Professor Bernanke’s Bogus Contra-Factual, Part 1: The Myth Of Great Depression 2.0

It took no “courage” whatsoever to inflate the Fed’s balance sheet from $900 billion to $2.3 trillion during just 17 weeks in September-December 2008. What it actually took was an epochal con job by a naïve Keynesian academic whose single idea about economics was primitive, self-serving, borrowed and wrong.

The claim that the Great Depression was caused by the Fed’s failure to go on a bond buying spree in 1930-1933 was Milton Friedman’s monumental error. Professor Bernanke’s scholarship amounted to little more than xeroxing Friedman’s flawed work, and then shouting loudly in the Eccles Building boardroom at the time of the Lehman bankruptcy that Great Depression 2.0 was lurking just around the corner.

That was just plain hysterical malarkey. But at the time, it served the interests of the Wall Street/Washington Corridor perfectly.

As Wall Street’s decade long spree of leveraged speculation was being liquidated in September 2008, Goldman Sachs, Morgan Stanley and their posse of hedge fund speculators desperately needed rescue from their own reckless gambles——especially their funding of giant balance sheets swollen by long-dated, illiquid, risky assets with cheap hot funds in the wholesale money market. So what better excuse to override every principle of free market economics, financial discipline and public policy fairness than stopping a reenactment of the 1930s—–putative soup-lines and all?

At the same time, beltway politicians and fiscal authorities were tickled pink. They would be able to unleash a monumental $800 billion potpourri of K-street pork and tax and entitlement giveaways to “fight” the recession, knowing that Bernanke & Co would finance it with an eruption of public debt monetization that was theretofore unimaginable.

In short, no public official has ever committed an economic folly greater than the horrific misdeed of Ben S. Bernanke when he provided the Great Depression 2.0 cover story for the lunatic outbreak of central bank money printing shown below. It destroyed the last vestige of Wall Street discipline in a financialized economy that had already been bloated and deformed by two decades of Greenspan era Bubble Finance.

Click on image to enlarge

Now the speculative furies would be unleashed like never before. In one great fell swoop the above monetary explosion destroyed price discovery and financial responsibility entirely, turning Wall Street into a pure casino and enabling windfalls of massive proportion and unspeakable inequity to be showered on a tiny slice of the population.

So just call Bernanke’s 583 page tome “The Courage To Print” and be done with it. He does not even bother to prove that a great depression was imminent. Nor does he show that what would have actually been a short-lived and healthy liquidation of financial speculation on Wall Street would have spilled over to the real economy and taken main street into the drink.

Indeed, in his interview with the Financial Times’ insufferable Keynesian scold, Martin Wolf, Bernanke let slip why he and his Fed colleagues were scurrying about saving the world from an imaginary catastrophe. To wit, Keynesian economists and modern central bankers——which are one and the same thing—-simply assume that capitalism has a death wish; and that absent their constant ministrations, and even occasional bouts of courage and extraordinary interventions, it tends toward breakdowns, slumps and even depressions.

Thus, in justifying the Fed’s brutal war on savers, Bernanke said the following:

But what’s the alternative? Should the Fed not try to support a recovery……And this is certainly not an argument for the Fed to do nothing and let unemployment stay at 10%.

Well, let’s cut to the chase. He’s basically saying that absent the Fed’s massive money printing in the fall of 2008, the US economy could not have ended its recessionary plunge, nor ever crawled out of the resulting economic hole.

But those propositions are manifestly untrue. The main street recession that began in January 2008 was warranted, rational, moderate and self-limiting. It represented the downshift of debt-financed spending by the household sector that occurred when the housing and mortgage bubble collapsed, and when consumer purchases of domestic goods and services were throttled back by the disappearance of the MEW (mortgage equity withdrawal) from home ATMs and other credit sources.

But this decrement to housing and consumption spending was healthy and self-contained because it had never been sustainable in the first place. It represented the purging of phony debt- fueled growth, not the diminishment of production and income based spending nor the reversible loss of “potential” GDP.

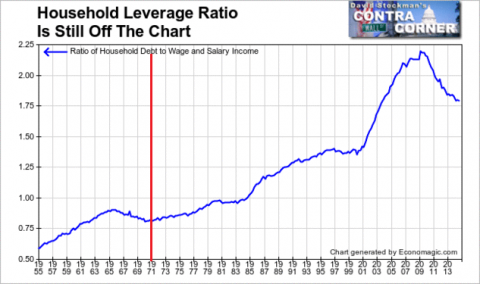

Stated differently, the so-called Great Recession excised the effects of the Fed’s financial repression or Bubble Finance from the main street economy—and none to soon. After all, here is what happened to household debt after Greenspan’s panicked reduction of money market rates from 6.25% to 1.0% in just 30 months after the dotcom bust.

Household debt grew at the preposterous rate of 10.2% per annum in the run-up to the January 2008 economic break; it doubled in less than seven years.

