Market Valuations Remain "Normal"

We now calculate that 48.83% of the stocks we can assign a valuation are overvalued and 16.16% of those stocks are overvalued by 20% or more. These numbers have increased-- slightly-- since we published our valuation study in July-- when the overvaluation was at 46%.

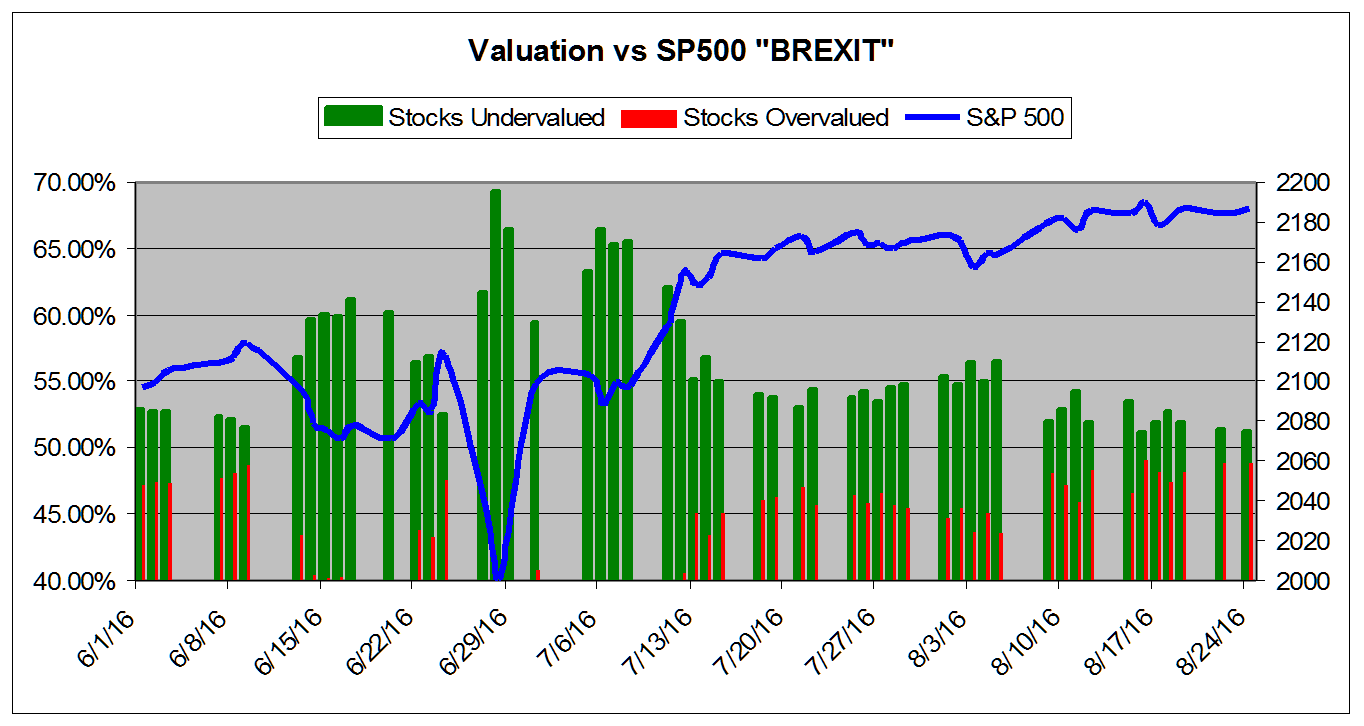

The markets in the U.S. and elsewhere certainly shook off that Brexit panic, with several indices setting new records throughout this Summer. The word now is "melt up" with many of the more bullish analysts arguing that as investors return from their Summer vacations and buckle down again in Fall, we may find more money coming into the market.

The optimists, as always, are facing off against those bears, who claim that this is all a bubble and once the Fed raises rates again the party will be over. Of course, those bears have been pushing that line throughout this historic rally. And if you had followed their advice at pretty much any time over the past seven years, you would have done the wrong thing for your long-term financial health.

We remain, as we have throughout the aftermath of the Bush recession, convinced that the Fed should refrain from further action not to provide additional aid to the stock market, but to help US workers. Their dual mandate demands that inflation be controlled--it is--and "full employment" be achieved.

That second part of the equation is where we have controversy. The official rate is currently @5%. But, we do not see the sort of wage increases and pressures one would expect if the labor market was tight. We do not think that rates should be increased until we see workers sharing in the prosperity.

