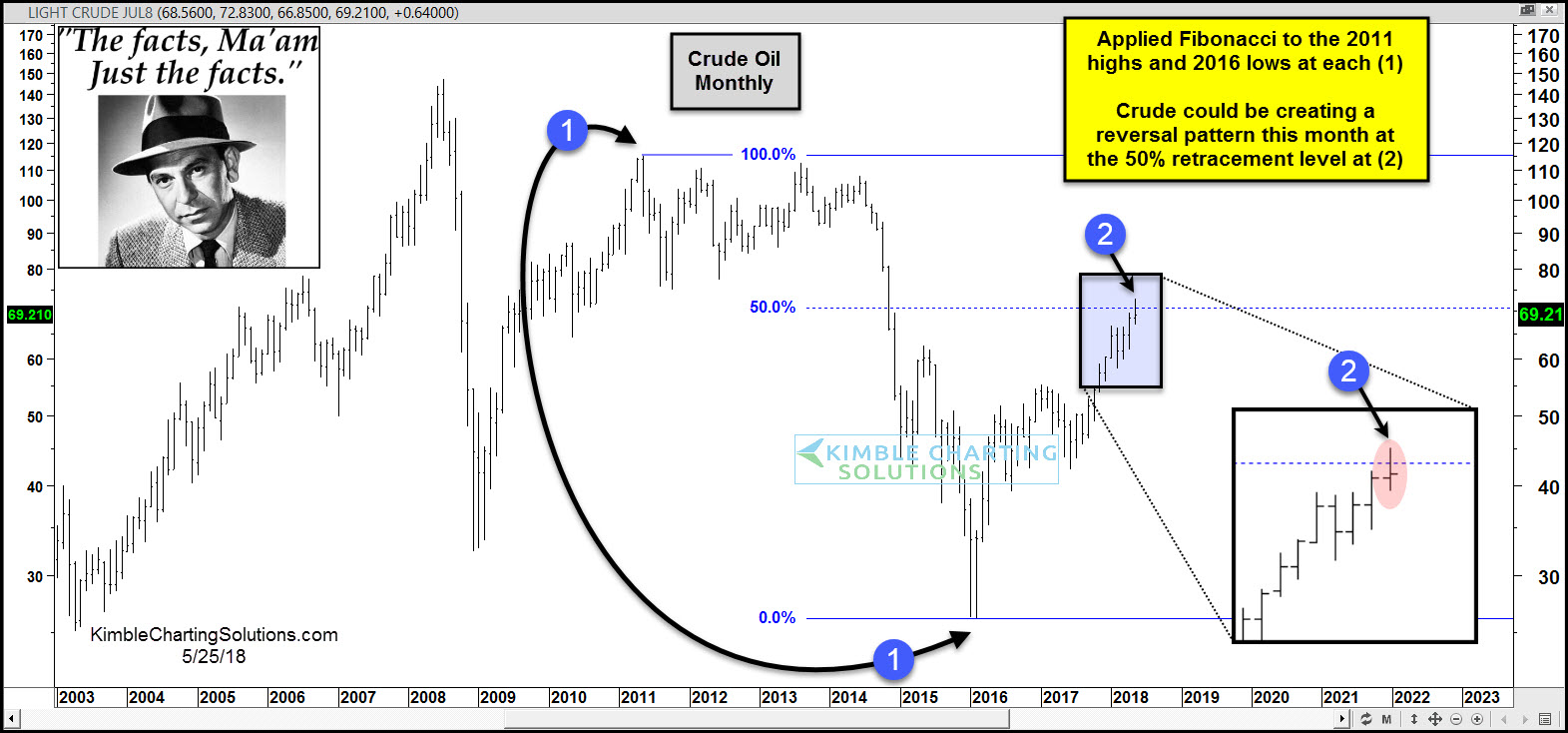

Crude Oil Suggesting Interest Rates Could Be Peaking, Says Joe Friday

(Click on image to enlarge)

Joe Friday suggested that Crude Oil could be peaking in the chart above first shared on 5/25/18, as Crude was testing its 50% retracement level at (2). Weakness in Crude of late has it down near 20% from recent highs. Crude is one of the most important commodities on the planet and big moves in it can ripple into other assets.

Below looks at a chart of Crude Oil and the Yield of the 10-year note:

(Click on image to enlarge)

Sometimes Crude Oil and the yield on the 10-year note have declined together over the past 13-years at each (1). Crude Oil weakness of late has it breaking 3-year support at the top of a rising channel at (2).

Joe Friday Just The Facts Ma’am- The yield on the 10-year note is kissing the underside of 10-year resistance at (3). Further weakness in Crude could be suggesting that interest rates are near an important peak, where a decline in rates could start.

Sign up for Chris's Kimble Charting Solutions' email alerts--click here.

Comments

No Thumbs up yet!

No Thumbs up yet!