The Federal Reserve Financed WW2 But Cannot Finance America Now

World War 2 was financed by the Federal Reserve Bank. The Great Depression came to an end through a dreadful war that was likely brought on by the central bankers' failure to finance economies in the Great Depression and prior to it:

When the United States entered the war, the Board of Governors issued a statement indicating that the Federal Reserve System was “. . . prepared to use its powers to assure at all times an ample supply of funds for financing the war effort” (Board of Governors 1943, 2). Financing the war was the focus of the Federal Reserve’s wartime mission. This mission differed from the mission of the System before and after the war...

...Plans for financing the war were devised by the Treasury and the Federal Reserve. These organizations met frequently to determine how to finance the war and organize machinery for marketing United States government securities.

The plan called for financing the war to the greatest extent possible through taxation and domestic borrowing.2 Paying for the war through levies on current incomes would minimize inflationary pressures, promote economic expansion during the war, and promote economic stability when peace returned.

To direct the savings of American citizens into the war effort, the Treasury and Federal Reserve marketed a range of securities that would fit the needs of all classes of investors, from small savers who wished to invest for the duration of the war to large corporations with temporarily idle funds. To distribute these securities, the twelve Federal Reserve Banks organized Victory Fund committees and established plans to market war bonds in cooperation with commercial banks, businesses, and volunteers.

This article proves that the Federal Reserve played a heroic part in the war effort with the efforts it made to market the war bonds. The quote above comes from it. Unfortunately, that heroic aspect of the Fed has disappeared entirely. It is now looked upon as a failed institution that helped some with the establishment of QE, but ravaged the middle class in favor of the richest by doing so. Asset increases, much of which was based upon mispriced risk, made money for American business but also hurt the middle class. Mispriced risk for assets caused booms and busts as the Bank of America stated.

Congress could permit the Fed to finance key drivers of the economy, like good roads and bridges. In a backdoor sort of operation, the Fed was used by congress to finance the last highway bill, as explained by Ellen Brown on Talkmarkets.

Some critics have said that the Congress overstepped but it is a complicated argument that really is not convincing. Even if the Fed claws back the funds, the highway bill is funded and the congress has set precedence for the Federal Reserve.

When looking at all the Fed did during World War 2, this is a very minor tweak of Fed policy. There are, of course, Build America bonds. But they are issued by state and local governments and are not backed by the full faith and credit of the United States. The Fed could pedal special treasury bonds that build America. But it doesn't.

Yet many are ready to pounce on the Fed for being the lender of first resort, even in the limited way Ellen Brown explained in her article. Libertarians do not want the Fed to be out front in any plan to rebuild America.

Libertarian anarcho-capitalist Doug Casey makes the case that low interest rates cause a misallocation of capital, which allows financial engineering. But in my opinion that is less a function of low interest rates than it is a function of stupid business leaders.

Casey makes a good case, however, that across the board stock buybacks is a massive misallocation of easy money. He shows earnings per share have been stagnant since 2013.

But I doubt the answer of most libertarians would be to let the Fed be the engineering lender into real projects for US growth, although I am sure Casey would prefer real growth to the economy rather than the fake growth we have now.

I am not saying that companies buying back stock is not a financially wise decision. It could be, depending on the business. But when they all do it at the same time it becomes a bit of a fraud, making the stock market look stronger than it really is. Earnings would tumble without stock buybacks. And the market would have cratered without the illusion of wealth creation.

Is the Fed happy enough with that illusion of wealth creation? We certainly hope not.

There may be a silver lining in current efforts by the Fed, in raising the Fed Funds Rate, however. Many view it as a tightening, but if it were more robust it could be looked at as growing the money supply.

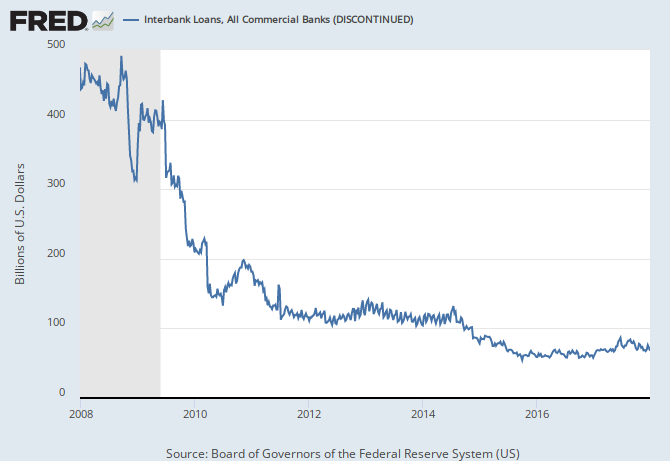

In a recent article entitled A Scary Monetary Conundrum Arises from the Great Recession, I pointed out that the Fed and market monetarists seemed to have reached a conundrum. The Fed interfered with interbank lending, and it had a slight bounce before diving. It now is all about the Fed Interbank.

So, one wonders if raising the Fed Funds Rate would give interbank lending a bounce. The Fed has said raising the Federal Funds Rate puts a floor under the rates. It seems to be worth a try, in order to break the conundrum, make the market monetarists happy, or at least as happy as economists can be, and get the Fed to input more stimulus into the banking system. The Fed has clearly failed to do so.

Clearly, with excess reserves making interbank lending less necessary, all that is left is for the Fed to fund infrastructure, maybe buy non financial assets like Japan does, and do more QE, but there is a shortage of long bonds in the economy and short bonds at the Fed to do repo.

The Fed is letting the world economy, and the US economy down. Everyone knows it. We cannot settle for negative interest rates and a cashless society. The Fed can do better, so can the treasury, and so can the comatose, zombie-like congress who is afraid of its own shadow (sorry for the mixed metaphor. Real zombies fear nothing), when it comes to getting our economy going again.

The Fed and the government need to work together to bring prosperity, because if they keep taking down small and medium businesses during downturns, who borrow and fail, pretty soon it won't be worth it for job creators to borrow and fail anymore.

There isn't physical world war, but there is an economic war going on against main street and small and medium business. And that war is being driven by Fed policy, even if it doesn't want to carry on that unpopular fight.

Disclosure: I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice.

Fascinating, this was a side to the Fed I had no idea even existed. Heroic indeed. Shame we seem to have lost some of that heroism over time.

Yes, certainly, Barry, you wonder why the Fed is so timid nowadays. The darkest interpretation is that it is a globalist conspiracy, and the US was more useful then than now. And/or it is because the banks bet on low rates now and the Fed is bank first and economy second. I hope those are not the real meaning of this failure of the Fed to work with government to get America moving. I am convinced that the Fed does bet on low rates and that is having a huge impact on the new normal.