Michigan Consumer Sentiment: February Preliminary Rises

The University of Michigan Preliminary Consumer Sentiment for February came in at 99.9, up 4.2 from the January Final reading of 95.7. Investing.com had forecast 95.4.

Surveys of Consumers chief economist, Richard Curtin, makes the following comments:

Consumer sentiment rose in early February to its second highest level since 2004 despite lower and much more volatile stock prices. Even among households in the top third of the income distribution, the Sentiment Index rose to 112.8, the highest level since the prior peak of 114.2 was repeatedly recorded in 2007, 2004, and 2000. Stock market gyrations were dominated by rising incomes, employment growth, and by net favorable perceptions of the tax reforms. Indeed, when asked to identify any recent economic news they had heard, negative references to stock prices were spontaneously cited by just 6% of all consumers. In contrast, favorable references to government policies were cited by 35% in February, unchanged from January, and the highest level recorded in more than a half century. In addition, the largest proportion of households reported an improved financial situation since 2000, and expected larger income gains during the year ahead. To be sure, higher interest rates during the year ahead were expected by the highest proportion of consumers since August 2005. Consumers also anticipated a slightly higher inflation rate, although the year-ahead inflation rate has remained relatively low and unchanged for the past three months. Purchase plans have been transformed from the attraction of deeply discounted prices and interest rates that outweighed economic uncertainty, to being based on a sense of greater income and job security as the fewest consumers in decades mentioned the favorable impact of low prices and interest rates. Overall, the data signal an expected gain of 2.9% in real personal consumption expenditures during 2018. [More...]

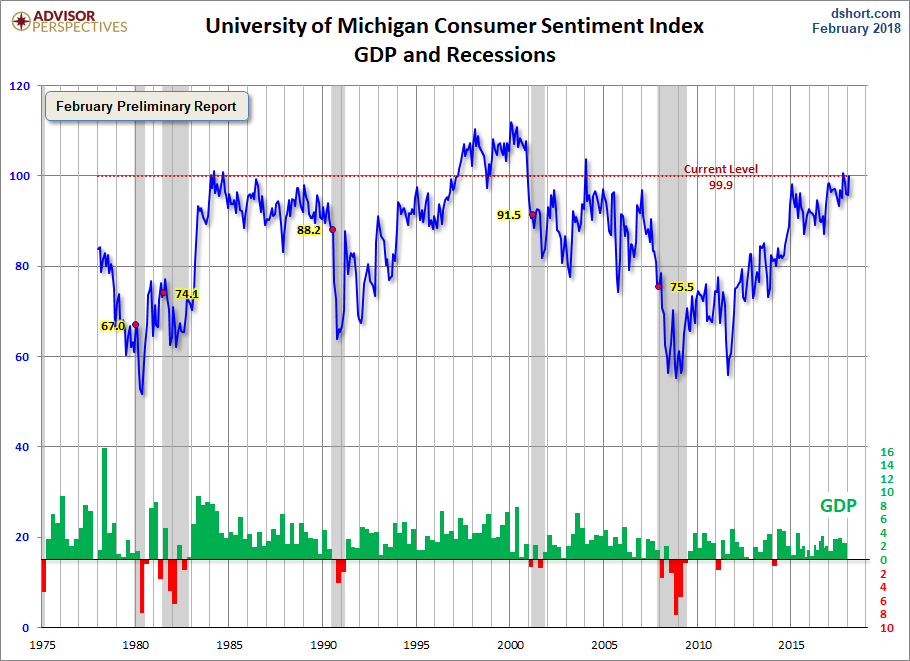

See the chart below for a long-term perspective on this widely watched indicator. Recessions and real GDP are included to help us evaluate the correlation between the Michigan Consumer Sentiment Index and the broader economy.

To put today's report into the larger historical context since its beginning in 1978, consumer sentiment is 16.4 percent above the average reading (arithmetic mean) and 17.8 percent above the geometric mean. The current index level is at the 90th percentile of the 482 monthly data points in this series.

