Negative Interest Rates Are Insane

Buy Low Sell High

Sales at stores on Main Street attract many eager and delighted buyers. The same should hold true on Wall Street when equities are priced at deep discounts form their dividend-discount values. Instead of shivering in their boots when shares are on sale, investors should be filling their boots with bargains.

Unfortunately for some perverse reason too many stock-market participants want to buy high in euphoria and sell low in despair. The old 90% rule continues to hold true that 90% of the people will miss 90% of the move 90% of the time.

Negative interest rates.

Anyone who is terrified by the current financial conditions and wishes to let me hold his or her money for any period of time and expect to receive their money back less a fee paid to me for the privilege of holding their money under my mattress is more than welcome to contact me.

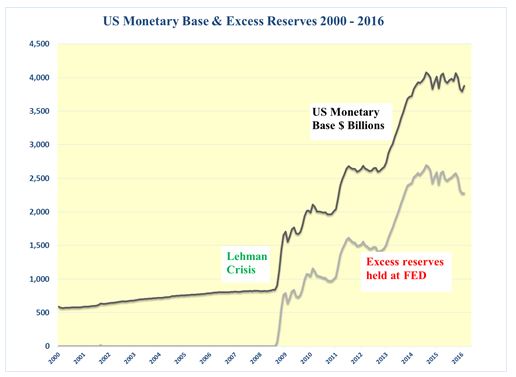

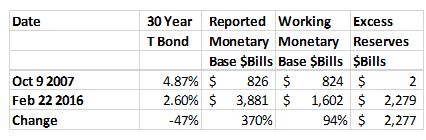

Negative interest rates are insane. Except as a measure whereby governments force bankers to move off their nice safe assets of excess reserves. In the USA the Fed is paying bankers O.5% pa. interest on US$ 2.28 trillion of excess reserves. This is US$11.4 billion pa. to keep senior bank executives in the bonuses and lifestyles to which it seems they feel entitled. One wonders if bonuses would have to be repaid if interest rates turn negative!

This situation is the result of changing regulations, increased risk oversight, low long-term yields and an all pervasive and continuing fear of replaying 2008. The fear is despite the regulations that have been enacted to ensure that such a nightmare is never repeated. This almost guarantees that the cause of the next collapse, if and whenever it might happen, will be due to something entirely different!

The Fed need not move to negative rates to push excess reserves into the real economy. All that is required is to curb the largess of paying any interest whatsoever on excess reserves.

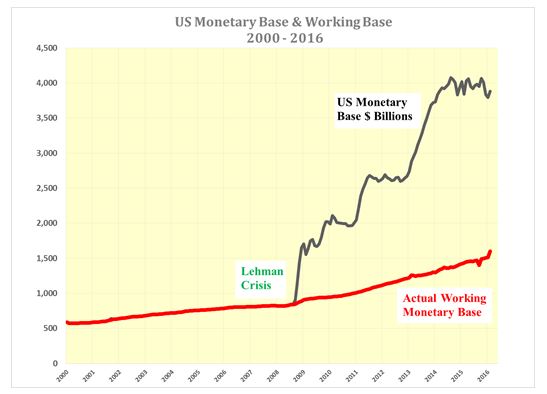

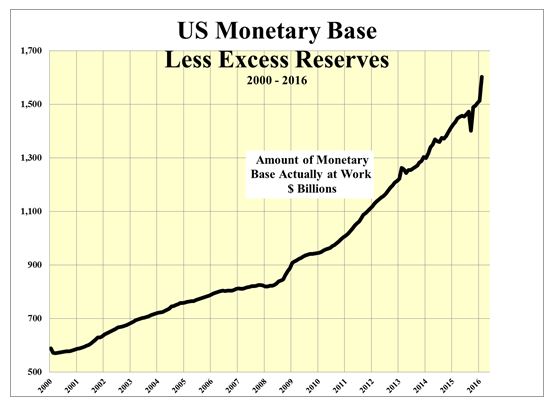

Quantitative Contraction by Fed Evident in January being reversed.

