Short Volatility Strategies And A Word Of Caution

This week will be a shortened trading week as we celebrate Thanksgiving Day on Thursday for which the markets will be closed. Of course the retailers will be opening their doors in the evening for shoppers to get a jump-start on the holiday gift-giving season. So what better way and time to publish my latest article while wishing everyone a safe and joyous holiday season? In this article I will outline some of my latest considerations regarding the Volatility complex and the proliferating sentiment that finds ever more short participation in the asset class. It is an asset class now is it not?

Through much of 2017, shorting volatility in its many forms and with its many derivatives has been increasingly en vogue. (High society verbiage there me thinks Justin LOL). For fiscal 2017, the VIX itself will possibly maintain a mean average below 15, something previously unheard of and certainly not within the realm of any one’s forecast. This year will prove to be quite the anomaly for the equity markets and volatility. And it’s with this characterization that I find a level of concern that I had not found in previous years.

Day in and day out I see, hear about and am personally confronted with new traders and investors desiring to dip their toe into the volatility pool. That’s what a sub-15, mean VIX reading will do after all; it can lure the unsuspecting, lesser informed and those lacking experience into an environment of decisive calamity that they have yet to fully understand and appreciate. It has been one of the simplest and true-to-form trades in 2017: Short the VIX or VIX derivatives for each and every time they spike in level or value and in “short order” you will find a significant return on capital deployed. In the 6 years that I’ve been shorting VIX-Exchange Traded Products it hasn’t been as simple as 2017 has offered it to be. It certainly hasn’t been that immediately rewarding or comforting to participate within the VIX complex. To the extent that I do appreciate newcomers I think it also necessary to warn of the pitfalls that are intrinsic to volatility trading.

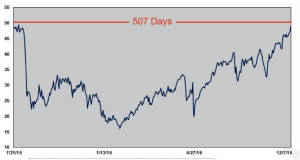

It is because of the rather immediate reward for shorting volatility in 2017 that a sense of complacency may be pervading those participating in the short-VOL trade. NO, that’s being a bit disingenuous! There is definitely complacency among short-VOL traders as I come across it daily. And no, I don’t dismiss myself out of like complacency in participation. It’s natural given the trend. But…but it’s easy to say that and it’s easy to find concern for complacency regardless of where it may be found right? When we speak of complacency it tends to carry a negative connotation. Nonetheless, and as I wax poetically, I’m concerned by what I encounter as I foresee a time where such complacency may be met with…well greater volatility for which greater expertise and even timing may be necessary to extrapolate profits from the volatility trade. Timing will be of even greater need for those who participate with instruments like VelocityShares Daily Inverse VIX Short-Term ETN (XIV) or ProShares Short VIX Short-Term Futures ETF (SVXY). These instruments are not double-leveraged and fail to achieve the same benefits that other 2X VIX-ETPs benefit from like a greater degree of options decay, contango and beta friction. SVXY and XIV can be marred during and after a VIX spike by beta slippage. If you don’t time your long participation with these instruments properly in an otherwise elevating or elevated VIX environment, it can take a longer time than realized for these instruments to rebound to prior levels. The chart below, from Russell Rhoads of the CBOE, is of XIV and clearly represents this beta slippage and need for timing certain VIX-ETP participation.

I see a good many newly positioned short-VOL strategies in the market and among the trading population. Many of these strategies, I would certainly offer, are ill advised and lack a necessary caution based on the practice of the trade. The strategies lay claim to low-risk/high reward characteristics and largely lean on the VIX-ETP charts and fundamental correlations that tell the tale of the VIX Futures upward sloping curve that either find the ETPs decaying or appreciating in value over time. What many of these strategies lack, be them long or short, is practical experience. It’s one thing to look back at the chart of UVXY and understand the annual rate of decay and correlate it to a capital allocation and return on that capital based on the rate of decay. That’s the easy part. The hard part is the actual participation! Most of these people outlining the low-risk, look at the chart, look at the yield and high return strategies aren’t even employing their own strategy. It’s easier to suggest, “This is a strong strategy”, than it is to actually use the strategy. Volatility trading demands of people that which is rather unnatural for people to express, a willingness to be inflicted with pain and/or discomfort beyond the norm. So when it is I read these new strategies I can keenly discern from personal experience that the strategy hasn’t be met with hardship or market turmoil.

The chart below of ProShares Ultra VIX Short-Term Futures ETF (UVXY) looks like an easy trade to replicate for capital returns. Over time it’s easy to extrapolate from this chart, alongside the composition of the trade, that UVXY declines because of decay intrinsic/inherent to options, established beta friction and of course consistent contango.

