My Secrets To 297%+ Gains In Biotech Investing

I am out in Las Vegas all week at the MoneyShow investing conference. I am giving a two-hour presentation here on the basics of properly managing a portfolio in the volatile biotech space. The presentation contains a lot of the lessons I have gleaned from over two decades of successfully investing in the biotech sector. Most of these foundational tenets on properly managing and optimizing a biotech portfolio were learned the old fashioned way, by trial and error. Many lessons were quite painful both to my ego and to my pocketbook. However, these learnings have made me much more successful in the biotech arena than I believed was possible a decade ago, and I want to share these learnings with you.

I want to share some of these hard learned lessons in the hopes that you might incorporate some of these concepts into becoming more successful in the intently interesting and lucrative biotech sector. Hopefully, I can help at least one reader avoid some of the trials I have had to go through to get to this stage without absorbing the painful hits I have endured in order to acquire this knowledge.

Diversification is important in managing any portfolio but is absolutely crucial in the highly volatile biotech area especially in the promising but speculative small cap sub-sector of the industry. Over the years, I have a developed a strategy I have dubbed “Shotgun Investing” for the small cap biotech arena. This involves holding many small stakes in myriad promising smaller concerns. This helps me to mitigate the inherent volatility in this high beta sector.

I go into investing in this area knowing that I am going to have numerous “strike outs” as even hedge funds with PhDs in Biochemistry on the staff pick up their share of investments in this area that don’t pan out. Developing a drug that can garner FDA approval is a very complex and challenging endeavor. There are hundreds and hundreds of small biotech companies as well as myriad larger pharma concerns spending tens of billions of dollars annually trying to successfully navigate through the trial process to get a new drug to market. For all of that, The FDA approved just 41 new drugs during 2014. However, the occasional five or ten bagger in this sector one should produce solid returns over time.

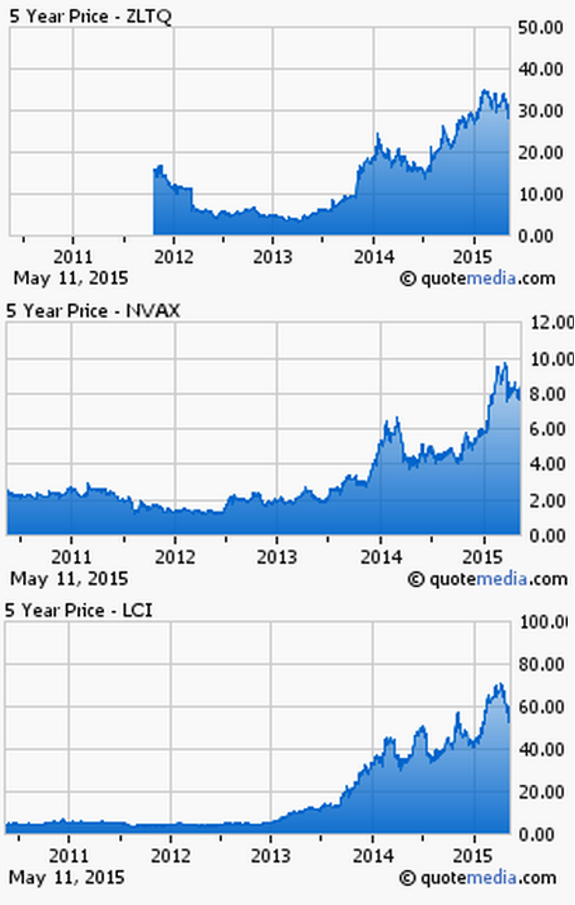

Over the past three years a number of the small biotech and medical device companies I have invested in and profiled have gone on to be these five to ten baggers: these include Novavax (NASDAQ: NVAX), Lannett Company (NYSE: LCI) and ZELTIQ Aesthetics (NASDAQ: ZLTQ). And I have another in the Small Cap Gems portfolio that’s currently up more than 300% since it was included in mid-December.

The second thing I have learned over the years is one should have a plan to cull profits in this area. Small biotech stocks can rally strongly or plunge based solely on the current sentiment in the market at the moment. It is a terrible feeling to have a stock that quickly doubles, decide to let everything ride and then watch the stock go back to the original entry level just because the sector is suffering from a current swoon that periodically sweeps over the space.

One also does not want to sell too soon and miss out on the huge gains like some of the names that were previously listed above. Over the years I have developed the following rule that I sometimes like to call “Jensen’s Rule”, for obvious reasons. After a 50% gain in any one stock, I sell 10% of the original stake. If the stock doubles, I cash out 20% of the original stake and do the same if I am fortunate to have an equity that triples. I now have a guaranteed gain and can let the remaining half of my position ride on the “house’s” money and likely become my next gargantuan winner.

It is not important that you adopt my exact strategy for taking profits in this area, but it is critical that an investor has a well-thought strategy they will follow come hell or high water. Developing a strategy when the sector is under pressure is not an optimal way to decide what to do. As Mike Tyson has famously said, “Everyone has a game plan, until they get hit in the face”. The more committed one is to a logical and thought out plan the more likely they will function well when an inevitable right hook from the market connects to the jaw.

Finally it is critical to spread one’s bets in the small biotech space across a wide swath of focus areas like Hepatitis B & C, cancer, Alzheimer’s, diseases and conditions treated with orphan drugs, etc… and not catch up too much in the latest trend that might be hot at the moment. A perfect example of this is how hot the immune-oncology or “CAR-T” craze was until recently. Stocks in this space like Juno Therapeutics (NASDAQ: JUNO), Kite Pharma (NASDAQ: KITE) and ZIOPHARM Oncology, Inc. (NASDAQ: ZIOP) have been smoking until lately when some of the air started to come out of this bubble.

This area holds great promise, but both Juno and Kite have been awarded multi-billion market valuations with any kind of possible earnings years and years down the road if ever. ZIOPHARMA is a stock I have recommended here on Investors Alley since it is was trading at $3.00 a share. As per the strategy outlined earlier I have sold half my position in three separate transactions and now am letting the remaining half ride on the “house’s” money.

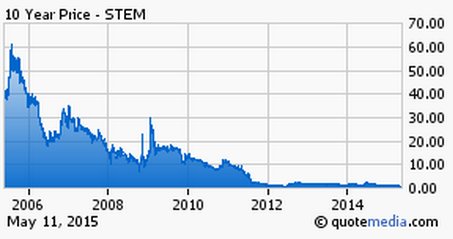

Investors may want to temper their enthusiasm whenever a new hot trend appears in biotech. For example in the mid-2000s stem cell research was all the rage led by the appropriately named StemCells (NASDAQ: STEM). This company once sported a market capitalization north of $6 billion and now is worth less than $100 million in the market as the only thing the company has been successful at over the last decade is raising money via equity offerings. The chart below should be a cautionary tale and why “shotgun investing” is the way to invest in this very volatile but potentially extremely lucrative area of the market.