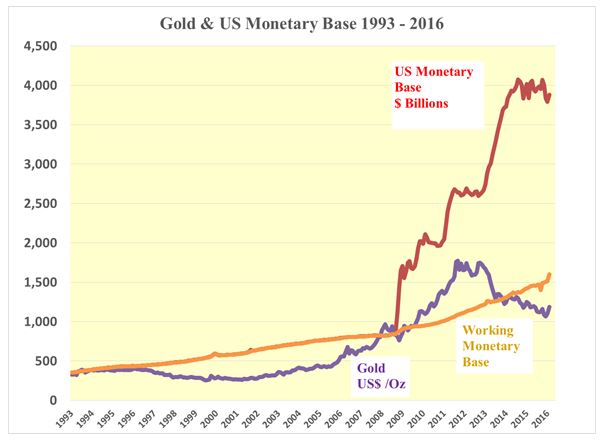

On January 6, it looked as though the Fed was tightening much more than implied by a 25 basis point rise in the Funds rate. Excess reserves fell significantly and it appeared as though the U.S. dollar would strengthen in consequence. Over the last month the total monetary base moved back up again by 7% form just over US$3.6 trillion on January 6 to just under US$3.9 trillion. Excess reserves also rebounded by 11%. However, the most encouraging change has been the jump in the amount of money that is at work in the economy to a record US$1.6 trillion.

The recent rapid easing of money and the ensuing chatter about negative interest rates have coincided with a weakening of the U.S. dollar and a strengthening of gold suggesting that the Fed will continue to do what it takes to avoid a recession. From this, it can be deduced that rates will remain low and that earnings should start to improve, with the exception of the oil patch where year over year comparisons will not be good in 2016. Furthermore the Fed can do little about lower oil prices.

Impact on DJII

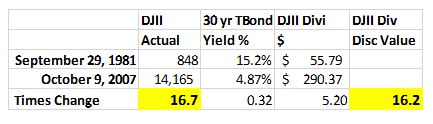

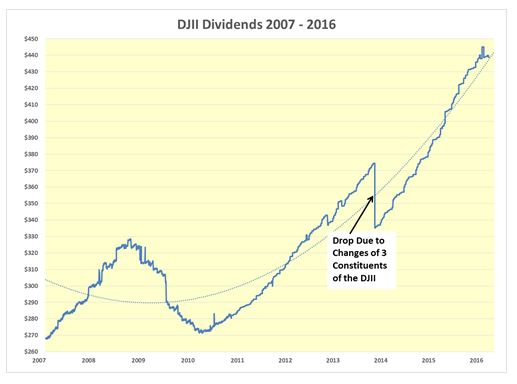

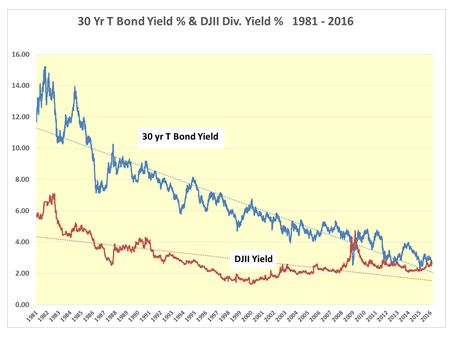

Low and falling interest rates are a perfect monetary environment for equities, provided that dividends are either stable or rising. The best long-term example of this is from the fall of 1981 to the pre-Lehman peak of the DJII in the fall of 2007.

On September 29, 1981 the yield of the U.S. 30 year T Bond peaked at 15.2%. The dividend of the DJII was US$55.79 and the DJII stood at 848. Pre Lehman the DJII peaked October 9, 2007 at 14,165 up 16.7 times. Over that period the dividend rose 5.2 times to $290.36 while the yield on the U.S. 30 year T Bond fell 68% to 4.87%.

Dividing the change in the DJII dividend of 5.2 times by 0.32 the dividend-discount value of the DJII increased by 16.2 times which is fairly close to the actual 16.7 times increase in the price of the DJII.

