Two Momentum Stocks With Triple Digit Potential

My allocation to the biotech and biopharma sectors is the largest within my own portfolio. The stellar potential growth prospects within these spaces stand out in a world with significant concerns around global growth. Most of my allocation within this area goes to Blue Chip Gems which are large cap growth stocks with attractive valuations such as Gilead Sciences (NASDAQ: GILD) and Celgene (NASDAG: CELG).

I also have 12 to 15 minor stakes in small cap concerns with attractive potential that are more speculative in nature. These tend to be investments in niche plays in specific evolving technologies within the sector. One has to be well-diversified in this sector. It doesn’t matter how good an investor is within this area, there are simply going to some blow ups from time to time as it is a very complicated industry. This will be made up for by the huge gains when an investment pans out.

A good example of this is the case of Avanir Pharmaceuticals (NASDAQ: AVNR). This small biopharma had the only FDA approved treatment for a condition called PBA as well as some interesting drugs in its pipeline when I invested in it during July of last year. It was positive Phase II trial results for one of these drugs, a treatment focused on reducing the agitation in Alzheimer’s patients, which was the primary driver of buyout offer from a larger Japanese based pharma company late last year. Avanir produced a 215% return in its less than five months in the Small Cap Gems portfolio.

One of the niches I have started to become fascinated with is the evolving area of wound care which is showing some impressive progress. Today we’ll go over the two small cap plays within this niche that have me intrigued at the moment. Both companies have good prospects, market capitalizations of under $250 million and go for less than $10 a share.

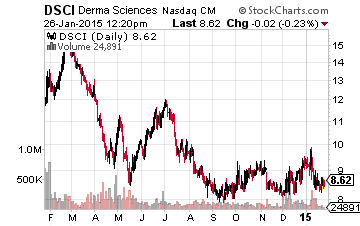

Let’s start with Derma Sciences (NASDAQ: DSCI), a small biopharma company that is exclusively focused on wound care. Derma has two businesses. The first is traditional wound care such as supplying bandages and dressings. This product line provides $45 million to $50 million in annual revenues with 25% to 30% gross margins. This part of the business is showing flat growth.

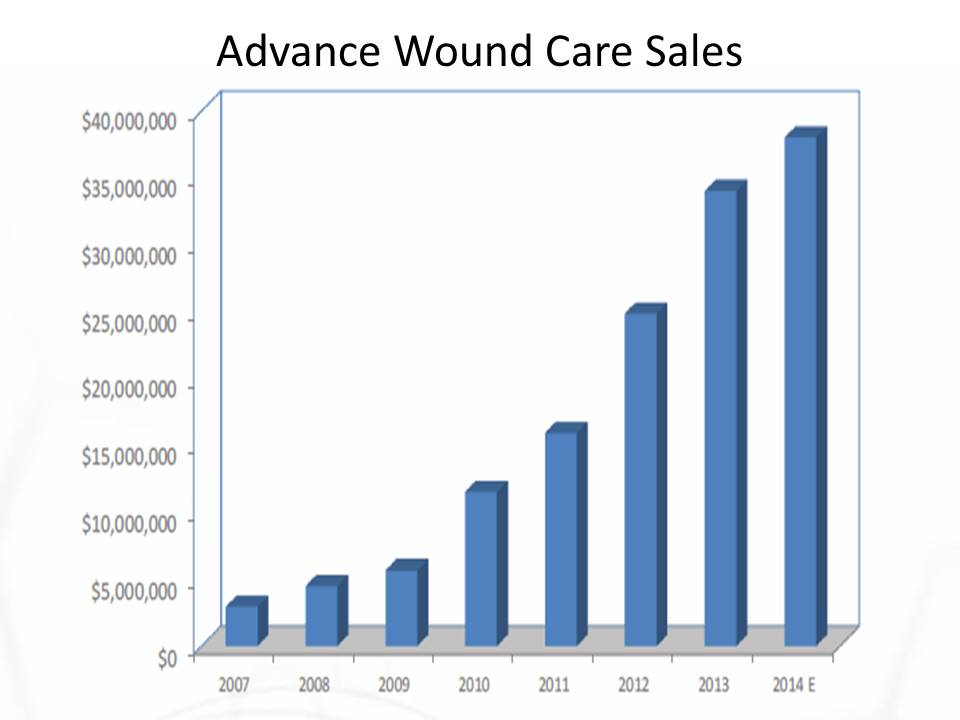

The other part of Derma’s business is much more exciting and is why growth investors should be interested in Derma. This division is Advance Wound Care that concentrates on proprietary technologies for chronic wounds and burns. The company’s primary products treat diabetic ulcers, impacting an estimated 300,000 to 500,000 individuals in the United States alone. This condition can cost $20,000 to $40,000 to treat and is behind some 100,000 amputations a year.

