Seriously, Wherefore Art Thou Collateral?

I’m going to go out on a limb and claim there is something seriously wrong in repo. All jokes aside, I know it sounds like a broken record but the dimension that matters is not intermittent collateral problems so much as the greater intensity to them and in a condensing timeframe. Escalation is a description you really don’t want to fit the circumstances.

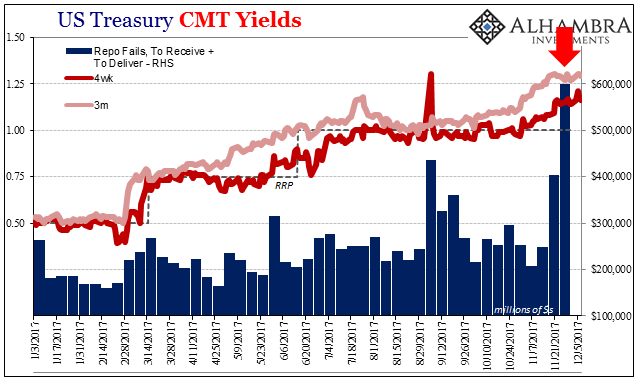

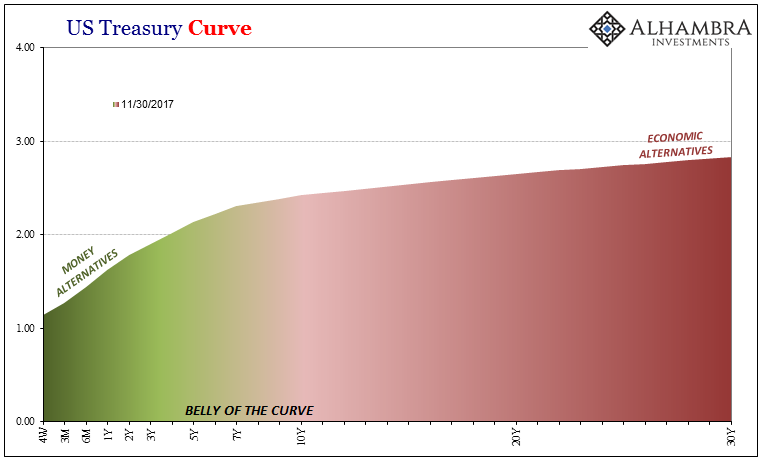

Earlier this week I noted the suspiciously shallow track of the 4-week T-bill equivalent yield, now less than a week ahead of the next “rate hike.” It continues to suggest, as it has for much of this year, collateral tightness (unrelated to the Fed’s symbolic federal funds policy) to some substantial degree. That particular bill yield got as high as 121 bps on Tuesday, but has declined again to 116 bps as of the treasury market close today.

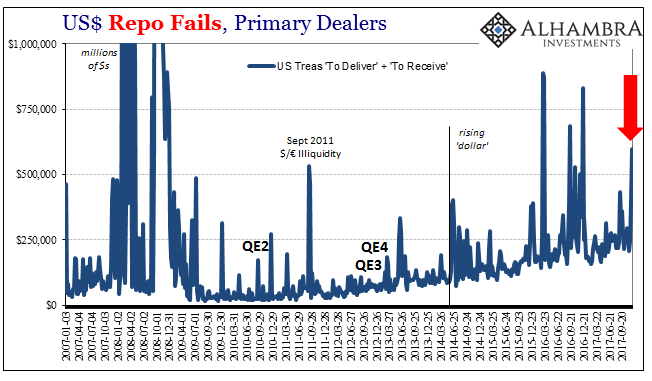

Given all that it was not surprising last week to find first a rather sharp increase in repo fails for the week of November 22. The latest update from FRBNY as reported to the central bank by the primary dealers, however, truly sticks out. For trading last week, fails (both “to receive” plus “to deliver”) were tallied at just barely less than $600 billion. It was by far the most in a year, among the highest since 2008. That’s an increase of nearly 50% from the drastic repo fireworks in early September (that were timed with CNY/HKD reversals and all that has so far been unleashed).

Again, it’s hard to see how the word “escalation” doesn’t fit here. Not only that, also like early September, the GC rate for the 10-year UST collateral has over the last few days dropped to well below the fails penalty rate. That’s indicative of huge and broadening collateral pressures in the repo market – just as it was three months ago (exactly).

