NFIB Small Business Survey: "Small Business Optimism Marks Two Years Of Continued Historic Readings"

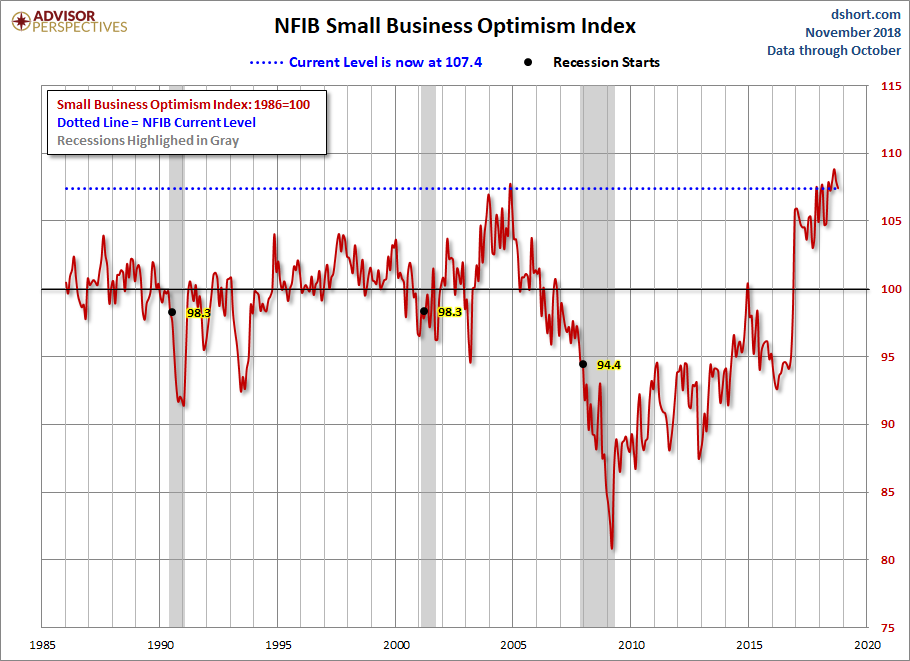

The latest issue of the NFIB Small Business Economic Trends came out this morning. The headline number for October came in at 107.4, down 0.5 from the previous month. The index is at the 98th percentile in this series. Today's number came in below the Investing.com forecast of 108.0.

Here is an excerpt from the opening summary of the news release.

Small business optimism continued its two-year streak of record highs, according to the NFIB Small Business Optimism Index October reading of 107.4. Overall, small businesses continue to support the three percent-plus growth of the economy and add significant numbers of new workers to the employment pool. Owners believe the current period is a good time to expand substantially, are planning to invest in more inventory, and are reporting high sales figures.

“For two years, small business owners have expressed record levels of optimism and are proving to be a driving force in this rapidly growing economy,” said NFIB President and CEO Juanita D. Duggan. “The October optimism index further validates that when small businesses get tax relief and are freed from regulatory shackles, they thrive and the whole economy prospers”.

The first chart below highlights the 1986 baseline level of 100 and includes some labels to help us visualize that dramatic change in small-business sentiment that accompanied the Great Financial Crisis. Compare, for example, the relative resilience of the index during the 2000-2003 collapse of the Tech Bubble with the far weaker readings following the Great Recession that ended in June 2009.