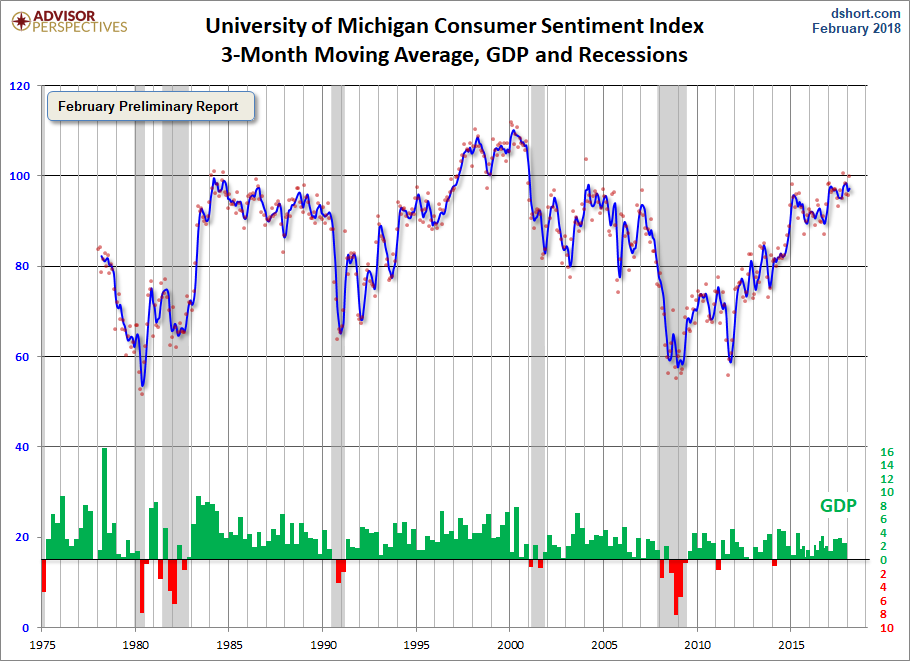

Note that this indicator is somewhat volatile, with a 3.0 point absolute average monthly change. The latest data point saw a 4.4 percent change from the previous month. For a visual sense of the volatility, here is a chart with the monthly data and a three-month moving average.

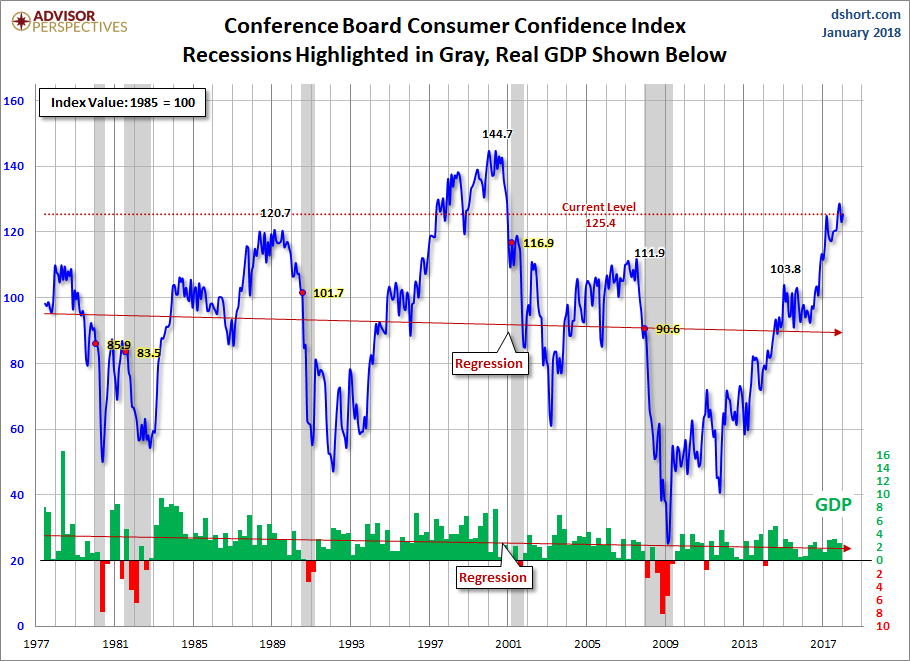

For the sake of comparison, here is a chart of the Conference Board's Consumer Confidence Index (monthly update here). The Conference Board Index is the more volatile of the two, but the broad pattern and general trends have been remarkably similar to the Michigan Index.

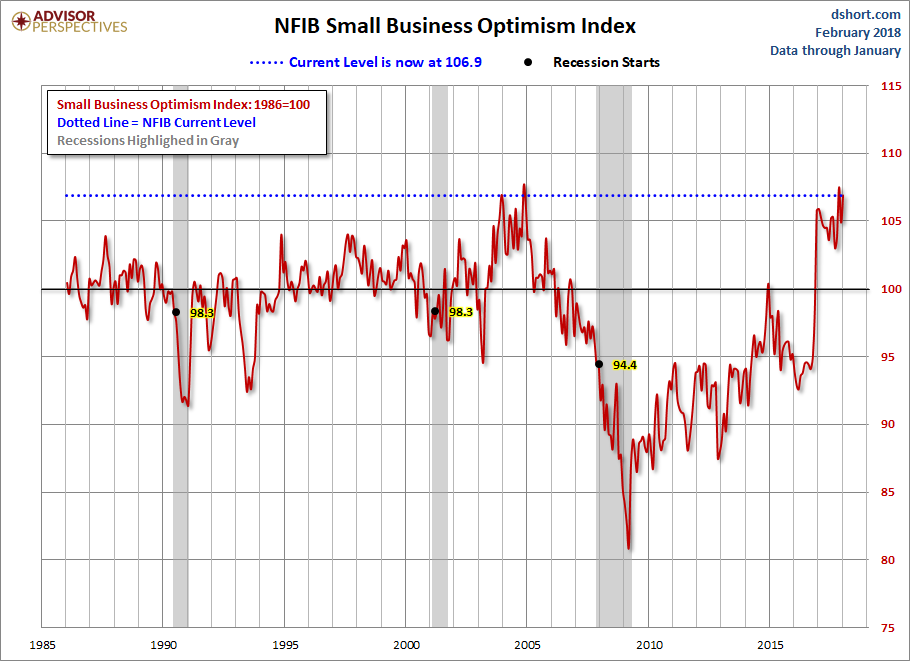

And finally, the prevailing mood of the Michigan survey is also similar to the mood of small business owners, as captured by the NFIB Business Optimism Index (monthly update here).

The general trend in the Michigan Sentiment Index since the Financial Crisis lows has been one of slow improvement.The survey findings since December 2015 saw gradual decline followed by a bounceback later in the year.

Disclosure: None.