Oil’s A Buy Again

How you buy oil is just as important as when you buy.

Something happened to the oil market at the end of July. It went unnoticed to a lot of investors and traders. Why? Well, mostly because trading rooms emptied out for August vacations. And then It was just a little thing anyway: a bullish crossover in the price of West Texas Intermediate (WTI) spot oil. Near-term price momentum is accelerating.

A barrel of front-month WTI is now changing hands at the $49-$50 level. If there’s any oomph to oil’s current momentum, a price objective of $61-$62 could come into view. You may know that bull moves in the crude oil market have been recent rarities. In fact, the last sustained upsurge was a 27-month stretch from February 2009 to April 2011—a bounceback from the Great Recession.

So why should investors care about crude oil prices? Two reasons. One, oil, like gold, is a portfolio diversifier. WTI’s correlation to the U.S. stock market over the past few years is 0.47. Not as low as gold’s but here’s the second reason: oil’s a better proxy for inflation than gold. You could even say that oil IS inflation nowadays.

So how does somebody put oil in a portfolio without having to venture into the highly leveraged world of futures? Oil exchange-traded funds, that’s how. There are three unlevered funds that track WTI futures:

- The United States Oil Fund (NYSE Arca: USO) holds front-month contracts which makes the fund particularly sensitive to contango—that feature of futures pricing in which later deliveries are costlier than near-term contracts. When contango exists, rolling the fund’s long position forward—which must be done to maintain exposure—can reduce the gain realized from spot price movements or even result in losses.

- USO’s sister fund, the United States 12-Month Oil Fund (NYSE Arca: USL) attempts to minimize the contango effect by taking positions in 12 different WTI contracts, one for each upcoming month. While negative roll yields are minimized, the fund is less sensitive to short-term ticks in spot oil prices compared to USO.

- Another approach to the contango problem is taken by the PowerShares DB Oil ETF (NYSE Arca: DBO) which optimizes its contract selection based on the shape of the futures curve. At roll time, the contract months which would produce the smallest deleterious impact in a contango market are selected as purchase targets.

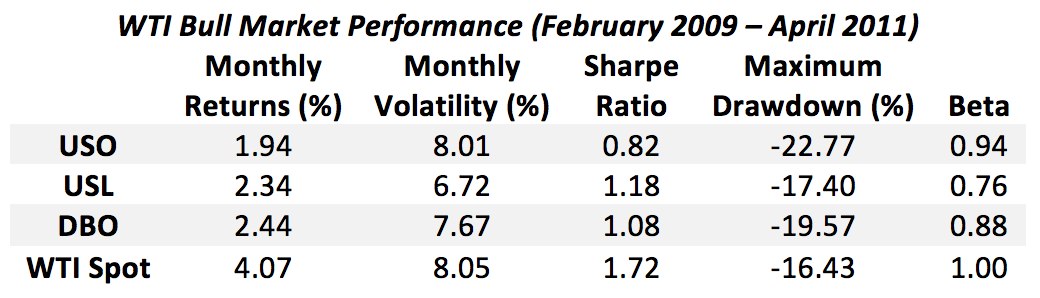

If we look back at the bull market performances of these three funds, we can see how they stack up against one another.

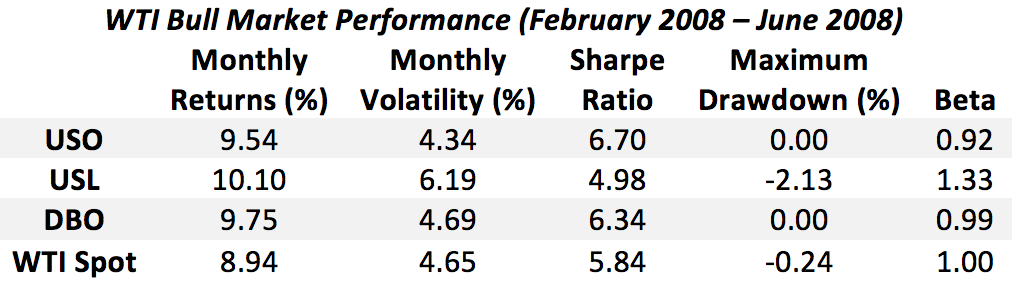

There was one other bull run in crude oil during the lifetime of the oil ETFs. That was in the five months immediately preceding oil’s recessionary nosedive.

A couple of things stand out when you compare the two bull runs. First, you can see the effect of contango—the upward-sloping futures term structure—on the ETFs in the 27-month run. Monthly returns earned by the ETFs were universally lower than that earned by physical oil. In the five-month run preceding the recession, the opposite was true. Then the ETFs outperformed crude oil itself. Why? Because the futures market wasn’t in contango then. The market was inverted, meaning near-term deliveries were priced higher than later-dated contracts. That happens when oil is in short supply.

Also noteworthy is the relative performances of the ETFs. Look at the Sharpe ratios which represent the funds’ risk adjusted returns. In the longer run, USL produced a better reward-to-risk tradeoff. In the shorter run, USO comes out on top. Again, we can credit contango, or its absence, for the disparate performance.

The takeaway? If you’re going to bet on a rising oil market, you not only have to have a price objective in mind, you’ve got to have a timeline in mind as well. What we’ve seen here is that USO is the better vehicle for navigating short-term moves in the oil market. USL works better over the long-term.

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) option ...

more