DJIA Price Still Has A Long Way To Rise.

The Perspective of a Starting Point is Critical

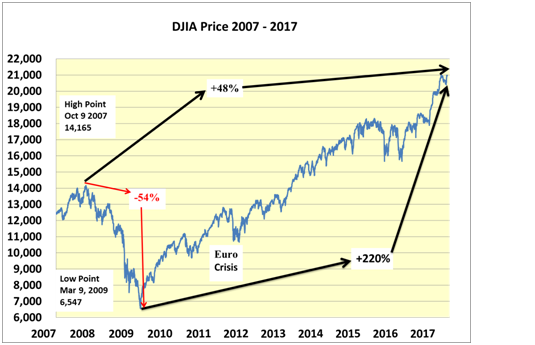

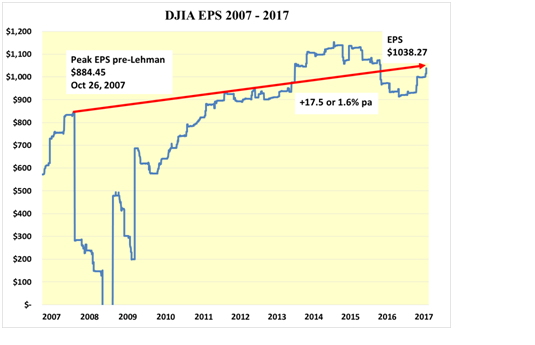

On March 9, 2009 the price of the DJIA closed at 6,547. Using that as the starting point of this bull market it is understandable why nervousness abounds with the price today up 220% at 20,941, with no improvement of a corresponding magnitude in the fundamentals. However, it can be argued that the post-Lehman collapse was greatly overdone.

From the perspective of the pre-Lehman peak of 14,165 on October 9, 2007, the last time that the price was vaguely in equilibrium with the dividend discount value, the price of the DJIA has risen by only 48% or 4.3% per annum, a much more tempered pace.

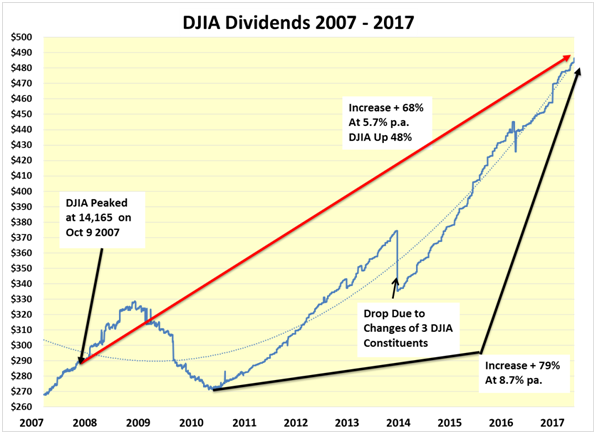

Over the same period the dividend of the DJIA has risen by 68% while the yield on the 30 year T bond has fallen from 4.87% to 2.95% pushing up the price of the bond up 65%.

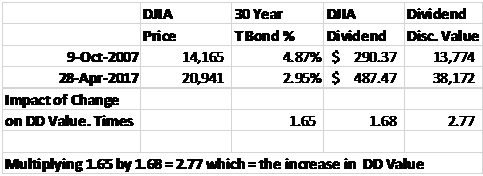

Dividends Up, Bonds Up, Raising Dividend Discount Value to 38,172

At 38,172 the dividend discount value of the DJIA remains at a substantial premium to its price of 20,941. Thus the pressure on the DJIA price remains decidedly up which should continue a considerable time.

The dividend discount value of the DJIA is function of two main vectors, the aggregate dividend of its constituents and the yield of the U.S. 30 year T Bond.

Since October 9, 2007, the dividend of the DJIA has risen 1.68 times from $290.37 to a record $487.47 while the yield of the T Bond yield has fallen from 4.87% to 2.95% resulting in a 1.65 fold increase in the price of the 30 year T bond. The product of which changes is a 2.77 fold increase in the value of the DJIA to 38,172

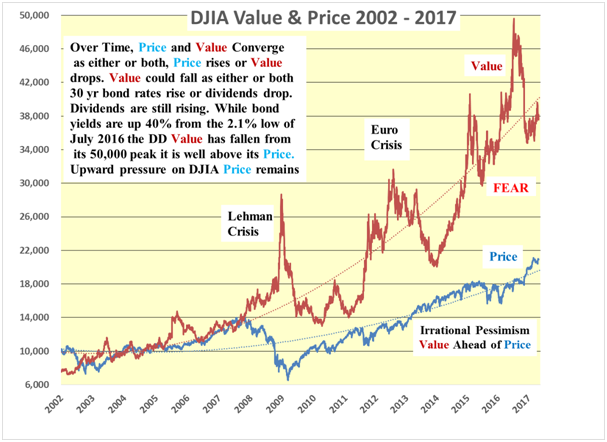

Comparing the Value of the DJIA with its Price

While previous reports looked at the longer term relation ship between the DJIA price and its value from 1981 to 2017 and showed the high correlation 0.93 between price and value up until Lehman, the chart below is a magnified version of the same chart from 2002 onward.

Although the price of the DJIA has yet to match its value post Lehman, the chart demonstrates how the pressure on the price has been continuously upwards towards value. This condition remains and should continue for some considerable time, unless the world wakes up to the extraordinary value available and buys the DJIA.

DJIA Record Dividend Considered Secure and Could Rise Substantially

DJIA earnings appear to have passed the nadir of last year’s earnings recession, attributed largely to the energy sector. This lends credence to the argument that the DJIA dividend, with its payout ratio of 47%, is safe and will probably rise further.

