What May Be The Final Month Of The Fake News Boom

For the second consecutive month, retail sales recorded by gasoline stations surged by an annual rate of more than 20%. It was the fourth month in a row where sales have been up by nearly that amount. Last year’s jump in oil prices is feeding through in a number of ways. From headline inflation rates to now consumer spending, the retail sales report has been boosted at the top.

Overall retail sales, which include those at gasoline stations as well as everywhere else, gained 6.85% year-over-year. It was the third time in the last four months when total retail sales were near 7%. This isn’t a coincidence, obviously, given those particular months correspond to the big jump in gasoline.

In comparison to 2014 and the apex of Reflation #2, consumer spending has been better. Going back to Reflation #1, however, even with the boost from oil prices, it isn’t anywhere close.

The narrative of the US economic “boom” is benefiting from two factors which going forward aren’t going to be nearly as favorable. Gasoline is, obviously, the first of those. If oil prices don’t undertake another major upward trend soon, retail sales growth rates with gasoline will begin to converge toward those without it.

If you take away the raw oil price factor, the US consumer doesn’t look so good. Retail sales are materially worse now than during 2014. In fact, Reflation #3’s effects aren’t nearly as compelling. The economy is better than it was in 2015 and 2016, but that’s not what anyone is really after.

The other factor is, ironically, hurricanes. While the US digests Florence’s devasting push, August will be the last month by which economic stats will compare to the Harvey-led shutdown. In short, base effects. August 2018 has both the favorable comparison to August 2017 as well as the short-term boost in spending both Harvey and Irma had triggered in their destructive wake.

Looking past those storms, assuming Florence doesn’t provide the “boom” a similar assist, retail sales have slowed – by a lot. Seasonally-adjusted, excluding gasoline stations, the underlying state of consumers is already back to stagnation. Tax cuts, the unemployment rate, labor shortage, etc., all those factors which were supposed to add up to a big economic surge have instead fizzled.

It wasn’t the unemployment rate, it was Mother Nature.

Over the three months of summer, those which include the crucial back-to-school shopping season, retail sales were nearly flat. Take away the oil price effect and retail sales were up by 0.8% total, which is a recession-like annual rate of just 3.3%.

While that dim result could just be the noise of a short 3-month window, it really isn’t any different from retail sales growth post-Harvey and Irma; i.e., the aftermath of their aftermath. Going back to last November, over the nine months that have followed retail sales (again, ex-gasoline) have gained just 2.8%. That’s an annual growth rate also less than 4%, also in the downturn zone.

What that shows, predictably, is that the US economy isn’t really booming at all. It is the same underlying stagnation that has been with us for a decade. There are times when it looks like things might be getting better, especially if during these periods there are artificial factors helping in the positive direction, but even in these best months, they aren’t meaningful upswings.

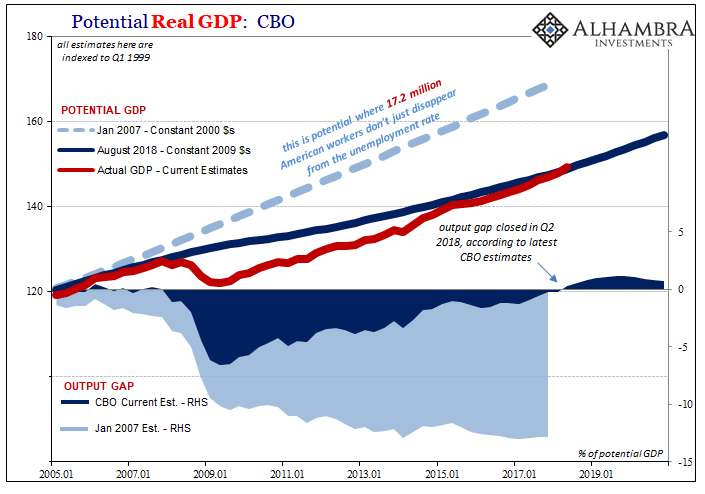

Reflation is supposed to be the first step to recovery. What’s instead happened is the convergence of these couple of factors plus another big picture change. The combination of hurricanes and oil prices has been added to the re-engineering of economic “potential” so as to declare a recovery out of essentially nothing.

Look at the two charts above; retail sales clearly belong to the light blue shaded area (output gap) not the dark blue that the CBO, Jay Powell, and the media have characterized as this “boom.” It’s not a boom at all. But over the last year, it has been made to sound almost like a real one. After August, it won’t be so easy.

To repurpose a popular term: fake news boom.

Disclosure: None.