USD/JPY, Treasury Yields Struggle Ahead Of More Fed Rhetoric

(Click on image to enlarge)

|

Ticker |

Last |

High |

Low |

Daily Change (pip) |

Daily Range (pip) |

|

EUR/USD |

1.2029 |

1.2059 |

1.1914 |

112 |

145 |

EUR/USD breaks out of the narrow range from earlier this week, with the pair at risk for a further advance as the European Central Bank (ECB) appears to be on course to conclude its quantitative easing (QE) program.

Even though the ECB remains in no rush to remove the zero-interest rate policy (ZIRP), it seems as though the Governing Council will stick to the December deadline for the Public Sector Purchase Programme (PSPP) as officials warn rates will ‘remain at their present levels for an extended period of time, and well past the horizon of our net asset purchases.’ Moreover, the recent comments from President Mario Draghi and Co. suggest the central bank will continue to tolerate the appreciation in the Euro exchange rate as ‘the current positive cyclical momentum increases the chances of a stronger than expected economic upswing,’ and the central bank may continue to gradually alter the monetary policy outlook over the coming months as ‘risks surrounding the euro area growth outlook remain broadly balanced.’ In turn, the shift in EUR/USD behavior may continue to unfold ahead of the next ECB meeting on October 26 as the Governing Council remains confident in achieving the 2% inflation-target over the policy horizon.

Nevertheless, EUR/USD may face a bumpy road ahead of the Federal Open Market Committee (FOMC) interest rate decision on September 20 as Chair Janet Yellen and Co. are also scheduled to release their new projections for growth, inflation and the benchmark interest rate.

EUR/USD Daily Chart

(Click on image to enlarge)

- Near-term outlook remains constructive for EUR/USD as it breaks out of the holding pattern from earlier this week, with a break of the 2017-high (1.2070) raising the risk for a run at the 1.2130 (50% retracement) hurdle, with the next region of interest coming in around 1.2230 (50% retracement).

- Keeping a close eye on the Relative Strength Index (RSI) as it works its way back towards overbought territory, with EUR/USD at risk for a further advance should the oscillator bullish momentum gather pace; however, failure to push above 70 may undermine the resilience in the euro-dollar exchange rate as the oscillator starts to deviate with price.

|

Ticker |

Last |

High |

Low |

Daily Change ($) |

Daily Range ($) |

|

USD/JPY |

108.09 |

109.27 |

108.06 |

113 |

121 |

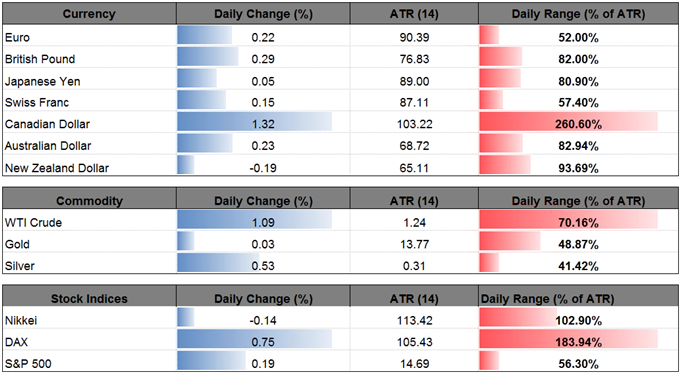

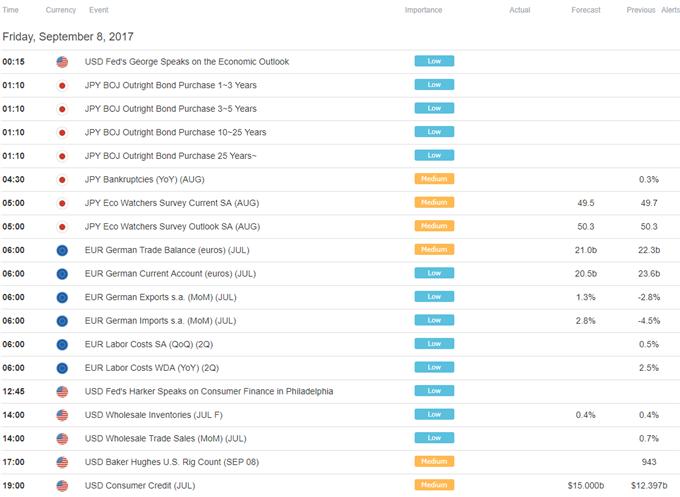

USD/JPY struggles to hold its ground ahead of another batch of Fed rhetoric, and the pair stands at risk for further losses as the 10 and 30 Year U.S. Treasury yield slip to fresh yearly lows.

In light of the mixed rhetoric coming out of the Federal Reserve, comments from Cleveland Fed President Loretta Mester, New York Fed President William Dudley and Kansas City Fed President Esther George may do little to prop up U.S. yields as market participants scale back bets for three rate-hikes in 2017. Fed Fund Futures now highlight a greater than 60% probability Chair Janet Yellen and Co. will keep the benchmark interest rate on hold even at the December meeting, with the U.S. dollar at risk of facing a more bearish fate over the coming months as central bank officials adopt a less-hawkish outlook for monetary policy.

In turn, USD/JPY may threaten the range-bound price action from earlier this year especially as it breaks the April-low (108.13).

USD/JPY Daily Chart

(Click on image to enlarge)

Chart - Created Using Trading View

- Even though USD/JPY breaks out of the downward trend from July, the lack of momentum to push back above the Fibonacci overlap around 111.10 (61.8% expansion) to 111.60 (38.2% retracement) may open up the downside targets as the pair continues to push to fresh monthly lows.

- Close below the support zone around 108.30 (61.8% retracement) to 108.40 (100% expansion) opens up the next region of interest around 106.60 (38.2% retracement) to 107.20 (61.8% retracement) followed by the 105.40 (50% retracement) hurdle.

(Click on image to enlarge)

Comments

No Thumbs up yet!

No Thumbs up yet!