While some Fed officials may desire to boost rates again before the end of 2016, we still believe that this will be difficult. We have a presidential election, a bad time to be seen as "political." We also have continued questions about both global and US economic growth. A trifecta of bad news has challenged the Fed--first in China, the the EU with Brexit, and then due to continued questions about the US overall GDP-growth rate.

Currently, futures contracts indicate that most investors remain doubtful that the US central bank will raise rates in September or November. And, for the last chance in December investor think the odds are still @50-50.

For now, our valuation figures still show a "normal" market, with valuations that remain nowhere near the bargain level they indicated in the immediate aftermath of the Brexit vote in June.

The chart below tracks the valuation metrics so far this Summer. It encompasses the Brexit sell off. It shows levels in excess of 40%.

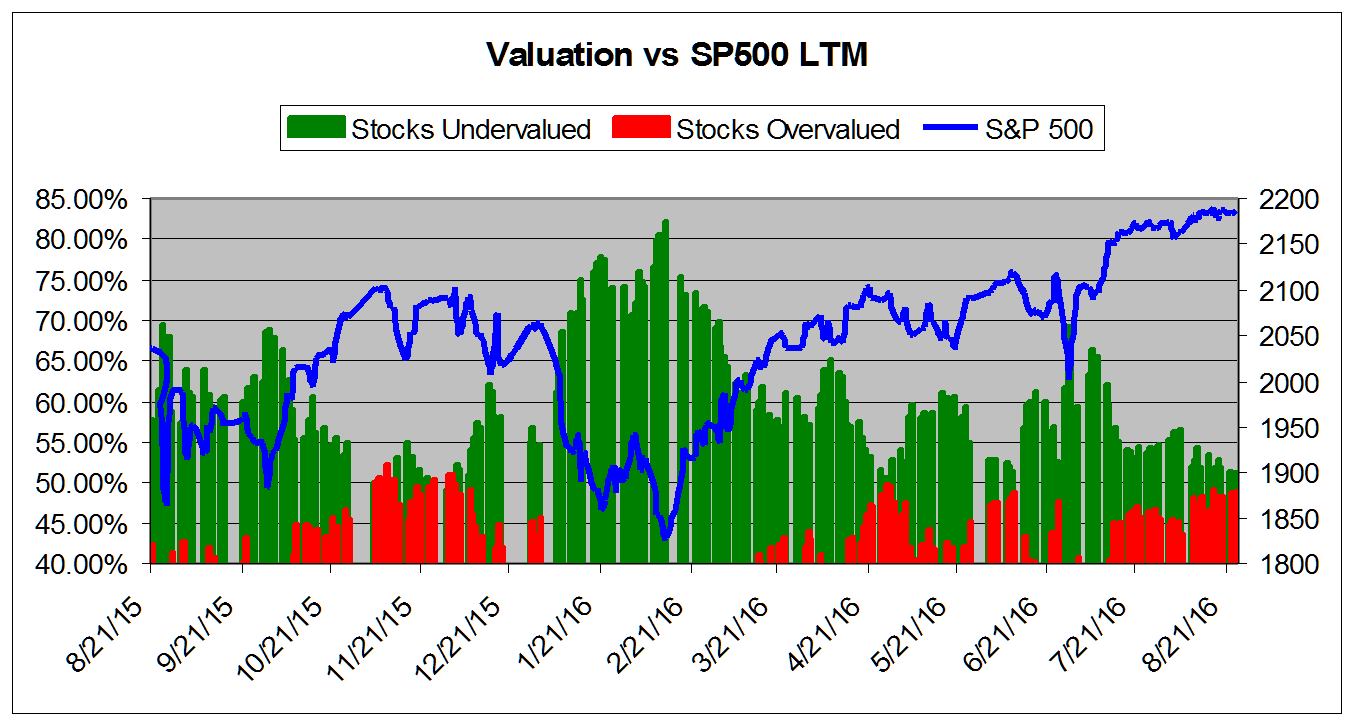

The chart below tracks the valuation metrics from August 2015. It shows levels in excess of 40%.