What are not easy to withstand are those little blips from the 5-year chart above. Those blips look more like this when we narrow the view as performed in the chart below.

Oh sure UVXY has a 90% annual decay rate give or take a few percent. But what happens when it climbs 200% for any brief period of time? How does that affect a traders’ individual, annualized performance over time? I know 36 people who traded through this displayed Aug. 2015 event that still trade short volatility today. Most of the people I participated with in the short-VOL trade leading up to this event no longer trade the markets at all.

Since publishing and discussing my volatility strategy over the last couple of years, I’ve been scrutinized and lauded, lamented over and found in favor for…but what I say I do, I most certainly do. For those of you reading my works for the first time, my strategy is as follows:

- Allocate 20% of investable capital to short VIX-ETPS, namely UVXY, TVIX and VXX. This is an established core position built over time.

- Maintain a high cash balance which provides roughly 200% liquidity daily

- Trade around my core position daily/weekly, scalping short-VOL opportunities when presented in order to compound annual returns

- Maintain core short-VOL positions until they reach a 90%+ profit profile if the market environment remains optimal to do so

- Participate in a fashion that permits trading my positions during all trading hours available inclusive of pre-market and after hours trading

6. Scale larger core allocation into VIX events of consequence

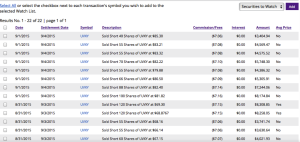

That’s my strategy for better or for worse and worse is an inevitable. Worse occurred in August of 2015 and carried over through much of September 2015. As I’ve offered in other publications and videos, this was a most uncomfortable period for the shot-VOL traders. Protection that many thought they had on their short-VOL trade was found to be anything but protection as many VIX-ETPs found this period expressing a greater than 250% move. My personal preparation for the event was somewhat a blend of intuition and luck as I had previously lowered my core short-VOL holdings to below 15% ahead of the time period. Below is a screen shot of executed short trades during this period from my brokerage account, which are also offered in my audited results.

By early September, my cash balance was running dry and my liquidity was barely 15 percent. I poorly scaled into this event and was left with miniscule lot sizes toward the height of the event. Much of this time was spent glued to CNBC and deciphering the hyperbole centered on a potential “hard landing” for the Chinese economy. In my newsletters to clients, I largely debunked the medias’ interpretations, speculations and forecasts on the subject matter and stayed the course, shorting UVXY largely with what little capital I had left and without going out on margin. Long story short…yeah you wish folks. I’m all about long stories! During this period I decided a new car was not in the cards, new appliances would have to wait and maybe, just maybe this trade perspective would be ending for me and the many others participating in the trade. You see, even with the confidence I had regarding a hard landing for China, doubt is ever-present as fear is found from massive drawdowns. As I know this from experience I also know that some of the newly positioned short-VOL strategies offered aren’t being utilized fully by those making the offer. Moreover, that’s what would be natural, the lack of full utilization of these strategies. Most people, some 90% of people, don’t have what it takes to wager risks as high as 20% in any particular equity let alone one of the most volatile means of investing capital, the short-VOL trade. Is 90% too high?

So maybe long ago I was set up for volatility and found my calling in the most unceremonious of ways. Don’t let 2017 fool you folks; trading volatility short will not always be as comfortable and rewarding as it has been in 2017. Experts in the short-VOL craft express a long-term and experienced track record. Yes long-term and experienced is a redundancy, but I’m trying to emphasize my point here. Volatility trading experts should have an ample and identified risk management system/strategy that has been tested for practical usage in the “worst of times” and found with great benefit. Volatility trading can be largely psychological in nature, demanding a unique set of abilities to withstand extreme moves in volatility that bring about great doubt, distress and discomfort for traders. Trust me folks, it’s a lot harder than looking at 90% annual decay and shorting calls, buying common shares of XIV and shorting common shares of UVXY.

It’s easy for me to offer my strategy, suggest you can do this too and hope to find many successful in their endeavors. But the psychology of watching your account drawdown 40% in a day or two, 80% in a week or two and as you sit alone behind a monitor/s watching it all happen…few, very few can do that and come clean out the other side with resolve and strong returns on capital.

This bull market cycle that has found 2017 without the semblance of a meaningful reset or pullback is unique. With a looming Debt Ceiling revisiting and Tax Reform Vote slated before year’s end, the equity market may not be reflecting risks to capital presently. I’m of the opinion that the path to passing Tax Reform is narrow and likely riddled with a need for great debate and negotiating that may put off a vote until early 2018. The failure to pass Healthcare legislation was likely an example of the headwinds that lay before the Tax Reform vote. Neither political party desires to ruin the most important economic cycle of the year, the Q4 holiday cycle. A failure to pass Tax Reform would likely disturb equity markets to the extent it spills over into the broader economy and ahead of the holidays nobody wants to see that. As such I’m not expecting a vote until early 2018 despite the assumptions for a vote this year.

