The Reckoning

As I have written many, many times, the “unexpected” events of January and February were a dramatic wake-up call for central banks. Last August’s global liquidation they could at least try to ignore because it could possibly fit within the paradigm of “transitory”, a one-off aberration that was some mysterious Chinese viral contagion and thus of not any great, lingering importance. The recurrence in the first part of 2016, though, destroyed those assertions and a lot of people noticed; and you can bet the Fed noticed that a lot of people noticed.

What is happening this year is astounding. After saying year after year after year that the recovery is coming, and even doing so to the point of condescension, the admissions of wrongfulness are starting to roll in, if only softly at first. How ludicrous does “transitory” look now? Though that word remains attached to official policy statements, official policymakers themselves have begun to act otherwise.

There was the brief flirtation with NIRP even in the United States, though fortunately disabused by clear Japanese example of the utter harm such monetary “stimulus” actually offers. Of late, economists having floating the idea for raising the inflation target, but they have yet to offer an explanation as to why that might be needed (even before they try to argue why it might work in a way the current one doesn’t). To get to the future of new policy regimes that are hopefully (to them) more successful, central bankers have to deal with the policies of the past that so clearly weren’t.

Even Jon Hilsenrath of the Wall Street Journal has been captured by the mood, certainly affected by the discussions to be taking place among central bankers gathered at Jackson Hole. The Kansas City Fed symposium might be better titled this year as “How do we get ourselves out of this mess we created?”

In the 1990s, a period known in economics as the “Great Moderation,” it seemed the Fed could do no wrong. Policy makers and voters saw it as a machine, with buttons officials could push to heat or cool the economy as needed. Now, after more than a decade of economic disappointment, the central bank confronts hardened public skepticism and growing self-doubt about its own understanding of how the U.S. economy works.

For anyone seeking to explain one of the most unpredictable political seasons in modern history, with the rise of Donald Trump and Bernie Sanders, a prime suspect is public dismay in institutions guiding the economy and government. The Fed in particular is a case study in how the conventional wisdom of the late 1990s on a wide range of economic issues, including trade, technology and central banking, has since slowly unraveled.

This is a theme that I have consistently presented as evidence for monetary evolution as both an explanation for Fed failure and what I believe will increasingly be appreciated as a depression. As I wrote just a few weeks ago:

Twice a year every year, the Chairman of the Federal Reserve drives up to Capitol Hill and formally reports to Congress. Given our current circumstances, these ceremonial affairs are lent a great deal of mainstream scrutiny as the public tries to parse the smallest scraps of unanticipated deviations from the carefully laid script. In many ways, this is a rerun of the late 1990’s dot-com bubble, but in reverse. When Alan Greenspan would testify, even his briefcase would be subjected not to so much scrutiny but reverence for what the Fed would not have to do, as the St. Louis Fed embarrassingly confirms. When Janet Yellen testifies, the world waits with baited breath for her to endorse instead the smallest little something that the Fed might have got right.

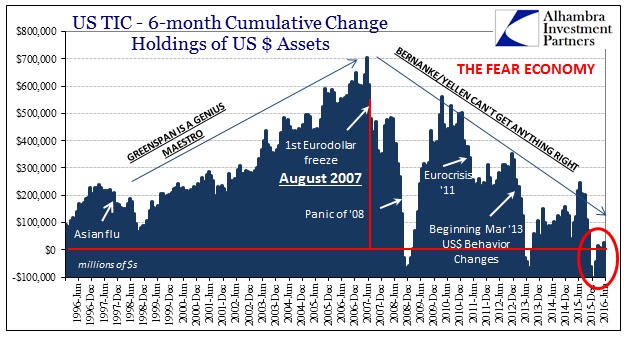

During the dot-com era, it wasn’t so much what Greenspan got right but what little the Fed had to actually do. The explosion of monetary evolution took care of the “moderation” of that time for him. It was all blasted apart on August 9, 2007, and hasn’t been fixed since (Humpty Dumpty references with regard to monetary policy are actually appropriate here, especially the horses) no matter how many trillions of worthless, inert bank reserves were created. Indeed, that is the crux of the matter; the true global currency standard was destroyed in further capacity for growth, economic as well as financial, and the agency charged with the care and nurture of the dollar responded with arrogant irrelevance.

Before the eurodollar break, the Fed was a bunch of geniuses, the best and the brightest the nation could possibly offer and a shining example to the rest of the world. They were the pinnacle of technocratic competence, admired for their power that everyone just assumed because, again, how little they actually did. After the break, they are an incompetent, increasingly petulant mess where the media looks to Janet Yellen in the desperate hope that there is the tiniest little scrap of good news all despite massive effort redeployed time and again.