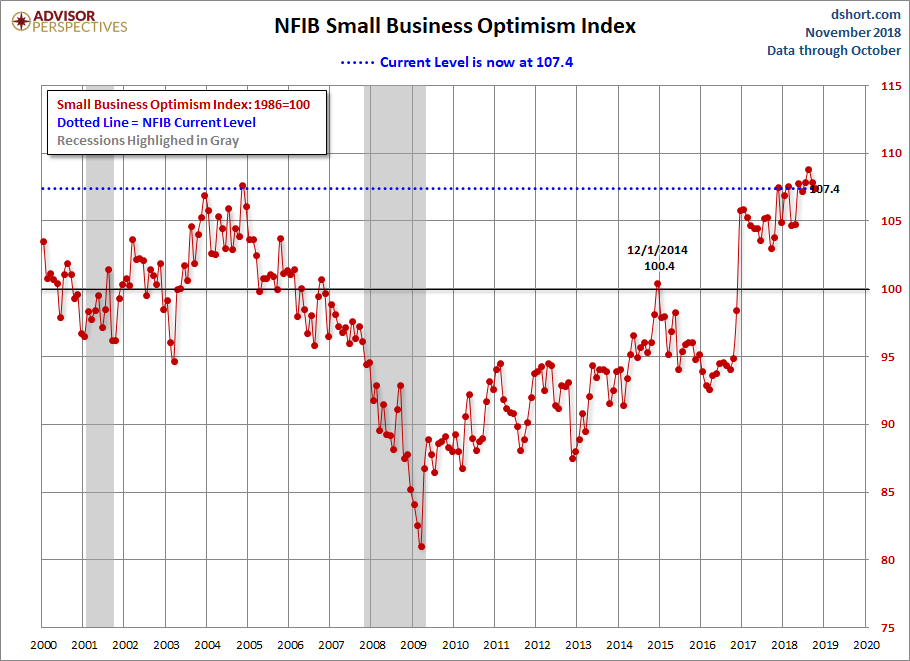

Here is a closer look at the indicator since the turn of the century. We are just below the all-time high.

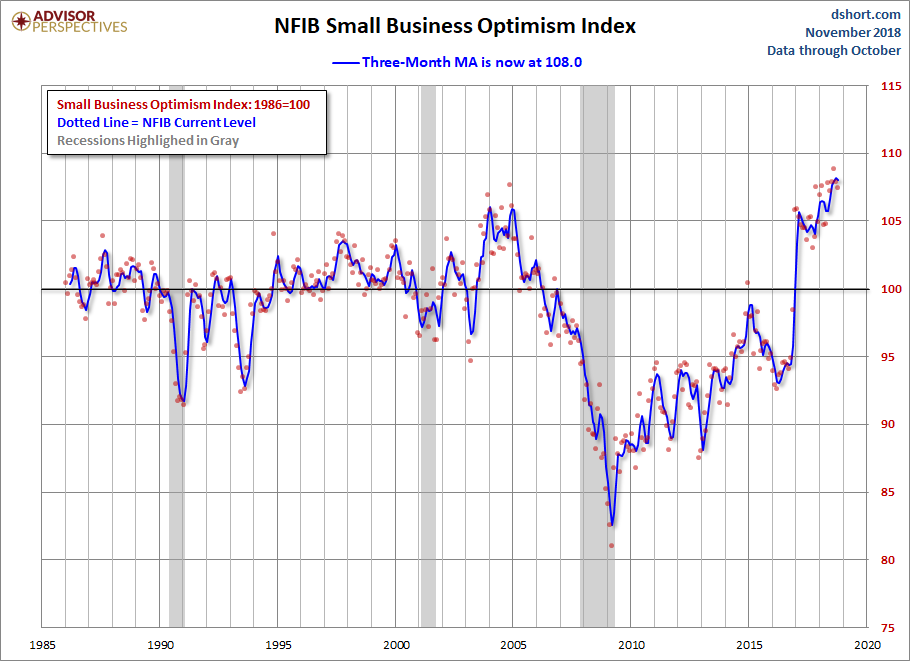

The average monthly change in this indicator is 3.0 points. To smooth out the noise of volatility, here is a 3-month moving average of the Optimism Index along with the monthly values, shown as dots.

Here are some excerpts from the report.

Labor Markets

ob creation was solid in October at a net addition of 0.15 workers per firm (including those making no change in employment), unchanged from September.

