Southwest Airlines Remains Top S&P 500 Stock

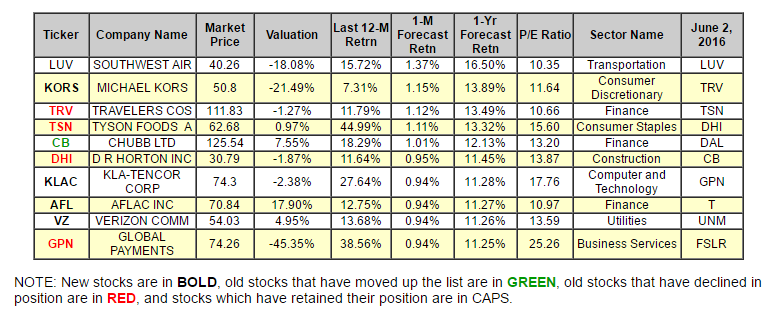

We can use our data to track individual stocks, industries, sectors, and indices. For today's bulletin, we present key metrics for the top picks in the S&P 500. The companies listed below represent the top-ten BUY/STRONG BUY stocks within the index. They are presented below according to their one-month forecast target prices.

The last time we looked at the S&P 500 was June 2nd. Since then, we have had a 40% turnover in our list. Traveler's has declined yet again as newcomer Michael Kors (KORS) debuts in the number two position. Chubb Limited (CB) has moved up one spot. Tyson (TSN), DR Horton (DHI), and Global Payments (GPN) have also declined. Other newcomers also include KLA-Tencor (KLAC), Aflac (AFL), and Verizon (VZ). Southwest Airlines (LUV) retains its number one spot.

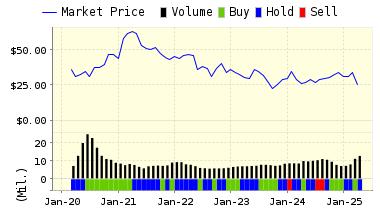

Below is today's data on our SP 500 leader, Southwest Airlines (LUV):

Southwest Airlines is a major domestic airline that provides primarily shorthaul, high-frequency, point-to-point, low-fare service. Southwest operates over Boeing 737 aircraft in numerous cities. Southwest has the lowest operating cost structure in the domestic airline industry and consistently offers the lowest and simplest fares. Southwest also has one of the best overall Customer Service records.

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on SOUTHWEST AIR for 2016-06-22. Based on the information we have gathered and our resulting research, we feel that SOUTHWEST AIR has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Sharpe Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

40.81 | 1.37% |

|

3-Month |

41.12 | 2.13% |

|

6-Month |

40.90 | 1.58% |

|

1-Year |

46.90 | 16.50% |

|

2-Year |

38.54 | -4.27% |

|

3-Year |

29.02 | -27.93% |

|

Valuation & Rankings |

|||

|

Valuation |

18.08% undervalued |

Valuation Rank(?) |

|

|

1-M Forecast Return |

1.37% |

1-M Forecast Return Rank |

|

|

12-M Return |

15.72% |

Momentum Rank(?) |

|

|

Sharpe Ratio |

0.92 |

Sharpe Ratio Rank(?) |

|

|

5-Y Avg Annual Return |

25.57% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

27.81% |

Volatility Rank(?) |

|

|

Expected EPS Growth |

8.23% |

EPS Growth Rank(?) |

|

|

Market Cap (billions) |

27.33 |

Size Rank |

|

|

Trailing P/E Ratio |

10.35 |

Trailing P/E Rank(?) |

|

|

Forward P/E Ratio |

9.56 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

1.26 |

PEG Ratio Rank |

|

|

Price/Sales |

1.35 |

Price/Sales Rank(?) |

|

|

Market/Book |

4.19 |

Market/Book Rank(?) |

|

|

Beta |

1.02 |

Beta Rank |

|

|

Alpha |

0.14 |

Alpha Rank |

|

ValuEngine Market Overview

|

Summary of VE Stock Universe |

|

|

Stocks Undervalued |

56.76% |

|

Stocks Overvalued |

43.24% |

|

Stocks Undervalued by 20% |

25.04% |

|

Stocks Overvalued by 20% |

14.84% |

ValuEngine Sector Overview

|

Sector |

Change |

MTD |

YTD |

Valuation |

Last 12-MReturn |

P/E Ratio |

|

-0.10% |

1.01% |

6.03% |

9.57% overvalued |

2.23% |

23.71 |

|

|

-0.48% |

3.52% |

33.40% |

9.16% overvalued |

20.13% |

28.65 |

|

|

-0.15% |

1.11% |

7.19% |

6.78% overvalued |

2.68% |

23.39 |

|

|

-0.67% |

1.78% |

12.81% |

5.17% overvalued |

-30.00% |

22.57 |

|

|

0.03% |

-0.21% |

4.25% |

3.18% overvalued |

-8.86% |

17.93 |

|

|

-0.19% |

0.13% |

5.72% |

2.13% overvalued |

-9.92% |

21.74 |

|

|

-0.27% |

-1.99% |

-3.78% |

0.32% undervalued |

-5.08% |

18.85 |

|

|

-0.77% |

-0.52% |

5.24% |

1.42% undervalued |

-9.68% |

27.78 |

|

|

0.31% |

-0.64% |

8.19% |

2.89% undervalued |

-10.28% |

22.81 |

|

|

-0.26% |

-0.49% |

2.37% |

3.13% undervalued |

-12.98% |

22.35 |

|

|

-0.11% |

-1.22% |

1.15% |

3.77% undervalued |

-6.05% |

15.80 |

|

|

-0.22% |

-1.14% |

18.72% |

4.76% undervalued |

-6.12% |

20.71 |

|

|

-0.30% |

-1.62% |

0.67% |

7.75% undervalued |

-27.65% |

13.31 |

|

|

-0.69% |

-1.95% |

-2.12% |

9.11% undervalued |

-18.18% |

11.88 |

|

|

-0.36% |

-1.70% |

-7.64% |

9.80% undervalued |

-25.60% |

26.57 |

|

|

-0.16% |

-0.11% |

-3.79% |

11.25% undervalued |

-14.81% |

22.14 |

VALUATION WATCH: Overvalued stocks now make up 43.24% of our stocks assigned a valuation and 14.84% of those equities are calculated to be overvalued by 20% or more. Six sectors are calculated to be overvalued.

Disclosure: None.

Disclaimer: ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, ...

more