SPX, Gold, Oil And G6 Targets For The Week Of January 28th

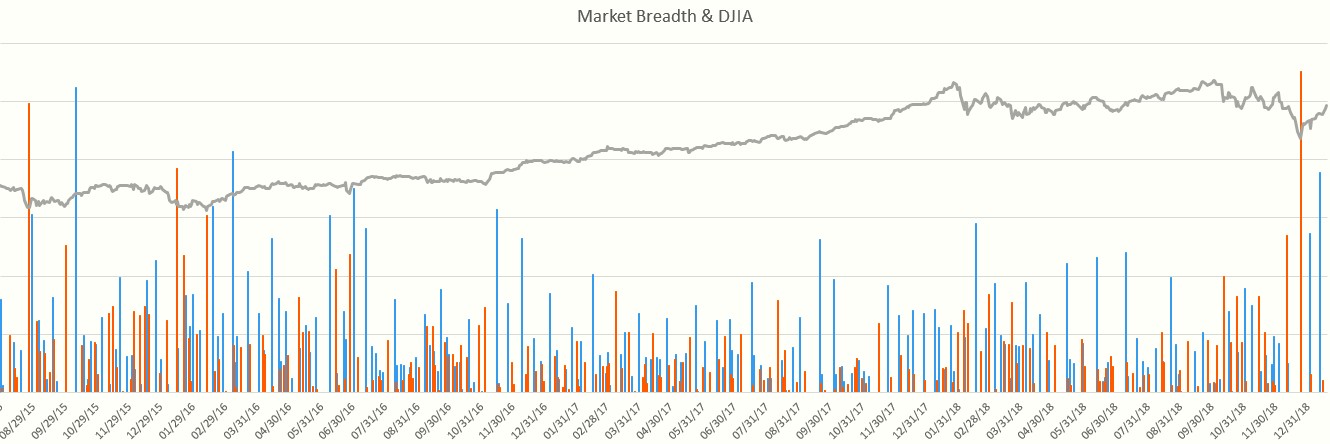

Before revealing the price targets for next week, first we’ll discuss the market breadth readings since the end of December. The cumulative down thrust number on December 24 by far exceeded the highest negative thrust readings for the last 30 years. Such large negative thrust numbers have been associated with significant low turning points in the past. The importance of the market turn at the end of December was further highlighted by the large up thrust market breadth numbers on January 2 and 11, which normally appear at the beginning or in the middle of strong upswings:

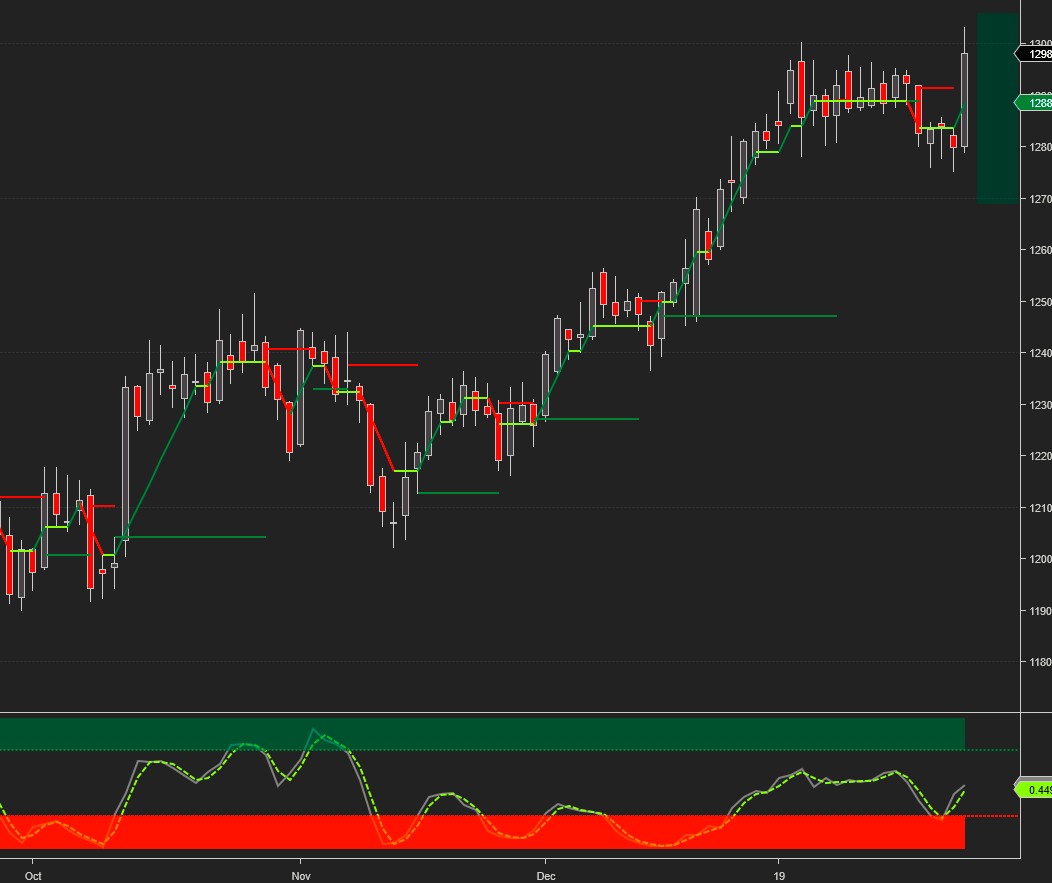

Supported by improving market breadth, the SPX sliced through two key resistance zones and advanced 13% since the December 2018 low. That’s an annualized rate of over 300%, which is obviously unsustainable as price is clearly running well ahead of time. The weekly hanging man candle is the first warning this month that bullish momentum may be slowing down. However, for a bearish confirmation a close below 2612 is needed.

Current signals*: Daily Long, Weekly Long

For Weekly Buy/Sell pivots check the TV page which gets updated on Monday.

The projected trading range for next week for SPX is 2550-2750.

Oil traded flat for the week but remains in an uptrend.

Current signals: Daily Long, Weekly Long.

The projected trading range for Oil for next week is 50 – 56:

