Priceline Shares Surge Following Upgrade From Stifel Nicolaus

Shares of online travel booking website Priceline (NASDAQ: PCLN) shot up 1.7% in trading on Tuesday after Stifel Nicolaus analyst Scott Devitt upgraded his rating on the stock from Hold to Buy with a price target of $1,400.

International gross bookings have consistently been the main driver of Priceline’s revenue, with most of it coming from the company’s subsidiary website, booking.com, in Europe. The analyst attributed his upgrade to the recent weakness in the European macro market and believes that the downturn will improve.

He noted, “We believe the recent underperformance in shares and conservative company guidance have reset expectations and priced much of the European macro risk into the stock. At this point we view the potential upside from positive surprises in the region as a key driver for share appreciation to new highs.” The analyst estimates that “over 70% of 2015 bookings” will involve European currencies, representing a “risk to reward scenario at current price levels.”

Despite the recent weakness in Europe, Priceline has a history of beating it's own guidance and analysts’ estimates, having done so for 16 consecutive quarters. Priceline beat Q4 estimates last month once again despite facing foreign currency headwinds, proving just how strong the company’s operations are.

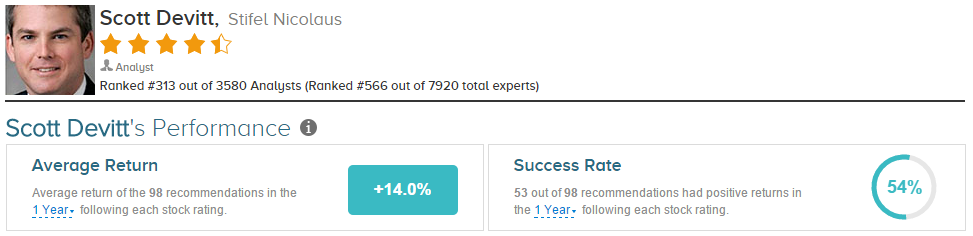

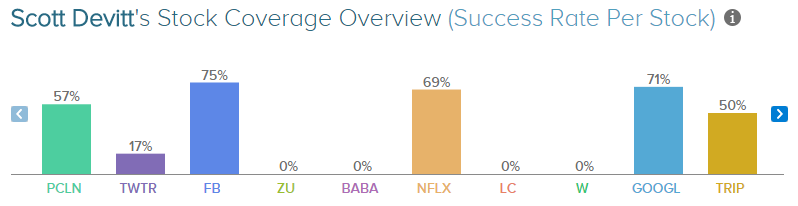

Scott Devitt has rated Priceline 9 times since October 2011, earning a 57% success rate recommending the travel company and a +12.2% average return per PCLN recommendation. Overall, he has a 54% success rate recommending stocks and a +14.0% average return per recommendation.

Devitt has a history of rating internet stocks such as Facebook (NASDAQ: FB) and Netflix (NASDAQ: NFLX). The analyst has rated Facebook 13 times since June 2013, earning a 75% success rate recommending the social media website and a +25.6% average return per recommendation. Likewise, he has rated Netflix 22 times since January 2009, earning a 69% success rate recommending the streaming website and a +66.1% average return per Netflix recommendation.

Devitt’s bullish rating caused Priceline’s stock to jump significantly. Do you trust his latest recommendation based on his financial advice history?

Disclosure: To see more recommendations from Scott Devitt, visit more