Resurgence Of Effective Demand

We are seeing a resurgence of effective demand from both long term yields (borrowing costs) and headline inflation falling.

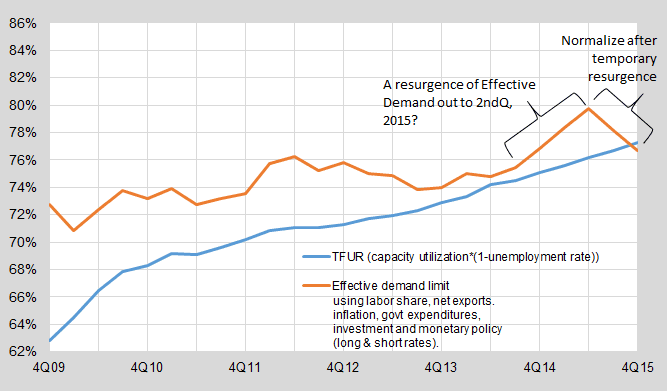

What if 10-year yields fall to 1.6% by 2nd quarter 2015? And what if headline inflation falls to -0.5% by 2nd Q too? (Barclays is predicting negative headline inflation through 2015, Matthew B tweet.) I graph what effective demand would look like keeping other factors constant (labor share, net exports, government expenditures, private investment, Fed rate at ZLB).

This resurgence in effective demand would make the US economy grow faster. Unemployment would come down more. Capacity utilization would go up more. We most likely would see a boost in real wages.

Core inflation can withstand the effects of lower oil prices that give some pricing power to other products and services. This helps the Fed in their desire to raise the Fed rate later this year. Still any setback to effective demand from a rise in the Fed rate looks to be already completely neutralized and more.

Are there dangers in inflating effective demand so much, so quickly? Eventually headline inflation will rise back to normal. Eventually the longer term 10-year rate stabilizes. Put these together at some point in the future, and you reverse the resurgence. Effective demand could normalize back down to around 77% in graph above.

If the utilization of labor and capital grow too much beyond a normalized effective demand level during the temporary resurgence, then I would expect the economy to contract when effective demand normalizes back down. However this temporary resurgence may be the boost that many economists have been hoping for to get the economy back to full-employment.

(Also see the very good post by Jon Hilsenrath today at the WSJ)

Disclosure: None.

Comments

No Thumbs up yet!

No Thumbs up yet!