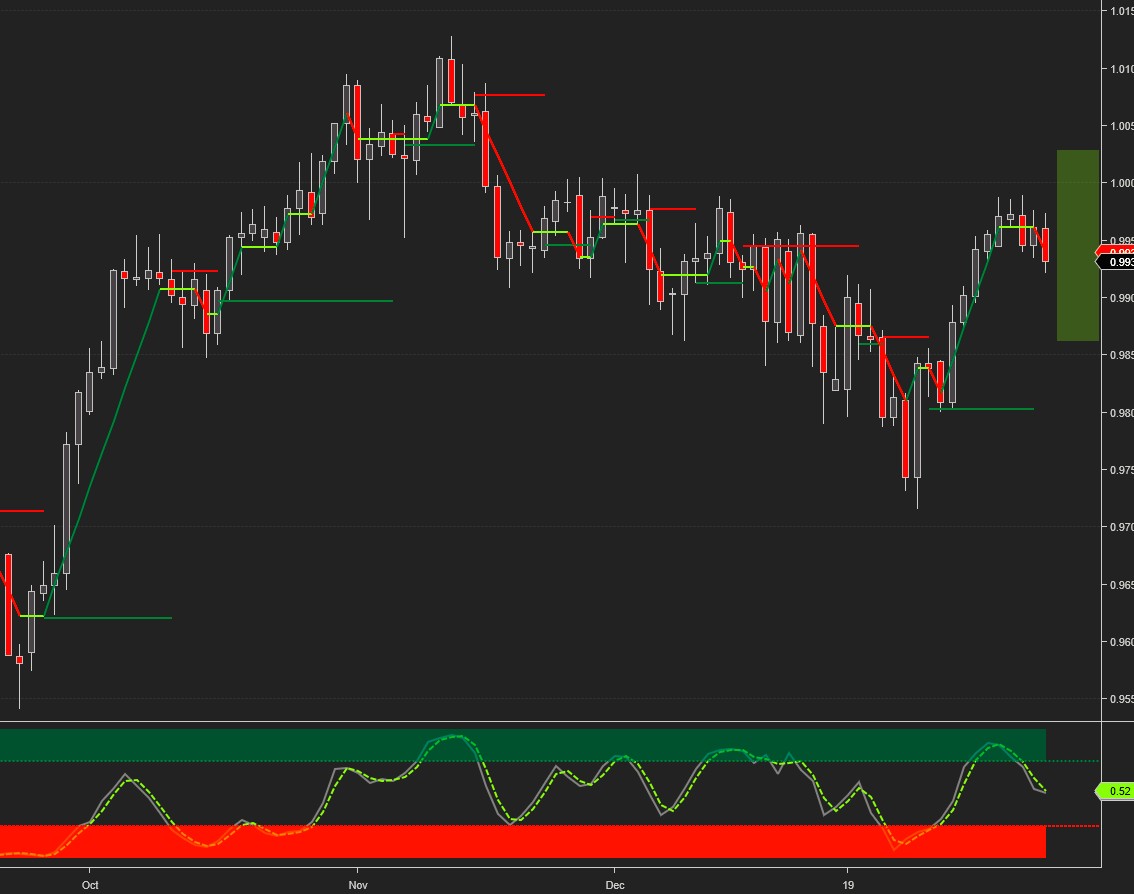

Gold is showing signs that the price consolidation phase following the November run-up may be over. A close above 1300 is needed to mark the beginning of a new upswing.

Current signals: Daily Long, Weekly Long

The projected trading range for Gold for next week remains unchanged: 1270 – 1310:

The Dollar index was strong most of the week until it sold off on Friday. This is reflected in the G6 charts below.

USDCHF came close to parity on several occasions during the first half of the week, but sold off afterwards. Our key long/short pivot remains at 1.00.

The projected trading range for USDCHF for next week is 0.984 – 1.0029:

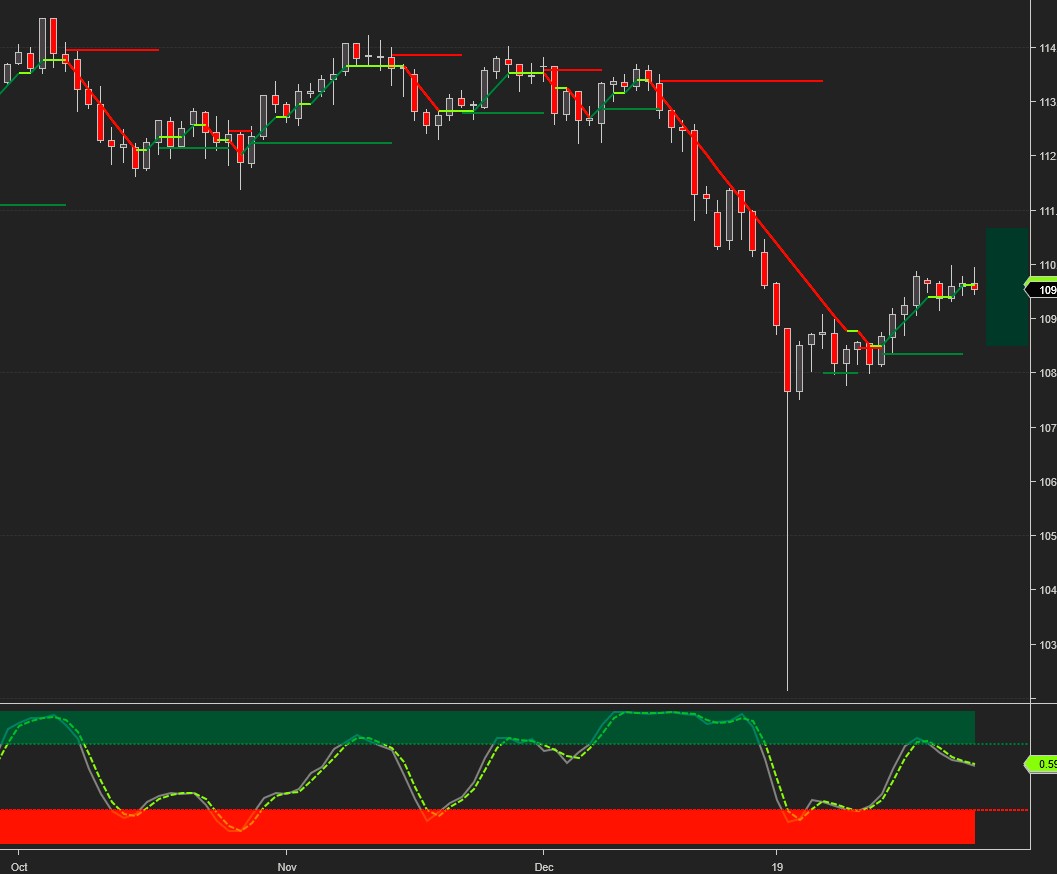

USDJPY remains in an uptrend but needs to break above 110 to keep the bullish momentum alive.

Current signals: Daily Flat, Weekly Flat.

The projected trading range for USDJPY for next week is 108.2 – 110.5:

EURUSD came to within a few pips of our downside target on Thursday but then staged a strong bullish reversal on Friday, keeping the uptrend alive.

The projected trading range for EURUSD for next week is 1.13 – 1.15:

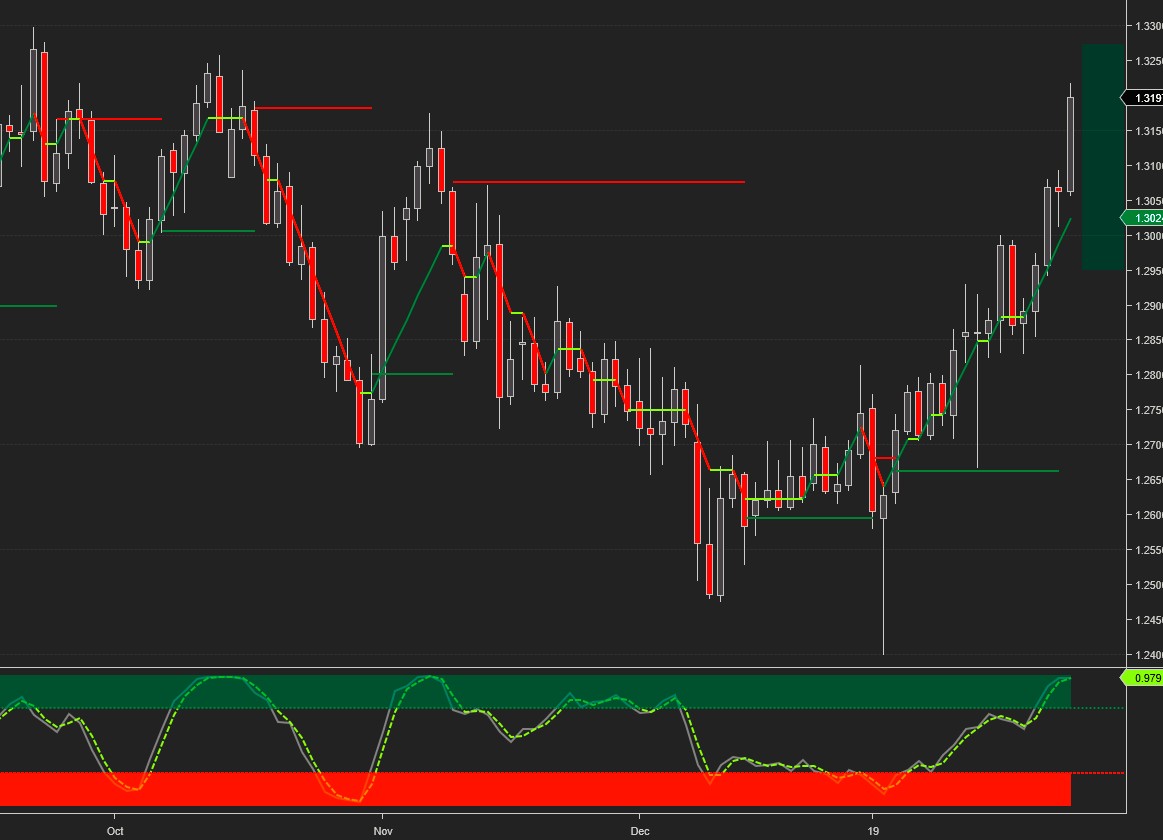

GBPUSD tested our upside weekly target several times during the week until decisively breaking above it on Friday. The daily and weekly uptrend remains in place.

Current signals: Daily Long, Weekly Long.

The projected trading range for GBPUSD for next week is 1.295 – 1.327:

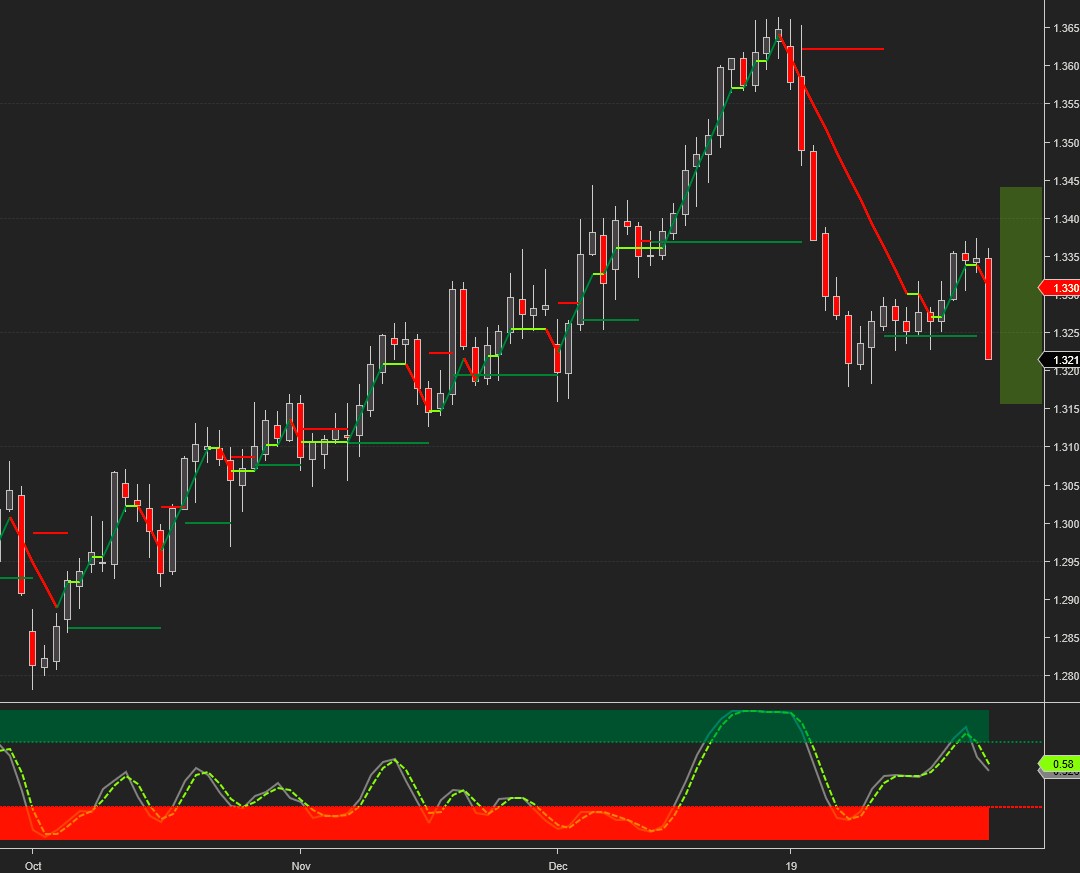

USDCAD challenged the upside weekly target during the first half of the week but sold off sharply on Friday. Support at the double bottom at 1.318 remains the key level to watch going forward.

