Tech Talk: Ghosts, Goblins And The Halloween Effect

(Click on image to enlarge)

There used to be a saying that you should “sell in May and go away.” The idea was that investors were less active in the summer months, with the result that stocks tended to drift lower.

This certainly used to be the case, as illustrated in the following summary of share price performance in the S&P 500 between 1970 and Feb. 2010:

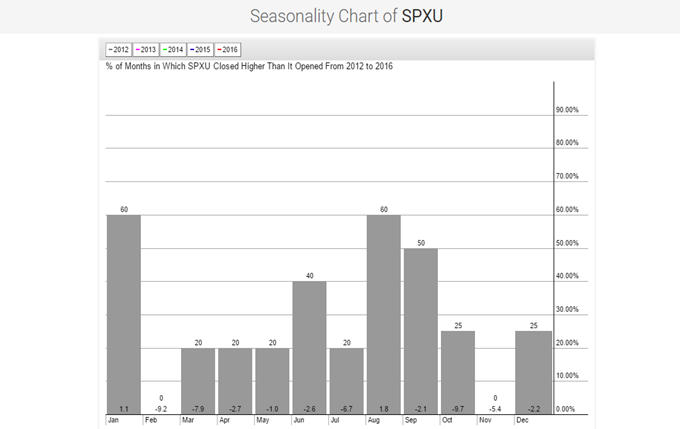

But what about today? Seasonality is still with us, as the following chart illustrates. The ProShares UltraPro Short S&;P 500 (NYSEARCA: SPXU) is a leveraged inverse exchange-traded fund (ETF) seeking to provide traders and speculators with a return that is three times the inverse of the daily performance of the S&P 500 Index. The problem is, in a bull market it’s not a buy-and-hold ETF. In a bull market, that’s a strategy for big losses in a market like today’s, when easy money is helping to buoy share prices.

But wait: Look at the seasonality chart I created. What it shows is that, during the last five years, SPXU has tended to rise in August. In September, whether you were to make money or not is essentially a flip of a coin.

For those with great intestinal fortitude, here’s a high-risk strategy that could yield a good return. Buy SPXU today. Intend to sell it next month, if the portents then are for the market to begin rising again. Whatever you do, get rid of SPXU by October, since the reliable Halloween Effect invariably comes along then to scare away the ghost and goblins of a short-term market bear.

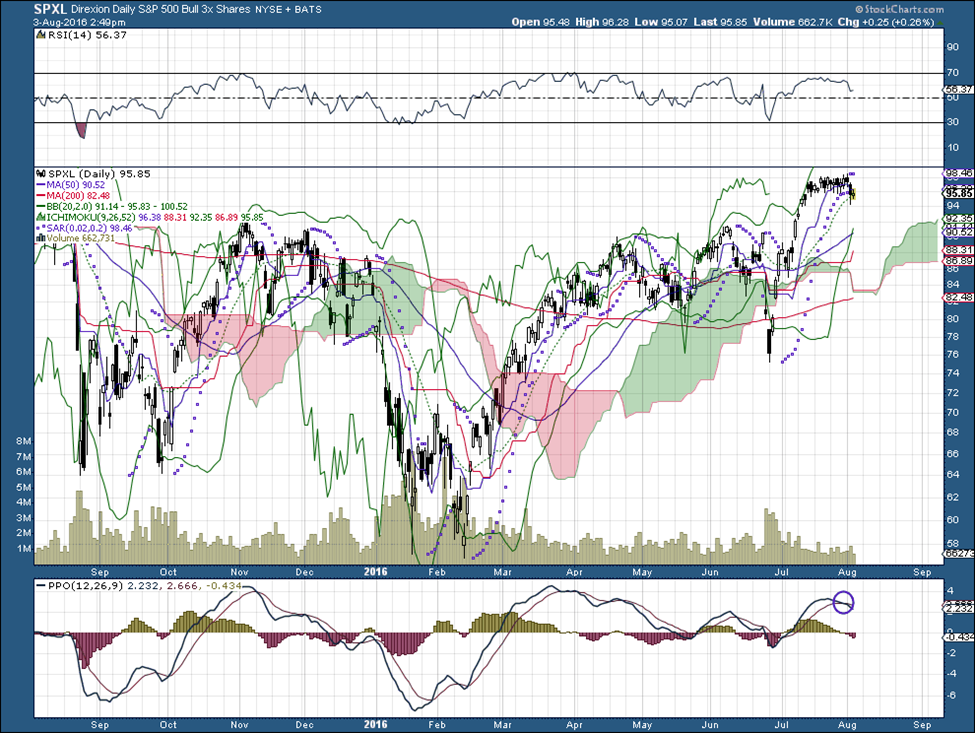

By late September, I intend to swap my newly-purchased SPXU for SPXL, which is SXPU’s happy twin. Here is the chart for SXPL during the last 12 months. Note that its PPO, an indicator for short-term outlook, has just turned negative. It is a mirror image of the PPO in SPXU, which just turned positive. I’ve circled the buy and sell signals in blue on the two charts, to stress that they are mirror images of each other.

Of course, I discuss strategies, but I never recommend them. Happy trading!

(Click on image to enlarge)

Disclosure: I do own some units.