Click on image to enlarge

It is now abundantly evident that this credit eruption resulted in US households running smack dab into a condition of “peak debt”. Accordingly, incremental spending for vacations, kitchen renovations, trips to the mall, restaurant meals, yoga teachers etc. had to be reduced on a one-time basis in order to realign spending with underlying levels of wages, salaries and other recurring income.

Household Leverage Ratio

But contrary to Professor Bernanke’s Keynesian catechism, the elimination of Bubble Finance distortions from main street borrowing and spending did not mean that the US economy was descending into an economic black hole or a self-fueling downward spiral. What happened instead is that bubble based jobs in housing, finance, real estate and domestic services and goods production were eliminated on a one-time basis. Likewise, domestic business inventories associated with excess credit based spending were liquidated.

This is what market based economies do to purge and heal excesses. For instance, business inventories plunged sharply for just 12 months after August 2008, dropping from $1.54 trillion to $1.31 trillion or by nearly 15%. But once the system was cleansed of excess, business inventory levels stabilized and by the fall of 2009 began to be replenished.

In this context it is crucial to note that this rational $230 billion inventory liquidation accounted for fully 67% of the $345 billion drop in nominal GDP between Q4 2007 and the recession bottom in the summer of 2009. Accordingly, the Great Recession did not represent an uncontrolled economic implosion; it reflected main street’s self-healing from the distortions imposed by lax central bank policies during the preceding Greenspan housing and credit bubble.

Moreover, the Fed’s post-Lehman mad cap balance sheet expansion had absolutely nothing to do with this reversal. Inventory liquidation had been a rational adjustment to the one-time household spending decrement, not the consequence of interest rates being too high in the first place. Nor was it owing to any other form of un-accommodative monetary policy that the Fed could fix by pegging money market rates at ZIRP.

Click on image to enlarge

The proof that the inventory bottoming shown above was self-generated lies in the credit statistics for the 12 months encompassed by the chart. After all, monetary policy transmission to the main street economy operates through the tangible medium of credit growth, not economic magic.

Yet total business credit outstanding shrunk by $525 billion or nearly 5%during the period in which Bernanke exploded the Fed’s balance sheet, and showered Wall Street with free carry trade gambling stakes. Self-evidently, businesses stopped liquidating inventory in late summer of 2009 because the latter had now become realigned with sales, not because the mad money printers in the Eccles Building had induced them to borrow a single incremental dollar of credit relative to the pre-Lehman levels.

Click on image to enlarge

In fact, notwithstanding the liquidation of one-half trillion dollars of business credit, inventory-to-sales ratio’s were quickly restored to health within a few months of the recession’s end, and then stabilized at normal levels without any help from the Fed’s easy credit whatsoever. Bernanke’s self-described courage to print was of no moment to the main street economy.

Click on image to enlarge

That point is reinforced by the job statistics. Fully 75% of the 8.7 million payroll jobs lost during the great recession occurred in the brief ten-month interval between August 2008 and June 2009. For all practical purposes the bottom was in thereafter, and the natural regenerative processes of capitalism were fully at work restoring employment and income.

Click on image to enlarge

Again, the bottoming shown above had absolutely nothing to do with ZIRP and QE. During this entire period, private sector credit market debt in the US continued to decline, dropping from $24.88 trillion on the eve of the Lehman bankruptcy to $23.37 trillion in Q2 2010.

Thus, private credit not only had dropped by $1.2 trillion or by 5% while Bernanke was running the Fed printing presses red hot, but it continued to shrink well after the non-farm payroll job count had begun to rebound in March 2010.

So the Fed absolutely did not cause the household and business sectors to borrow more. As Nixon might have said in another context, its credit channel of monetary transmission had become non-operative.

Click on image to enlarge

At the end of the day, Bernanke’s whole case rests on the contra-factual. That is, his assertion that the US would have otherwise plunged into an economic black hole in the absence of the Fed’s massive intrusion into financial markets.

But as will be shown in subsequent parts, the post-Lehman financial meltdown would have burned out within the canyons of Wall Street all on its own. There was never anything more in store than a moderate self-correcting adjustment of excessive business inventories and labor.

Likewise, the myth that a Great Depression 2.0 was avoided by the Fed’s allegedly courageous action is a complete crock. That claim is actually based on a prior myth penned by Professors Bernanke and Friedman that furious Fed bond-buying during 1930-1933 would have prevented the liquidation of bad credit and unsustainable economic excesses during that period.

Absolutely not true.

Read Part 2: Professor Bernanke’s Bogus Contra-Factual: Why The Friedman/Bernanke Thesis About The Great Depression Was Dead Wrong

Disclosure: None.

I am no fan of protecting speculation. I hate it. But David, there were mass layoffs in late 2008. Credit dried up for real businesses at the same time speculation was being plummeted. Speculation as it applies to housing meant workers with real skills like carpentry, were simply not needed anymore. They experienced a real depression. Many of the best paying jobs for the middle class are in the trades. That is where speculation and real come together and that is where the banks have the advantage over the world.

So, when we get to the point where the skilled trades workers are merely bubble based job holders, we are in real trouble as a society. Real trouble.