Until further notice, my short-VOL participation will remain on course. I’ll continue to monitor the economic and political climate for any potential impacts on the market as well as impacts on capital allocation decisions. As usual I will offer my guidance and positioning via my Twitter feed. In the coming weeks my website will also be available to the public although you will still find me participating with TalkMarkets.com as I find the platform very much trafficked and in demand.

There is so much to know and understand about why shorting volatility has become increasingly popular for which I couldn’t possibly offer in a single article. From the underlying construct of the ETPs and the correlating variables to the asymmetric trade itself. There is much to discuss and consider. On a daily basis I offer warnings to those going long volatility. Yea, can you believe that! Traders still look at the noted charts above and attempt to go long the likes of UVXY, TVIX and/or VXX. What they don’t understand and have limited appreciation for is participation within these ETFs and ETNs is pretty well structured and all within a certain feedback loop that begins and ends with VIX money flow. Asset managers of these products linked to the VIX are flowing capital that is negatively correlated to spot VIX levels. Swap dealers like banks that are hedged long volatility are actually transacting with hedge funds shorting volatility. These hedge funds make up the bulk of the trade. For banks that have long volatility positions it invariably defines there is a short option contract hedge and gamma position. Where you have short gamma positions you’ll find delta hedging. Even factoring in long gamma there will be delta hedging to support the underlying. It’s all really fascinatingly symmetric in practice, but fails to find rationale with those unwittingly trying to participate long in VIX-ETPs.

More recently I offered to my friends and followers one of the indicators I use to measure the breadth of a VIX spike via the VXST. The VIX is the expected/implied volatility over the coming 30-day period. VXST is the expected volatility over a much shorter duration, 9 days. Shadowing the VIX, VXST usually rises faster than the VIX and drops faster than the VIX. As such, when it begins to drop it can prove to express the peak of a VIX spike. Nothing is a direct 1:1 correlation in the VIX complex and much of what can be gleaned from VXST in the way of deciphering a VIX spike can largely be done in hindsight. With that said if following the VXST as a course of study I would be of the opinion that real time determinations can be extrapolated and put to use. A great article on VXST was recently written by Eric Vymyslicky and titled The VXST:VIX Ratio- Knowing When A VIX Spike Is Out Of Steam

From me to you: I’m thankful for this journey and those who choose to embark on it with me. Have a joyous holiday and be well.

Disclosure: I am short UVXY, VXX and TVIX

Another great article. Truly professional and perfectly detailed! I appreciate your explanation in every way and your ability to give to people. Thank you friend.

Thank you Jim!! Enjoy the holidays and many blessings to you and yours!

wow you ramble a lot huh? While your understanding of VIX related products is profound, your explanation is unnecessarily complicated. Also your trading of said product is novice, resulting in poor use of capital.Your returns would be far greater with the use of derivatives, its not for everyone and requires a great deal of study. To be writing articles for the masses to see is a great achievement for you I'm sure, offering such advice you may want to tone down outlandish remarks implying tax reform may not get passed this year because health care reform did not get passed. Such comments is are unproffesional and self serving.

Excellent contributor who is the real deal... It is interesting following Stocktwits and seeing how after only a week of vol expansion so many people saying that vol is never going down again and we are in a Bear market and this is the new normal.. As you point out volatility can expand for extended periods and as you experienced in 2015 many people who are really laying into this when it pops blew out. Execution in the real world in real time is very different from talking about things in theory and people have a hard time pulling back from the minute by minute to look at the bigger picture.

I try to get perspective by switching my charts from the 5 minute view to the 1 year view when we have a big move or spike. This helps me regain perspective. Trading through that period from 2000 -2002 also helps me now to think big picture. Thank you for your bravery in discussing your childhood and personal stuff..

-Dave (aka Famisdave)

StockTwits is definitely an interesting place. It can be both beneficial and dangerous at the same time. It really depends on the involvement of the participation and the expectations. Thank you for your participation Dave and reading my material! Have a great Holiday season and be well!

Good read.

I like StockTwits a lot but definitely agree with you. Anonymity can be dangerous. I appreciate the content here where only the best are accepted as contributors and they stake their real name, face and credentials to add credence to their opinions. To me, that's more valuable than the faceless, nameless masses on StockTwits.

Well said Barry and thank you for taking the time to read the article!