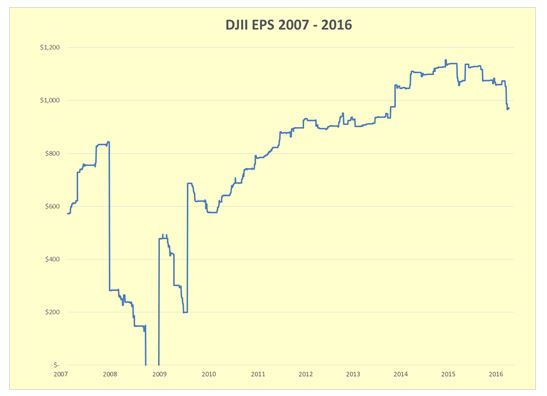

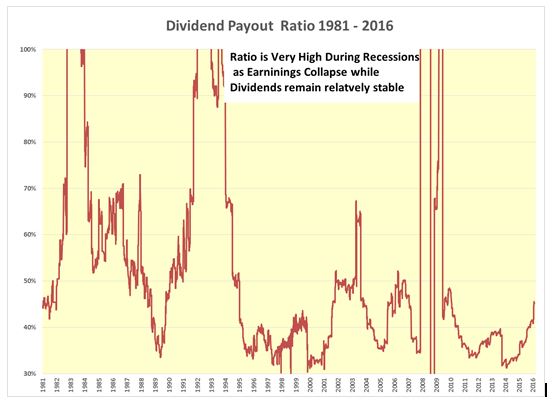

Of late, dividends have held up well despite the current earnings recession. What is needed is for banks to do their job of pushing the excess reserves out along the yield curve and into the economy at large to get earnings rising again.

The DJII dividend has fallen modestly over the past month but the payout ratio remains reasonable at the lower end of historical levels.

More fiscal changes required to accelerate the move of money into economy

For a start it will require a great deal more than the US$305 billion approved so far by the U.S. Government to kick start the long-overdue massive rebuilding of the Nation’s decaying infrastructure. Let us hope that such programs do not become mired in, real or imagined, green protests such as Canada’s Pipeline East proposal.

This infrastructure proposal for shipping western Canadian crude oil to east-coast refineries would obviate the need to import foreign crude from the likes of Saudi Arabia and improve the Canadian balance of payments. Furthermore, with more oil production it would help Alberta continue to make transfer payments to those eastern provinces that refuse to allow fracking for environmental reasons while hypocritically accepting those same transfer payments from oil producing provinces.

Money is available and in vast quantities, it has been created and there is a great deal of it. However, there is too little demand. Money needs to be mobilised with either carrot or stick into the real economy from the banks, institutions, individuals and corporations that are sitting on the fence terrified of a re-run of 2008.

As was the case in late 2008, early 2009 and thereafter, the huge amount of excess reserves have pushed interest rates to today’s very low levels.

These continuing low rates is further evidence that there is ample money available as well as palpable fear that investors seem to have of moving out along the yield curve. There is simultaneously a continuing search for yield but a seeming refusal to invest in equities where not only are yields higher than that of the 30 year T bond but the dividends, or coupons, have grown over time.

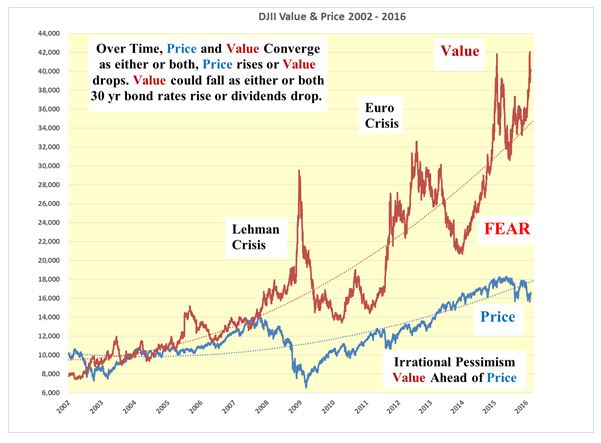

Furthermore, the dividend discount value of the DJII stands at 142% higher than its price, which makes the DJII a screaming buy.

