July 2018 Trade Exports Decline

Trade data headlines show the trade balance worsened from last month - and export rate of growth declined.

Analyst Opinion of Trade Data

The data in this series wobbles and the 3 month rolling averages are the best way to look at this series. The 3 month averages are declining for exports and improving for imports. The trade balance worsened.

Note that the headline numbers are not inflation adjusted.

Even though headline exports declined this month - there is little evidence of a trade war in the data.

- Imports of goods were reported up - import goods growth has positive implications historically to the economy. Econintersect analysis shows unadjusted goods (not including services) growth accelerated 5.7 % month-over-month (unadjusted data) - up 12.9 % year-over-year (up 8.6 % year-over-year inflation adjusted). The rate of growth 3-month trend is accelerating (rate of change of growth is accelerating).

- Exports of goods were reported down, and Econintersect analysis shows unadjusted goods exports growth acceleration of (not including services) 0.4 % month-over month - up 9.3 % year-over-year (up 5.0 % year-over-year inflation adjusted). The rate of growth 3-month trend is decelerating.

- The decline in seasonally adjusted (but not inflation adjusted) exports widespread but obviously agriculture products. Import improvement was due to capital goods.

- The market expected (from Nasdaq / Econoday) a trade balance of $-51.2 B to $-44.8 B (consensus $50.2 B billion deficit) and the seasonally adjusted headline deficit from US Census came in at $50.1 billion.

- It should be noted that oil imports were up 6 million barrels from last month, and up 5 million barrels from one year ago.

- The data in this series is noisy, and it is better to use the rolling averages to make sense of the data trends.

The headline data is seasonally but not inflation adjusted. Econintersect analysis is based on the unadjusted data, removes services (as little historical information exists to correlate the data to economic activity), and inflation adjusts. Further, there is some question whether this services portion of export/import data is valid in real time because of data gathering concerns. Backing out services from import and exports shows graphically as follows:

Growing exports is a sign of an expanding global economy (or at least a sign of growing competitiveness).

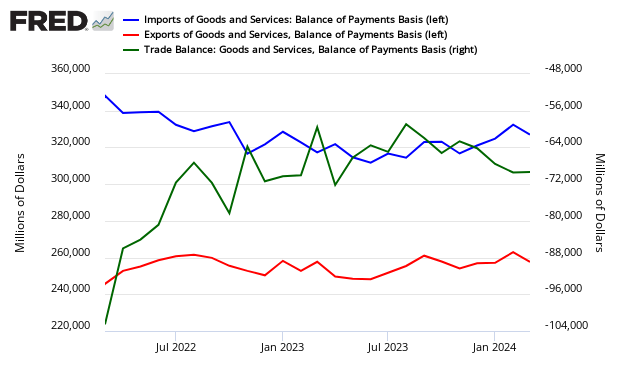

Seasonally Adjusted Total Imports (blue line), Exports (red line) and Trade Balance (green line)

Econintersect is most concerned with imports as there is a clear recession link to import contraction. Adjusting for cost inflation allows apples-to-apples comparisons in equal value dollars between periods. The graph below uses seasonally adjusted data.

Seasonally and Inflation Adjusted Year-over-Year Change Imports (blue line) and Exports (red line)

Note: In general this is a rear view look at the economy - however, imports do have a forward vision of up to three months ahead of expected economic activity.

Caveats on Using this Trade Data Index

The data is not inflation adjusted. Econintersect applies the BLS export - import price indices to the data to adjust for inflation - total exports, total imports, and imports less oil. Adjusting for cost inflation allows apples-to-apples comparisons in equal value dollars between periods.

Although Econintersect generally disagrees with the seasonal adjustment methodology of U.S. Census, in general, this methodology works for this trade data series as the data is not as noisy as other series. Another positive aspect of this series is that backward revision has usually been very minor.

Econintersect determines the month-over-month change by subtracting the current month's year-over-year change from the previous month's year-over-year change. This is the best of the bad options available to determine month-over-month trends - as the preferred methodology would be to use multi-year data (but the New Normal effects and the Great Recession distort historical data).

Oil prices, and also quantities of imported oil, wobble excessively year-over-year and month-over-month. In 2010, the percent of oil imports varied between 10.4% and 14.6% of the total. In 2008 the variance was between 11.5% to over 20%. No amount of adjusting - short of removing oil imports from the analysis - allows a clear picture of imports.

An improving trade balance historically is a sign of a slowing economy.

Disclosure: None.