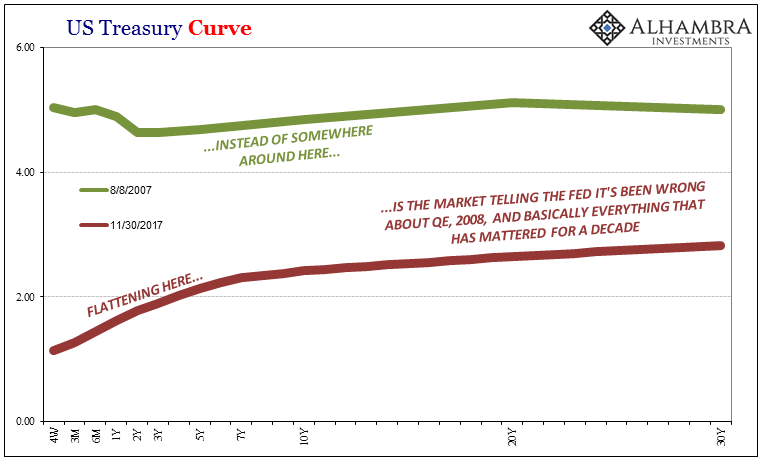

As is almost always the case with these things, of the very few in the mainstream who follow the repo market they write it all off as UST shorts. As noted also earlier this week with regard to UST futures trading, the bond market isn’t at all onboard with rising interest rates. It has positioned instead in the other direction consistent with repo fails – tightening, or lower yields as in the repo equivalent of the interest rate fallacy.

As I wrote on September 7, the last time the GC 10s was so insane:

GC rates for UST 10s collateral has dropped through the repo penalty floor (200 bps minus RRP). It indicates a severe shortage of 10s for collateral, which for the mainstream devolves into dreams about the Treasury market finally getting on board with interest rates have nowhere to go but up (a huge increase, supposedly, in short Treasury positions)…

The larger issue is this collateral shortage that appears lingering beneath the surface all this time. Again, the interest rate fallacy is operative. Bond yields have been moving lower almost all year, suggesting tighter money not from monetary policy but in spite of the FOMC (think the behavior of eurodollar futures). The relationship between oil and bills seems to establish collateral swaps as one likely culprit, though, as is so often the case, there is almost surely more going on than just the one thing.

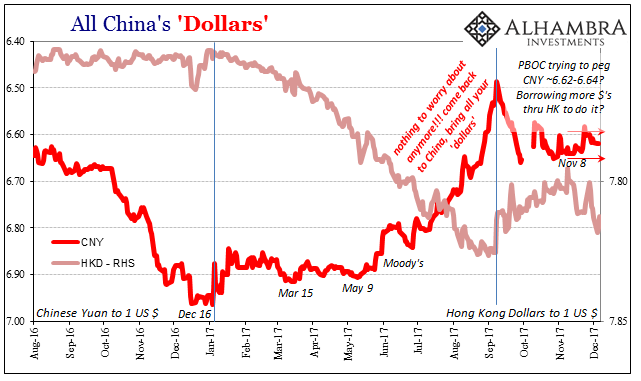

My own suspicions still involve China and the unwinding of the Hong Kong ad hoc “dollar” express. HKD and HIBOR behavior over this very period in question (coincident to repo collateral difficulties) only further bolsters that case.

It’s been pretty dicey and volatile (you don’t want to find money rates and the currency exchange fall into such a tight correlation like you see above; it indicates a bit of artificial desperation) in Hong Kong since early November, picking up more so by the middle of last month right when repo fails jumped up again.

I wrote yesterday (subscription required) that even though HKD is falling again CNY isn’t rising against it anymore like it did before that crucial first week in September. Does that indicate the Chinese can’t buy sufficient “dollars” via Hong Kong, funding instead at most rollovers?

One other possibility is Japan, though that may not actually be a separate issue from Hong Kong. I wrote also this week (it’s been a very interesting week):

The other side of a dollar shortage is, quite simply, “a combined uptick in currency-hedging costs” from the perspective of Japanese banks.

Off in the world of footnote dollars, FX derivatives, it’s gotten more expensive again (starting right around mid-September) to obtain funding in “dollars.” That could have the effect of pushing more Japanese banks into repo while at the same time demanding more collateral of them for any collateralized currency swaps already on the books (meaning their operating bank books, not the accounting statements produced for the public, apart from, of course, the footnotes).

While we can speculate all day and for the rest of the month what’s really going on out there deep inside the shadows, three pieces of information that we do know with reasonable assurance are; 1. Collateral pressures are very real, and coming from somewhere; 2. They are increasing in intensity (escalating); 3. It’s not, repeat not, about UST shorts building up because Janet Yellen is right about long end term premiums.

Disclosure: None.