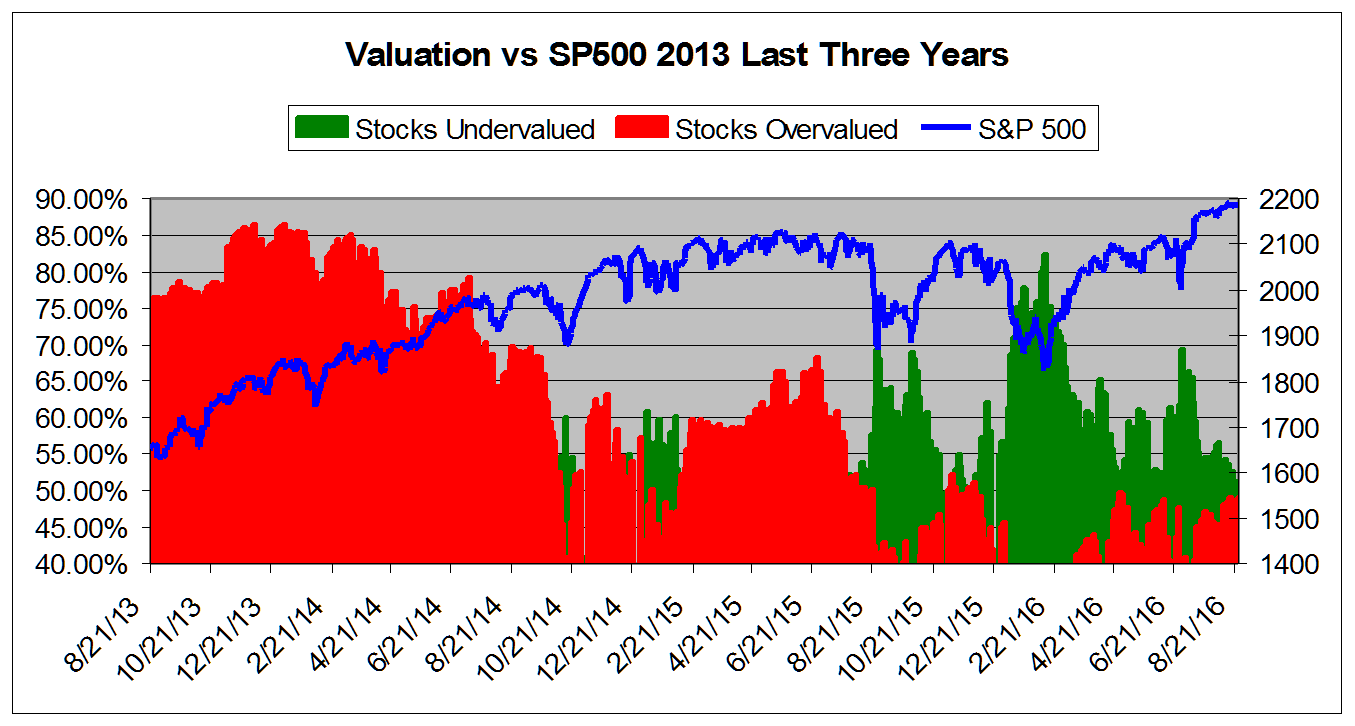

This chart shows overall universe over valuation in excess of 40% vs the S&P 500 from August 2013