Normal Interest rates?

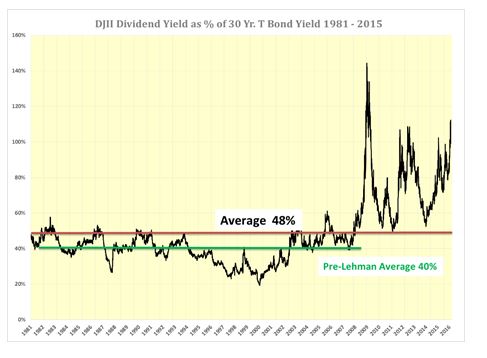

It is almost as though market participants are waiting for bond yields to return to “normal” levels, whatever they are. Perhaps, investors are taking their cue from the price of the DJII being correct, which would be justified by a 6.30% yield on the U.S. 30 year T Bond. If so, investment in bonds would not be a good idea.

However, as there is so much chatter about negative yields, being in bonds would be seem to be a very good strategy if one were to ignore the impact of such a development on the dividend-discount value of the DJII. This would be a great shame as further declines in interest rates would push the dividend-discount rates even higher and the relative DJII yield to the point where it should become obvious to even the most terrified investor that the price of the DJII is far too low.

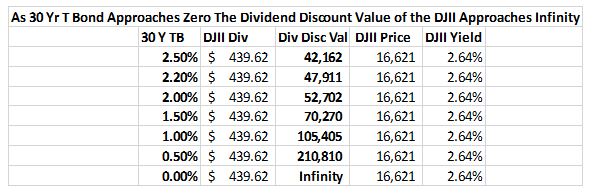

In the extreme, negative short term interest rates could push the yield on the 30 year T Bond to zero. In which case the dividend discount value of the DJII would be infinite. A negative 30 year T Bond yield would push this argument into the world of the “reductio ad absurdum”!

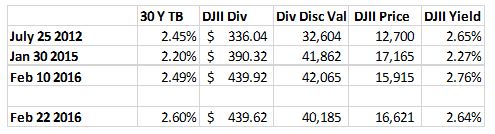

Using the low yield points of the U.S. 30 year T Bond since 2012 as a base for the exercise of testing the impact of ever-diminishing long bond yields it can be seen that the DJII yield exceeded the 30 year T Bond yield each time:

Holding the price of the DJII steady at 16 621, its yield of 2.64% becomes increasingly attractive the lower the U.S. T Bond yield falls. It is unlikely to remain so high with long rates falling and the dividend-discount rate expanding toward infinity as the yield on the 30 year T Bond approaches zero. The DJII yield should thus decline as the DJII price rises.

Even though there is an earnings recession underway the dividends of the DJII appear secure. Should the economy slip into a recession and earnings deteriorate further actions by the Fed, including a move to negative rates should be sufficient to reverse this unexpected event.

Gold

Negative interest rates runs counter to all arguments against gold. The prime one being that gold pays no interest. Neither, indeed, does money if one pays someone else to hold it.

The jump in the actual working amount of the monetary base over the last month has kick-started the overdue rise in the price of gold toward the US$1,600 per ounce level which would be in keeping with my belief that the price is determined more by the actual working amount of the monetary base of US$1.6 trillion rather than the total monetary base of US$3.9 trillion.

Data Sources: US Federal Reserve, Dow Jones, Bloomberg and the London Bullion Market

As gold rises so too do the shares of gold mining companies. It is still early for the explorers but their turn will come.

Oil - Still too Early

The chances of an agreement between Saudi Arabia, Russia, Iran et al to cut production are about as high as a meaningful ceasefire happening in Syria. Somewhere between zero and nil.

The market clearing price is yet to come under US$20 per barrel, so keep the powder dry and avoid trying to catch a falling sword. There will be plenty of time to buy oil shares.

Non-ferrous metals

LME inventories are still falling and the prices of base metals have probably passed their respective nadirs but it will take some time for LME inventories to reach the pinch points.

more