This business line has 48% to 52% gross margins and sales have increased some 150% since FY2011 and this division on the verge of producing some $40 million in sales annually. The company’s primary product in this category just got a significant reimbursement rate increase that took effect on January 1st.

In addition, the company is in the process of completing enrollment in an over 1,000 person Phase III trial for DSC127 which could be the next advancement for advance wound care for diabetics and scar prevention. Derma believes this is a $1 billion annual domestic sales opportunity.

These trial results should come out in 2016 and is the main reason Derma is currently posting losses as it will probably take some $60 million to get this to approval. The company has almost $85 million in cash and marketable securities on hand as of the end of the last reported quarter.

Over the last month, Roth Capital reiterated a “Buy” rating and a $16.50 a share price target on Derma. Canaccord Genuity also reiterated their “Buy” rating and a $18.00 a share price target around the same time. The stock currently goes for just under $9.00 a share. Given the lack of global sales and the potential of DSC127, I would not be surprised if a larger firm with a global sales force targets Derma for acquisition à la Avanir at some point in the foreseeable future. Only 10% of diabetic patients reside in the United States.

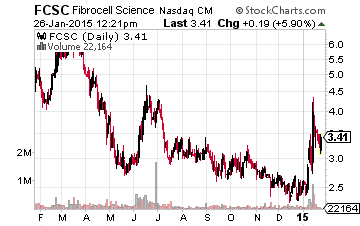

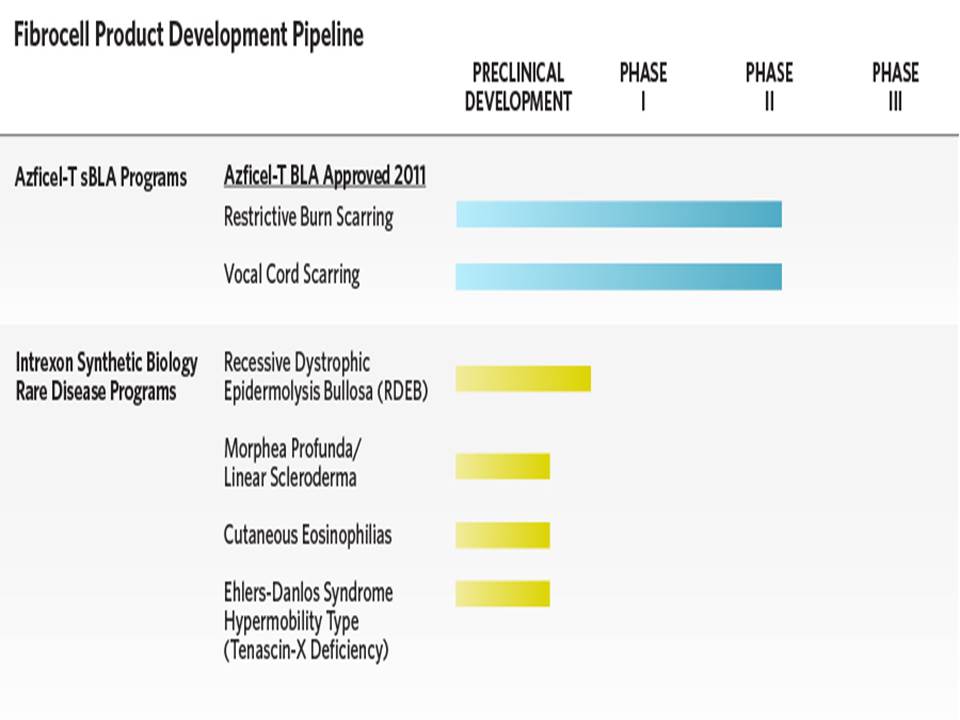

My next recommendation in this niche is Fibrocell Science (NASDAQ: FCSCFCSC), a stock I have owned since the summer of 2014 as I saw the firm had some significant insider buying and the stock now sits at just over $3.00 a share. The company develops therapies to treat rare and serious skin and connective tissue disease based on its proprietary technology platform. Fibrocell extracts cells from skin to create localized therapies that are compatible with the unique biology of each and every patient. The company has one FDA approved product, LAVIV, that is currently approved for targeting “smile” lines.

Fibrocell has little revenue at the moment but has a deep and intriguing pipeline which is why this play makes sense for speculative investors. The company has some $45 million in cash on hand and is burning through $6 million a quarter. Fibrocell’s market capitalization is just north of $100 million.

If all goes well the company should see Phase III results for its vocal cord and restrictive burn scarring sometime in 2016. The stock traded above $6.00 a share prior to the huge sell-off that hit the entire biotech sector in March of 2014. Insiders continue to make frequent but small purchases in the stock as well, which is encouraging.

Disclosure: Long DSCI, ...

more