Where do we go from here?

Despite the huge increase in world’s monetary base it is almost as though the world has lacked leadership and direction other than to bail out the financial sector. It may be that the new leaders are attempting to focus on how to put to work all of the surplus money sloshing around the world. In the USA infrastructure spending on roads, bridges, dams, railways, pipelines and airports could lead to more corporate capital spending to expand the nation’s productive capability.

A particular case in point is the lack of available capacity in the domestic steel industry to meet the demand for pipelines. Enforcement of the “Buy America” plan will take time to build domestic pipe capacity but it will come eventually. The same may be true of other industries to meet the requirements of other infrastructure projects. If domestic capacity is unavailable it is unlikely to materialize overnight.

Some corporations such as Tesla are building new plants but these would only appear to be the advance guard of what could be an avalanche of investment construction that normally takes over from autos and housing to prolong the economic cycle.

Infrastructure projects take time to approve, fund and start as well as a great deal of time to complete. There now appears to be a recognition of the need for renewal and some states such as New York are already advertising that they are moving forward. This points to many years ahead of serious capital spending for which the Fed has done its part in creating the monetary base required. It is now up to the leaders to set this juggernaut into motion.

Over and above the potentially massive and long-lived benefits of infrastructure renewal could be a near-term boost from the successful passing of the proposed Trump tax reductions and reforms, which should trigger further substantial increases in the DJIA earnings and dividend. Hence, one of the two vectors in the dividend discount model is seen as stable to higher. The other vector, the direction of the 30 year T bond yield, is still expected to range 15 bps either side of 3%.

There is no desire on the part of the Fed to raise rapidly short term interest rates and tip the economy into a recession, particularly after such a disappointing first quarter of 2017. In fact while the Fed is talking about further modest increases in the Funds rate the monetary base has been expanding after its contraction in the second half of 2016.

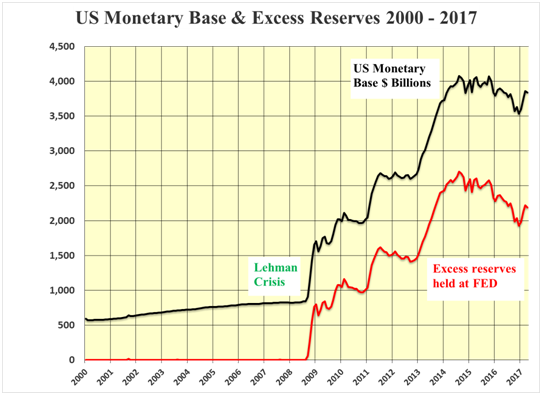

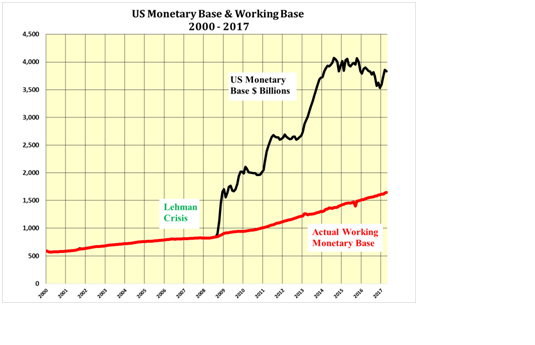

U.S. Monetary Base rising again, pulling down Price of Money.

In the Forex market this is the price of the U.S. dollar and in the domestic market the yield of the 30 year bond.

The quantitative easing of the U.S. monetary base between 2008 and the third quarter of 2014 held both the 30 year T bond yield and the U.S. dollar down. Thereafter, the dollar rose as European and Japanese quantitative easing gathered pace. This was compounded in the latter part of 2016 with a substantial contraction of the U.S. monetary base, which led to a further strengthening of the U.S. dollar to the point where a great deal of concern was voiced about the negative impact on the U.S. economy.

In the first quarter of 2017 the concerns seem to have been taken to heart and the monetary base has once again started to expand with the U.S. dollar moving back to parity and below.

Despite the rise in both the monetary base and the excess reserves held at the Fed, the actual working monetary base is still rising which is probably a major reason why the 30 year T bond rate remains as expected within 15 bps of 3.00%.

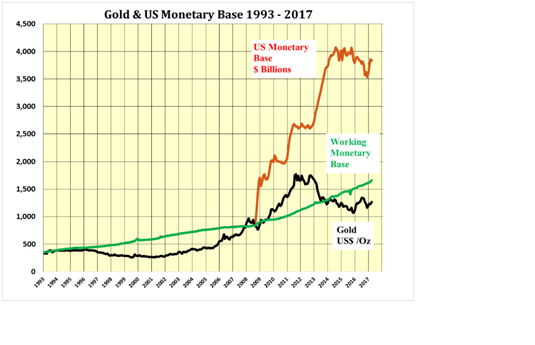

Gold at US$1,600 per ounce still possible this year

During the first decade of the millennium it appeared as though the gold price was strongly influenced by the rapidly increasing total U.S. monetary base. However, by 2012 it became clear that the bulk of the newly created money was being stashed away in the form of excess reserves at the Fed. The price of gold retreated to the Actual Working Monetary Base AWMB. While the price of gold is influenced by many other factors the amount of money appears to be the major factor. In this case the AWMB rather than the total monetary base. As such it appears that the price of gold should move back above the US$1,600 per ounce level, possibly this year.

more

Comments

No Thumbs up yet!

No Thumbs up yet!