Trucking Growth Is Up Year-Over-Year In May 2018

Headline data for truck shipments showed continued improvement in May 2018.

Analyst Opinion of Truck Transport

I tend to put a heavier weight on the CASS index which continues to show a stronger rate of growth improvement year-over-year. Part of the problem with ATA data is its poor presentation and lack of transparency.

It should be pointed out that the trucking movements are improving YoY - no matter what source is used.

ATA Trucking

American Trucking Associations' advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index rose 0.7% in May after rising 2.7% in April. In May, the index equaled 113.8 (2015=100), up from 113 in April.

Said ATA Chief Economist Bob Costello:

This continues to be one of the best, if not the best, truck freight markets we have ever seen,. May's increases, both sequentially and year-over-year, not only exhibit a robust freight market, but what is likely to be a very strong GDP reading for the second quarter. However, in the near-term, look for moderating growth rates for freight simply due to more difficult year-over-year comparisons, not from falling tonnage levels.

ATA Truck tonnage this month

Compared with May 2017, the SA index increased 7.8%, down from April's 9.9% year-over-year increase. Year-to-date, compared with the same five months last year, tonnage increased 8%, far outpacing the annual gain of 3.8% in 2017.

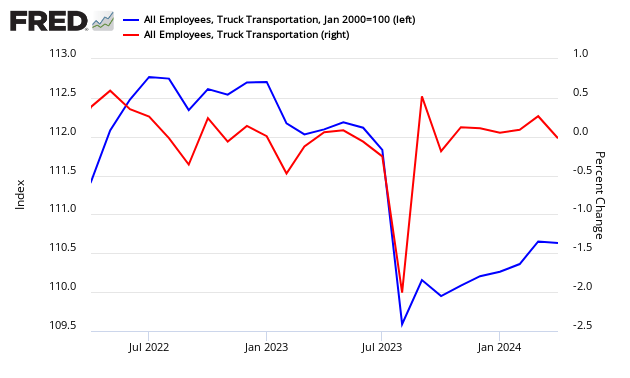

Econintersect tries to validate ATA truck data across data sources. It appears this month that jobs growth says the trucking industry employment levels were improved month-over-month. Please note using BLS employment data in real time is risky, as their data is normally backward adjusted (sometimes significantly).

source: ATA

CASS FREIGHT INDEX REPORT

Volume Strong, Pricing Even Stronger - Can It Get Any Better?

From both a volume and a pricing perspective, the U.S. freight economy is extraordinarily strong. The Cass Freight Shipments and Expenditures Indices are clearly signaling that the U.S. economy is ignoring all of the angst coming out of Washington D.C. about the potential of a trade war and all of the concerns coming out of Wall Street about the increased threat of inflation or the rise in interest rates. These indices are displaying accelerating strength on top of increasingly difficult comparisons. Demand is exceeding capacity in most modes of transportation by a significant amount. In turn, pricing power has erupted in those modes to levels that continue to spark overall inflationary concerns in the broader economy. As we explained in previous months, we do not fear long-term inflationary pressure as technology provides multiple ways to ever-increase asset utilization and price discovery in all parts of the economy, but especially in transportation. In fact, we are seeing more signs that ELDs (Electronic Logging Devices) initially hurt the capacity/utilization of truckers, especially small truckers, but many of the truckers most adversely affected are now beginning to recover some of the loss in utilization through gains in efficiency.

Year-over-year, shipments first turned positive twenty months ago, while expenditures turned positive seventeen months ago. The current level of volume and pricing growth is signaling that the U.S. economy is not only growing, but that the level of growth is expanding. The 11.9% YoY increase in the May Cass Shipments Index is yet another data point confirming that the strength in the U.S. economy continues to accelerate. This level of percentage increase is usually only attained when emerging from a recession, not when comping against already strong statistics.

Disclosure: None.