'What Were You Thinking?'

My friend Eric recently shared an iconic quote from the dot-com mania that is especially relevant to the equity market today. Scott McNeely was the CEO of Sun Microsystems, one of the darlings of that bubble. At its peak, his stock hit valuation of ten-times revenues. A couple of years afterward he had this to say about that time (via Bloomberg):

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?

Below is a chart of Sun Micro from 1996 to 2006. It started around $5 ran up to that $64 Scott mentions and then fell right back to $5. And you would think this might serve as a cautionary tale for investors today.

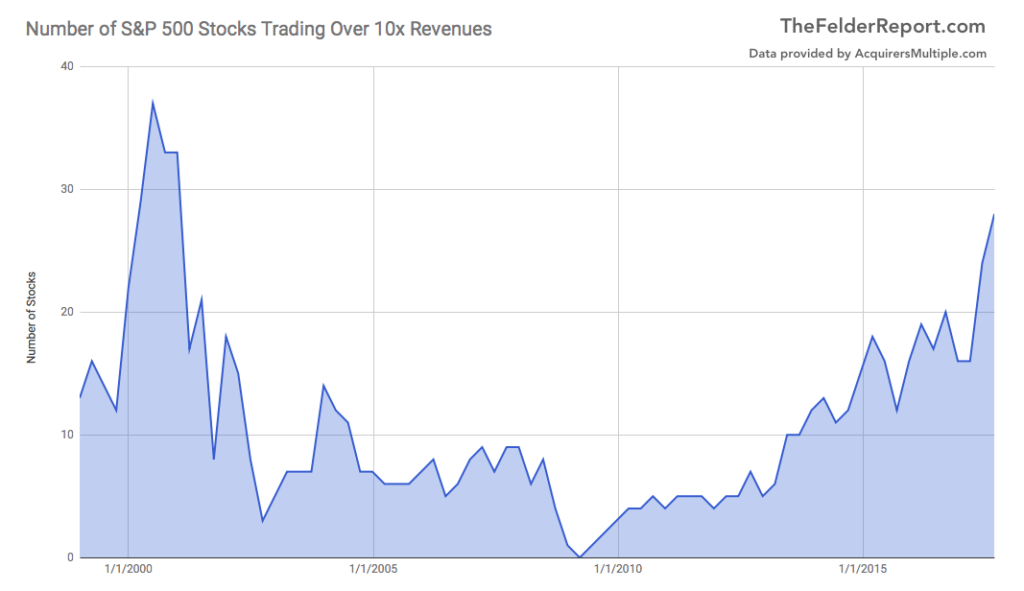

In that case, you thought wrong. Interestingly, there were 29 stocks within the S&P 500 that traded above ten times revenues at the peak of the dot-com mania (though that number did surge higher after prices had already peaked). Today, there are 28.

Facebook is one of those 28 and actually trades at over fifteen times revenues, more than 50% higher than Sun Micro did at its peak. Ironically, Facebook now resides at Sun’s old headquarters. I don’t know if they will follow the same path Sun did but it certainly looks like there are a ton of investors that will, at some point in the future, be asking themselves once again, ‘what were you thinking?’

Disclosure: Information in “The Felder Report” (TFR), including all the information on the Felder Report website, comes from independent sources believed reliable but accuracy is not ...

more