Inflation

How effective has the Fed's monetary policy been in lifting inflation to it two percent target rate?

The net percent of owners raising average selling prices rose 1 point to a net 16 percent seasonally adjusted. Twenty-nine percent of the construction firms reported raising prices (4 percent reduced) while 36 percent of the firms in agriculture report lower average prices (16 percent raised).

Credit Markets

Has the Fed's zero interest rate policy and quantitative easing had a positive impact on Small Businesses?

In a string of strong compensation reading, reports of higher worker compensation fell 3 points from its record high to a net 34 percent of all firms. Plans to raise compensation fell 1 point to a net 23 percent.

NFIB Commentary

This month's "Commentary" section includes the following observations and opinions:

The employment picture is exceptionally good as small businesses hire or try to hire at record rates. Job gains have averaged 210,000 a month this year. Both hours worked and hourly wages rose in October, a good boost to incomes. The unemployment rate for individuals with less than a high school education is a shade over 5 percent, compared to a long term average of 9 percent. Earnings for this group are also growing faster than for those with higher educational attainment. Advanced degrees seeing the slowest growth. Owners report raising compensation at record rates, and this is apparently working, as the participation rate for prime working age individuals is rising in response to better pay and more widespread job availability. An unburdened small business sector is great for employment and the general economy.

Bottom line, the October report sets the stage for solid growth in the economy and in employment in the fourth quarter, while inflation and interest rates remain historically tame. Small businesses are moving the economy forward.

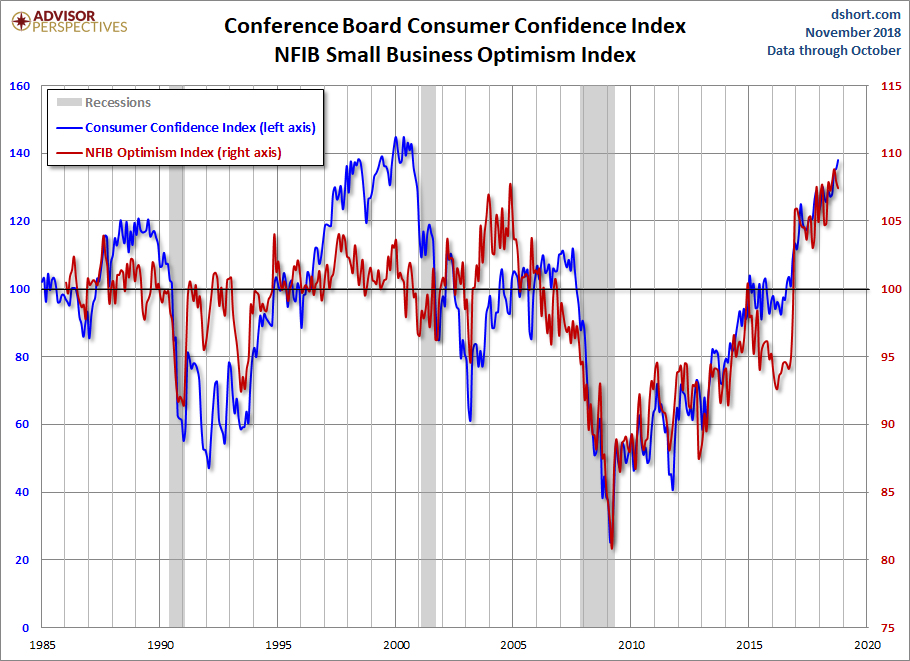

Business Optimism and Consumer Confidence

The next chart is an overlay of the Business Optimism Index and the Conference Board Consumer Confidence Index. The consumer measure is the more volatile of the two, so it is plotted on a separate axis to give a better comparison of the two series from the common baseline of 100.

These two measures of mood have been highly correlated since the early days of the Great Recession. The two diverged after their previous interim peaks, but have recently resumed their correlation. A decline in Small Business Sentiment was a long leading indicator for the last two recessions.