tactical Strategies Aren’t Working Very Well - Part II

<<Read More: Why Tactical Isn’t Working – Part III (Everybody’s Doin’ It)

With the markets (a) stuck in what I’ll call price discovery mode in relation to the idea that we are seeing the beginning of the end of the QE Era and (b) in the middle of what has historically been a seasonally weak period for stock prices, I’m going to spend my time this morning continuing our series on why tactical/technical strategies have not fared well in recent years.

So far, we’ve established that many tried and true stock market indicators have disappointed investors looking to be long the stock market when the bulls are running and to take defensive measures when prices fall. There can be little argument as to whether this scenario is playing out as most folks I know using a tactical approach to the market have experienced a rather long period of underperformance. The key question is why is this happening?

I have opined that there are three primary reasons for the struggles in tactical trading arena. I titled these reasons, “Everybody’s doin’ it,” “Global QE,” and “The rise of the machines.”

Last time, we explored the idea that everybody on the planet now employs technical analysis and price/trend tools in their work. I suggested that the popularity of moving averages, trendlines, and support/resistance zones, which together are the crux of a trend-following approach, has led been their downfall.

This morning, I’d like to spend a few minutes talking about the role the global central bankers have played in this issue.

Just What Is QE Anyway?

To be clear, what I’m about to present is an oversimplification of a very complex issue. But the premise is still pretty straightforward. When global central bankers buy bonds on the open markets (a tactic called “quantitative easing” or “QE” for short), they are doing two things. First, they are trying to push bond yields lower. And second, they are “expanding their balance sheet” in the process. This means that the central bank in question is basically printing money (a term I’m using loosely here) in order to make the purchase of the bonds.

Why would a central banker employ such a strategy, you ask? The thinking is that if the markets know a central bank is going to buy bonds each and every month over an extended period of time, traders will join in the game and rates will move lower during the QE period. And a primary theme in the world of central banking is that low interest rates help stimulate a country’s economy (oops, I mean, increase employment and inflation).

The QE game has been going on for many years now and analysts continue to debate the effectiveness of the plan. Many will argue that QE hasn’t really done a good job of stimulating economies. However, QE has caused interest rates around the world to fall as prior to the latest tantrum in the bond market, something on the order of one-third of all government bonds in the world traded with a negative yield. So, there can be little question that QE does cause rates to fall.

In terms of being a stimulative measure from an economic standpoint though, the reviews are definitely mixed. The party line from the central bankers has been that things would have been MUCH worse if the QE schemes had not been implemented.

Money Goes Where It Is Treated Best

But I digress. For our purposes, the bottom line is a QE scheme effectively winds up creating new capital in the markets. The central bank buys a bond on the open market. The seller of the bond (primarily big banks), receives money from the sale that needs to be reinvested. In other words, this fresh capital created by QE has to go somewhere.

And this is the key point. While the jury is still out on whether or not QE really works from an economic standpoint, it DOES create capital. And a fundamental rule of markets is that “money goes where it is treated best.”

One thing traders have learned since the credit crises ended is that a fair amount of the fresh capital created by a QE program winds up going into the U.S. stock and bond markets. And it really doesn’t matter what the color, shape, or size of the currency is that is being “printed.” The important thing is that a great deal of that new money apparently winds up in our markets – especially when prices are going down.

Buy The Dips!

Whether or not it is true that the actual seller of the bond a central bank is buying turns around and invests the proceeds directly in the stock market, traders do know that when central banks create capital, it eventually has to go somewhere. And since the U.S. tends to be the place where money is “treated best,” well, traders know that the U.S. markets wind up being supported by global QE programs.

The central bankers also know this. So, every time there is a new crisis or threat to the economy, the bankers flock to the microphone and start talking about all the additional stimulus they “can” provide if the instability in the markets continues.

Thus, each and every decline seen in the U.S. stock market over the past several years has been reversed in relatively short order. Why? Because traders know that the QE money will be coming. And just like the potential crossing of a once-important moving average, traders want to get in front of this event. As such, a buy-the-dip mentality has become the norm in the stock market.

This means that declines of 5% to 10% are erased in a matter of days. And reversals of what were once meaningful declines (10% to 20%) now occur within a month or so.

And THIS is another reason why tactical risk management techniques such as moving to cash when prices start to go in the tank have proved largely ineffective since 2010. Because declines are reversed very quickly whenever the central banks start talking about saving the day again. Risk? What risk?

Bottoms Are NOT a Process These Days

So… The key here is to recognize that markets have not followed the traditional pattern during a corrective phase. Typically, a correction in the stock market plays out as follows. Stocks decline in response to some event or fear. Then they bounce off the bottom on a “sigh of relief.” But then the reason for the decline reappears and the indices retest the lows in some fashion. And finally, as things settle down over time, the markets experience a basing period before beginning the next leg higher.

This is why analysts contend that bottoms in the market are a “process” and not an event. However, this has definitely NOT been the case in the QE era. Instead of a bottoming process occurring over a period of weeks or months, central bankers start talking to the press and BAM – traders start buying.

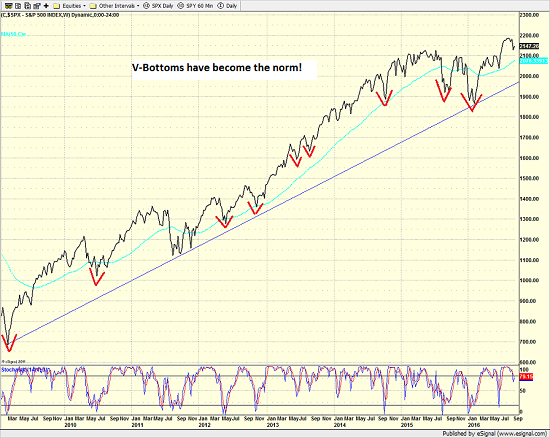

S&P 500 – Weekly

Because of this, fast-paced “V-Bottoms” have become the norm. And cutting to the chase, a V-Bottom that is triggered by a headline is very difficult to anticipate. Thus, tactical systems wind up being caught off guard and whipsawed as traders fall all over each other buying the dips at the speed of light.

Speaking of trading at the speed of light, next week, we’ll explore the “rise of the machines.” And then finally, I’ll finish up this series by offering up my take on how to deal with this tactical/trading dilemma.

Comments

No Thumbs up yet!

No Thumbs up yet!