Forget Beaten Up Utilities, Buy This 7.1% Clean Energy REIT

Summary

- My attraction with utility stocks is related to the sustainable attributes that make the defensive asset class virtually recession proof.

- It’s important to understand that HASI is a REIT but it’s really considered more of an investor in clean energy assets.

- HASI has an attractive portfolio of assets that are 97% investment grade.

- HASI is clearly not a utility stock but I believe the financier of clean energy is a sound sector with similarly reliable attributes.

- I am recommending shares at the current price level and I believe a big part of the discounted valuation is reflected in the modest coverage (investor) base.

Earlier this week I wrote about a utility stock called Connecticut Water (NASDAQ:CTWS) and while I have been searching to add a few utilities to my dividend portfolio, it's become a disenchanting task. It seems that this low-risk sector has become a bit frothy and as investors have become fixated on safe income-paying companies with sustainable and growing dividends.

Most utility investors favor regulated stocks, whose returns are set by law, versus companies with exposure to the unregulated sector. As I mentioned in my recent article, I took a small stake in CTWS hoping to begin a dollar-cost averaging strategy in hopes that this most predictable dividend payer would move into a fair value range (of around 17x price to earnings). CTWS closed at $36.11 with a 2.9% dividend yield.

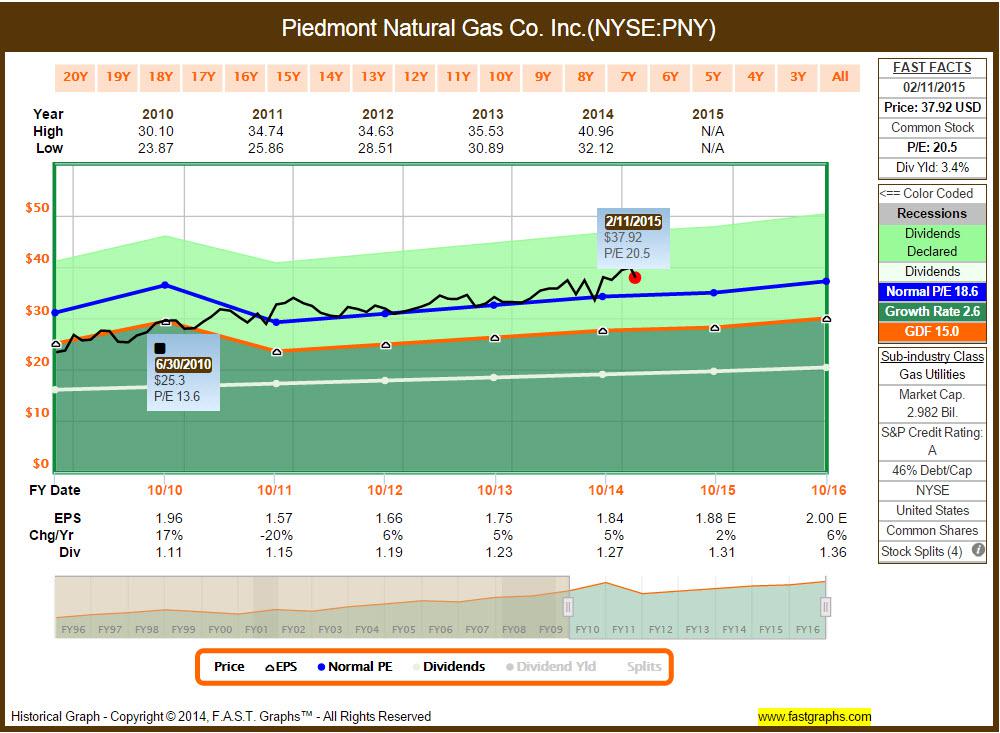

Click on picture to enlarge

Scanning the utility landscape, I also looked at Piedmont Natural Gas (NYSE:PNY). I pay the Carolina-based gas company a monthly check for natural gas service and I was hoping to become a shareholder so the 64 year-old company (commenced operations in 1951) would pay me. Unfortunately, this utility stock is no bargain: Shares are priced at $37.92 with a P/E multiple of 20.5x. PNY has a higher yield (3.4%) than CTWS but I see no margin of safety.

Continue reading this article here.

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor ...

more