Current signals: Daily Short, Weekly Short.

The projected trading range for USDCAD for next week is 1.31 – 1.345:

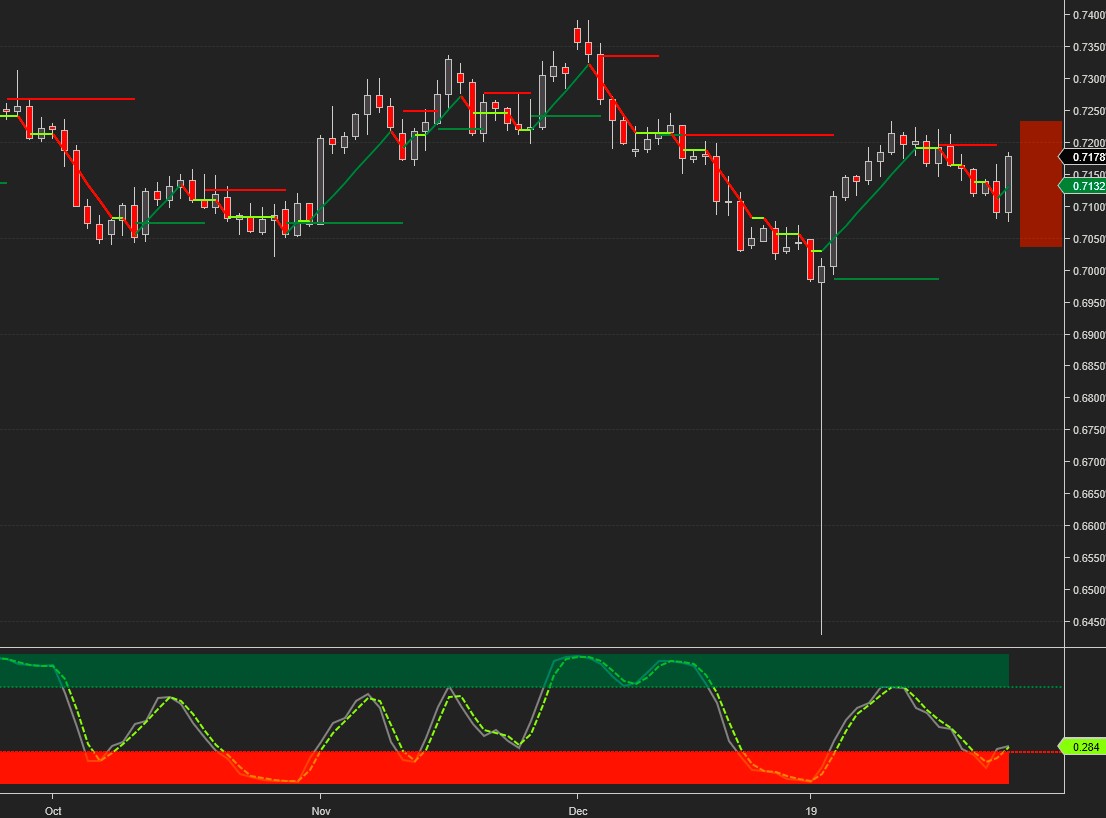

AUDUSD continues to be on a tear following the January 3 flash crash, and finished the week on the upper weekly target. There’s a heavy resistance band above, between 0.735 and 0.745.

Current signals: Daily Long, Weekly Long.

The projected trading range for AUDUSD for next week is 0.705 – 0.725:

Please note that the trading signals are in effect as of the close on Friday and may change as soon as the markets re-open. When the current signal is hold, we may also include the preceding buy or sell signal (e.g. Buy/Hold or Sell/Hold). Hold signals followed by a buy/sell signal in the direction of the preceding buy/sell signal can be considered for pyramiding the position.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8.

For intraday charts and update follow us on TradingView.

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more