But we should be vigilant about what is really going on here. I very much doubt there is a true mea culpa gathering to be offered from economists who up until recently vehemently abused any notion that they could be wrong. A preview of myRealClearMarkets column tomorrow:

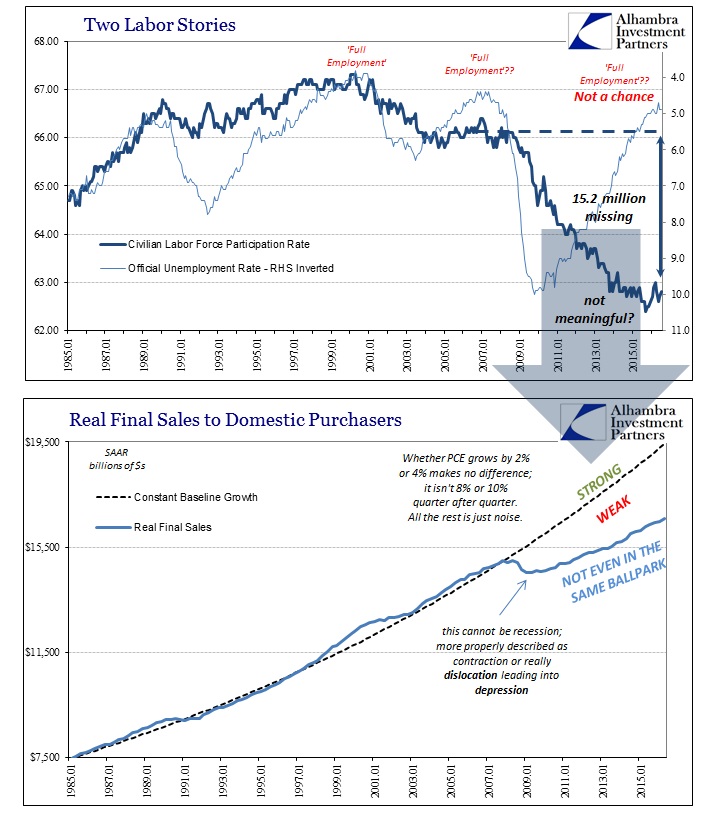

There is at the very least a growing realization even among economists that their policies aren’t working; it only took nine years. It is the byproduct of the threat to survival; after having remained consistently optimistic to the point of shouting down anyone who challenged the recovery narrative, increasing popular unrest is creating political unrest that will, if unchecked, threaten even the longstanding cherished place of orthodox economists who have remained on such pedestals since the 1930’s. Thus, there can be no depression because if we all admit what is increasingly obvious that would leave no doubt as to just who has been at fault.

Economists are almost certainly repositioning themselves for when (not if, I believe wholeheartedly) that occurs. Once the depression sinks in, there is no room left for orthodox economists who blamed only the gold standard for the possibility.

So we should be very clear also in response; they should be denied any seat at the table of reform. While starting to at least admit the possibility might seem to be something, it is far too little and much, much too late. Economists and central bankers have disqualified themselves for participation in the project. It’s not like the monetary system’s change and evolution was something that just happened overnight; it was right there for them to see all along, not the least of which was everything that has happened since August 2007. They have even talked about in at least vague and general terms for decades, only to dismiss it every time as of no great importance.

Once the people’s mindset changes, what they will find in especially Federal Reserve conduct could border on criminal neglect. There was Greenspan’s warning in June 2003 that perhaps the banking world had indeed changed in a meaningful way, and that monetary capabilities might need to be more carefully examined before they had to be used as in the Japanese experience. Three years before that, Alan Greenspan admitted right in the FOMC transcripts that the Fed had no idea what modern money even was:

The problem is that we cannot extract from our statistical database what is true money conceptually, either in the transactions mode or the store-of-value mode. One of the reasons, obviously, is that the proliferation of products has been so extraordinary that the true underlying mix of money in our money and near money data is continuously changing. As a consequence, while of necessity it must be the case at the end of the day that inflation has to be a monetary phenomenon, a decision to base policy on measures of money presupposes that we can locate money. And that has become an increasingly dubious proposition.

Did the Fed expend every resource to rectify this knowledge gap? No; emphatically no. Quite the opposite as they openly proved in discontinuing M3 in March 2006, writing in the official press release that the “costs of collecting the underlying data and publishing M3 outweigh the benefits.” Any institution that made such judgment only a little over a year before the repo and eurodollar markets blew up should be prohibited from all discussions going forward.

There is a world waiting to be rebuilt and a growing realization from even the most recalcitrant orthodoxists, those stubborn elite who denied all this for decades, that such a job is going to get done. We are moving past “if” and finally toward “when.” They are not interested in litigating past liability, only ensuring that they have a voice in that outcome. That should never happen; they had their chance, squandered it, and proved themselves unfit for the huge task ahead that was left to us by nothing more than Lord Acton’s axiom about power corrupting. A republican democracy needs no such people in positions of influence. They couldn’t be trusted to do what was right, and now we are left still to tally the costs of such blatant immorality.

The only positive that will come out of this changing tone and softening stance is that it will finally crystallize all the various threads that have been aligned against true reform, including and especially the idea that monetary policy as it is would still be an option. As I write for tomorrow:

He [Former Fed Governor Warsh] is of the growing chorus of even former insiders and members of past authority who are calling for letting go of the ideological rigidity set in place during the New Deal. Warsh takes no prisoners, charging, correctly, that a “numeric change” for the inflation target is “subterfuge”, a case that I and many others have been making for years. Pretending everything is fine delays the recovery, not aids in it.

It has been my fervent, pleading hope for years now that the phrase “they really don’t know what they are doing” will become associated with central banks and central bankers in the mainstream consciousness of the public as well as the professional verdict from politicians on down. For the Wall Street Journal and none other than Jon Hilsenrath to write that article (and it is not the only one of late) is a clear sign that we are moving ever closer to that day. Even so, we need to be mindful that, pace Churchill, it would mark only the end of the beginning. There is a vast and hopeful world yet to be created and a great many people who have proved themselves utterly unqualified to help create it.

Disclosure: None.