The Trouble With Shiller's CAPE Ratio

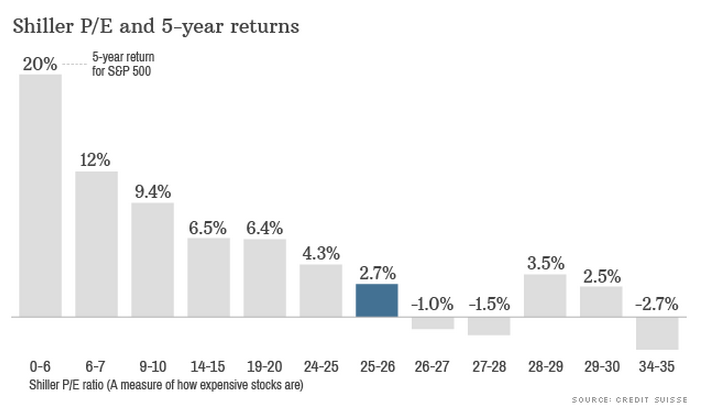

Wade Slome of Investing Caffeine takes down the popular CAPE ratio, a metric many investors rely on, or at least consider, when arguing whether stocks are too cheap or too expensive. Critically, it is an important number to some people in deciding whether stocks will produce high or low returns.

The CAPE ratio is a simple 10-year average of the P/E ratio for the S&P 500 index. It is heavily weighted towards the past and only measures stock prices compared to company earnings. One of the key problems with CAPE (along with others) is that it ignores the investing environment, including a very important factor affecting returns: interest rates.

From CAPE, Forward Returns and You:

The Shiller P/E ratio is also known as the Cyclically Adjusted Price-Earnings (CAPE) ratio and the P/E 10 ratio. It was developed by Dr. Robert Shiller who won the Nobel Prize for his work in economics in 2013. CAPE is a tool people use to find the likely returns of the stock market based on current valuations of stocks (Investopedia).

One of CAPE’s flaws as a predictive indicator is that the ratio does not take into account the economic environment. For instance, interest rates are likely to affect the relationship between valuations and 5-year returns. A CAPE ratio of 20 when interest rates are high does not equal a CAPE ratio of 20 when interest rates are near zero. When interest rates are extremely low, as they are now, a high CAPE ratio may be associated with higher average returns on equities. Stock market returns do not occur in a vacuum...

The chart below is from Credit Suisse via CNNMoney:

In Shiller CAPE Peaches Smell Like BS, Wade discusses why CAPE is not very useful in a market that is trending up (ours) or down, but has some value in a sideways market. Read the whole article for a more detailed takedown of this overrated indicator.

If something sounds like BS, looks like BS, and smells like BS, there’s a good chance you’re probably eyeball-deep in BS. In the investment world, I encounter a lot of very intelligent analysis, but at the same time I also continually step into piles of investment BS. One of those piles of BS I repeatedly step into is the CAPE ratio (Cyclically Adjusted Price-to-Earnings) created by Robert Shiller. For those who are not familiar with Shiller, he is a Nobel Prize winner in economics who won the award in 2013 for his work on the “empirical analysis of asset prices.” Shiller vaulted into fame in large part due to the timing of his book, Irrational Exuberance, which was published during the 2000 technology market peak. He gained additional street-credibility in the mid-2000s when he spoke about the bubble developing in the real estate markets.

What is the CAPE?

Besides being a scapegoat for every bear that has missed the tripling of stock prices in the last five years, the CAPE effectively is a simple 10-year average of the P/E ratio for the S&P 500 index. The logic is simple, like many theories in finance and economics, there often are inherent mean-reverting principles that are accepted as rules-of-thumb. It follows that if the current 10-year CAPE is above the 134-year CAPE average, then stocks are expensive and you should avoid them. On the other hand, if the current CAPE were below the long-term CAPE average, then stocks are cheap and you should buy. Here is a chart of the Shiller CAPE:

As you can see from the chart above, the current CAPE ratio of 26x is well above the 134-year average of 16x, which according to CAPE disciples makes the stock market very expensive. Or as a recent Business Insider article stated, the Shiller CAPE is “higher than at any point in the 20th century with the exception of the peaks of 1929 and 2000 – you know what happened after those.”

Continue reading Wade's article here.

Visit Market Shadows to sign up for trade alerts and our newsletter (add your email at the top left of the more