Positioning Shows Risk Appetites Remain Extreme, Dollar Holdings Retreat

Video length: 00:18:59

Volatility can be misleading. Sharp moves in markets can arise due to a thin liquidity, developments that will absolutely struggle for conviction and follow through as there is not inherently enough market to carry the market to further stages. The same is true of technical breaks and reactions to fundamental developments. How many range or trendline breaks as of late have completely lost momentum just beyond the border on the chart? How many headlines have been cobbled together after surprise activity in assets to 'explain' motivation? What decides sudden and lasting moves in the markets is the capital that chases the prevailing appetite for return or safety. Despite evidence of rising anxiety and caution in the system, the market remains firmly committed to its extraordinary speculative exposure. We can see this in both the type of assets that are outperforming as well as the measures of exposure that we have available to us.

Looking at the 12-month performance of popular risk-oriented assets, we see a tangible appetite for higher returns and even greater volatility - capital gains is increasingly the remaining opportunity for meaningful returns versus income. In the ranking, the Emerging Market ETF has even outpaced the preternatural outperformer in the S&P 500. This is a definitively higher risk (higher volatility) asset class, and these priced based swings are the appeal. Yet, we have also seen the downside in pursuing such leverage with the extreme activity of just the past week. The gap lower on US political risk was particularly violent for the EEM - though so too was the subsequent gap higher. In contrast, carry trade (the Deutsche Bank Carry Harvest Index) has floundered with an explicit dependence on its yield and substantially smaller priced based swings on which to take advantage. This appetite for more movement has further fed demand for greater amplitude to such trades through leverage. While it is difficult to measure how much leverage is used across the markets, we have the NYSE broker-level margin which continues to push record highs.

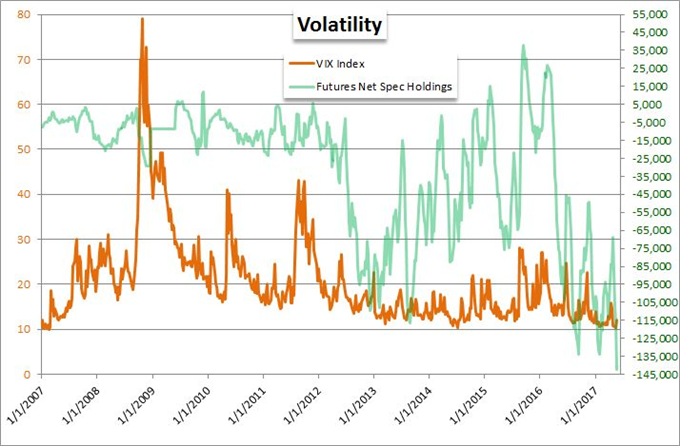

In specific asset classes and markets, we can measure quantitative exposure. Beyond the flip to inflows into equity based ETFs and a persistent speculative-oriented appetite for bond funds, we have the speculative futures holdings figures from the COT. Arguably the most remarkable exposure comes via the VIX futures which saw a record net short position this past week. What is even more extraordinary about that reading is that the data updates run through Tuesday - a day before the volatility surge which would have offered actual premium to earn. A dramatic swing in Treasury futures positioning and its current record net long position speaks to a more subtle universal exposure but one more systemic in nature. Perhaps one of the most impressive changes in exposure for breadth is the Dollar's shift. Holding of long Dollar positions are reversing aggressively in pairs like EUR/USD, GBP/USD and USD/CAD. What does positioning and capital flows say about our markets now and what does it suggest of the future? We discuss that in this weekend Strategy Video.

Comments

No Thumbs up yet!

No Thumbs up yet!