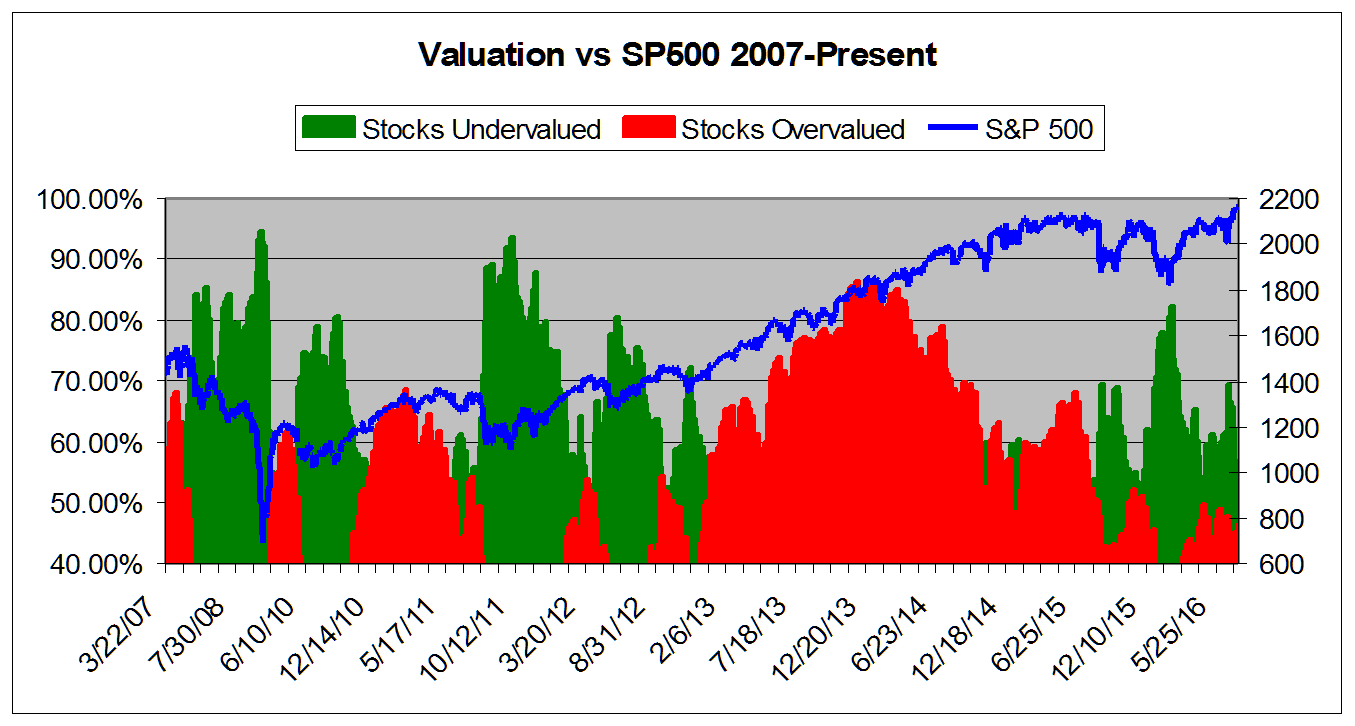

This chart shows overall universe under and over valuation in excess of 40% vs the S&P 500 from March 2007*

*NOTE: Time Scale Compressed Prior to 2011.

Market Overview

|

Summary of VE Stock Universe |

|

|

Stocks Undervalued |

51.17% |

|

Stocks Overvalued |

48.83% |

|

Stocks Undervalued by 20% |

20.74% |

|

Stocks Overvalued by 20% |

16.16% |

Sector Overview

|

Sector |

Change |

MTD |

YTD |

Valuation |

Last 12-MReturn |

P/E Ratio |

|

Multi-Sector Conglomerates |

0.27% |

2.71% |

10.24% |

12.74% overvalued |

10.14% |

20.84 |

|

Consumer Staples |

0.19% |

1.81% |

11.14% |

9.57% overvalued |

16.04% |

24.96 |

|

Basic Materials |

-0.05% |

1.03% |

50.65% |

8.93% overvalued |

64.65% |

32.83 |

|

Industrial Products |

0.45% |

3.27% |

16.78% |

7.41% overvalued |

13.78% |

23.21 |

|

Utilities |

-0.10% |

-2.53% |

10.98% |

3.07% overvalued |

17.19% |

22.21 |

|

Aerospace |

0.03% |

0.28% |

-1.23% |

2.89% overvalued |

4.19% |

19.37 |

|

Oils-Energy |

0.68% |

3.31% |

17.38% |

2.77% overvalued |

2.98% |

25.18 |

|

Computer and Technology |

0.32% |

3.11% |

14.83% |

2.36% overvalued |

13.79% |

29.38 |

|

Finance |

0.24% |

2.02% |

6.67% |

0.09% overvalued |

8.11% |

16.19 |

|

Construction |

0.90% |

1.00% |

30.67% |

0.35% undervalued |

16.44% |

21.46 |

|

Consumer Discretionary |

0.27% |

2.05% |

9.74% |

0.55% undervalued |

4.26% |

24.25 |

|

Transportation |

0.54% |

1.20% |

11.91% |

3.67% undervalued |

-9.60% |

15.17 |

|

Business Services |

0.47% |

1.17% |

15.00% |

5.29% undervalued |

4.34% |

24.76 |

|

Retail-Wholesale |

0.54% |

3.25% |

3.84% |

7.67% undervalued |

1.90% |

23.09 |

|

Auto-Tires-Trucks |

0.15% |

2.27% |

4.51% |

8.50% undervalued |

7.47% |

16.41 |

|

Medical |

0.25% |

-0.04% |

1.37% |

8.65% undervalued |

-8.79% |

27.75 |

Disclaimer: ValuEngine.com is an independent research provider, producing buy/hold/sell recommendations, target price, and ...

more