Unmixed Signals

In mid-December, the Bank for International Settlements (BIS) published its regularly quarterly update. It was just in time for the current bout of “overseas turmoil” which included a lot that wasn’t overseas. The BIS noticed, I’m sure reluctantly.

Financial markets swung widely, eventually netting a sharp correction, during the period under review, which started in mid-September. Asset prices fell across the board and US government yields widened in October before retracing that increase and dropping further as the selloff of risk assets spread. Volatility and term premia jumped. A further round of turbulence, this time accompanied by lower yields, hit markets in December.

The anticipated BOND ROUT!!!! of normalcy further postponed. The wild swings in markets would only get wilder following the publishing of the report. This wasn’t supposed to happen, not in 2018. Globally synchronized growth was going to carry the global economy if not all the way back to pre-crisis conditions than at least somewhere close enough to them.

Raw disappointment oozing out from each of their words, the BIS continued:

The repricing took place amid mixed signals from global economic activity and the gradual, yet persistent, tightening of financial conditions.

When any official, political outfit characterizes anything as “mixed signals from the global economy” they don’t actually mean mixed. The correct word to have used in this context would have been contradictory. They mean “mixed” in the sense that the evidence is increasingly going the other way which doesn’t comport with the hugely optimistic standard narrative.

The data is negative but the narrative remains positive nonetheless. That kind of “mixed.”

The title of their summary is, after all, Yet More Bumps On The Path To Normal. If they mean “normal” in that the global economy can never really get going because it lurches from downturn to low-grade upturn and back again, then, yes, that’s what we have in front of us here. Eurodollar normal. They don’t mean that version, however.

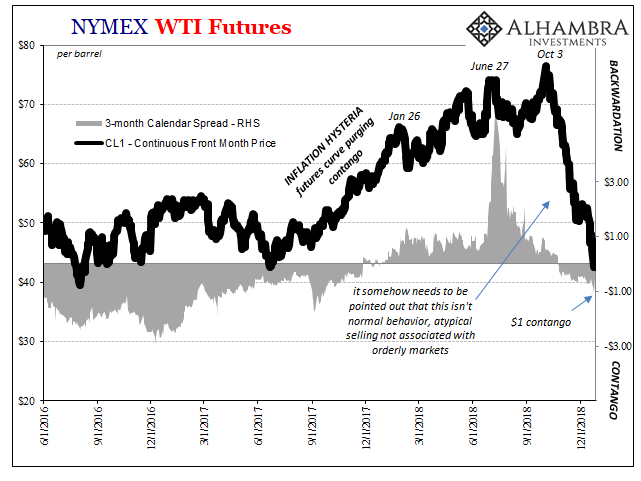

Economists really think the world is getting better rather than falling off again. It doesn’t matter how many times they think it, say it, print it, it never happens. They mean “normal” in the small “e” economic sense, and thus will be surprised as well as sorely disappointed by exactly what the oil market is saying on the topic. An oil crash is never a good thing.

A 40% decline in oil prices spread out over a two-year period would be a huge boon to consumers; in two months, it’s nothing other than panicky liquidation which points to the same familiar if undesirable direction.

That’s because it comes along when the data has become pretty homogenous really. The latest are more estimates out of China where downturn is perhaps closest at hand. Industrial profits, an important indication of economic progress, contracted in November (year-over-year) for the first time since 2015.

Just as there is a space between recession and growth there is one between reflation’s end and downturn. It’s here where the data might’ve been mixed but as the calendar progresses toward 2018’s turn it has been much less so. Whatever might’ve been possible before, say, May 29 really doesn’t seem the slightest bit likely any longer. After October 3?

That’s what markets are now pricing – what the final end of Reflation #3 means. It leads nowhere good, the same economy as the last eleven years of lost decades and stubborn malaise. If China is rolling or has rolled over then what’s in front is only downside.

As Chinese industry goes so does the Chinese economy and therefore what’s left of globally synchronized growth. It was always more of a pipe dream than anything, but after so much time without actual growth in the world that was enough for many people. A lot them really thought this time it had to be the one.

Imagine what would happen when they find out it isn’t and won’t be, no upside left after gaining not much to begin with. Unfortunately, we don’t have to imagine, the “mixed signals” of plunging markets is already doing it for us.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more