Has The Rebound In US Consumer Spending And Income Peaked?

Most economic measures continue to paint an upbeat profile for the US, but yesterday’s September report on consumer spending and income hints at the possibility that softer growth is approaching. There’s still no clear sign of rising recession risk on the immediate horizon, but it’s reasonable to wonder if the surge in economic activity following Donald Trump’s election two years ago is now in the process of reversing and giving way to a lesser rate of expansion.

One school of thought for explaining a possible slowdown: the previous round of tax cuts that juiced the economy are beginning to fade. Add to that the ongoing risk of the current trade war between the US and China, which could get worse, and the Federal Reserve’s plans to keep raising interest rates and it’s clear that the macro headwinds are blowing harder.

The stock market is certainly discounting a higher risk of trouble these days. The S&P 500 Index continued to fall in Monday’s trading, slumping to the lowest close since early May.

“Changes in stock prices can have an adverse effect on spending, at least in the short-term,” advised Joseph LaVorgna, chief economist for the Americas at Natixis, in a research note last week. “If the recent market swoon persists, consumer spending could slow over the next few months with negative effects on retail sales and GDP growth.”

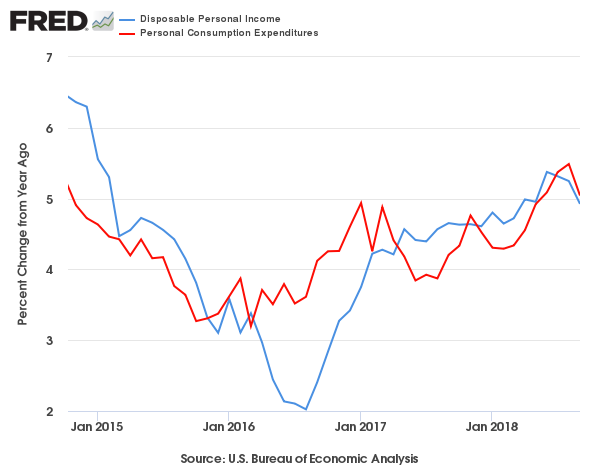

Slightly slower growth is on display in the latest release for personal spending and income. The year-over-year changes on both counts eased in September, according to the Bureau of Economic Analysis. Personal consumption expenditures downshifted to a 5.0% annual pace from 5.5% in the previous month while disposable personal income grew 4.9% vs. the year-earlier level, the second month of slightly softer increases. It could be noise, of course, but for the moment it’s reasonable to consider the possibility that the recent revival in the consumer sector has peaked.

True, the latest annual increases still align with a healthy trend, which suggests that the nine-year-old economic expansion will roll on for the near term. But yesterday’s results add more weight to the view that the Trump rebound has run its course and that something approximating a “normal” rate of growth – read slower – is coming.

That’s certainly the message in the Atlanta Fed’s preliminary estimate for GDP growth in the fourth quarter. The bank’s GDPNow model yesterday (Oct. 29) projected that output will rise by a modest 2.6% in Q4, well below Q3’s 3.5% and Q2’s 4.2%. It’s still too early in the current quarter to take that nowcast seriously, but it’s fair to say that there’s a case for expecting economic deceleration to roll on until new numbers tell us otherwise.

“We think U.S. growth may have just peaked,” says Michael Gapen, chief US economist for Barclays Capital. He advises that consumer and government spending is on track to slide in the coming months. A key factor: the fading support from income-tax cuts.

To be sure, expectations of a slowdown still leave room for a moderate expansion to roll on into next year. Fears of a new recession, in short, are still premature, at least for now, based on the recent business-cycle profile.

Meantime, all eyes will focus on this Friday’s employment report for October for an update. At the moment, the outlook is encouraging. Econoday.com’s consensus forecast calls for a solid rebound in private-sector jobs growth via a 180,000 gain, up sharply from a 121,000 rise in September. If the estimate is right, the year-over-year trend for private payrolls will increase by 1.9% — a tick below September’s 2.0% gain (a two-year high), but still strong enough to deflect any concern that a downturn is imminent.

Alternatively, if Friday’s numbers disappoint, the crowd may assume the worst. For an early hint of what may be in store at the end of the week keep an eye on tomorrow’s ADP Employment Report for October. Economists are looking for a softer gain in US private employment via this estimate: a 178,000 increase, according to Econoday.com’s consensus forecast, down from September’s strong 230,000 advance. But that’s enough to keep the year-over-year trend for the ADP numbers growing at a healthy rate of nearly 2.0%.

In short, if the consensus outlook prevails this week for October payrolls, the economic outlook will remain upbeat.

Disclosure: None.