COT Blue: Biggest Warning Yet

The problem, or one of them anyway, with so many glaring market warnings is that it becomes difficult to keep up with all of them. You tend to focus on those right in front of you, the more immediate and visible. Oil is everything for reflation, and therefore its untimely end, so naturally the WTI curve gets all the unlovable love.

And while we pay a lot of attention to the yield curve, there is less emphasis on some of the mechanics behind it. The Treasury futures market sort of runs the place, but it isn’t always a straightforward process from which to drive analysis.

What we do know is that December has been a total disaster. In the stock market, of all places, the S&P 500 entered the month on an upswing. The initial liquidation that began like WTI after October 3 by the last stretches of November seemed to be under control. The index had rallied back almost to 2800 by December 3.

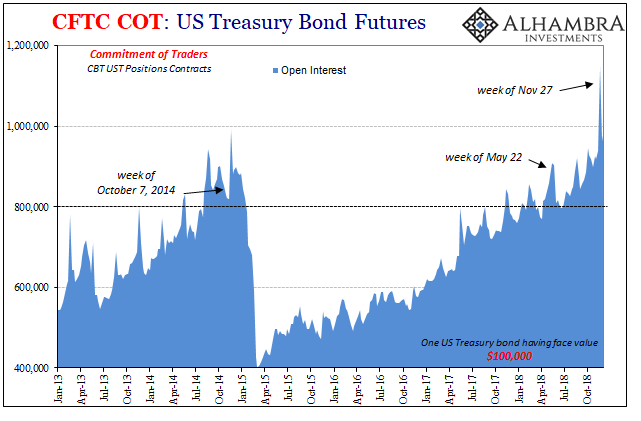

It’s now down almost 10% in just a few weeks, more importantly setting a new low for the year (lower lows). While that has surprised many, the Treasury futures market issued up what might have been the biggest warning yet the last week in November.

One of the odd aspects of UST futures is the futures contracts themselves. I don’t mean their technical specs, rather how they are sometimes used. I wrote near the start of this year about the curious interest over open interest.

Compared to a lot that goes on in these kinds of markets, especially where derivatives like these are concerned, this one’s pretty simple and intuitive. Open interest goes up when markets aren’t very sure about what’s in the future. Since UST’s are the settlement product for a variety of shadow trades, especially derivative FX, what’s being hedged here isn’t really UST yields or the US government’s credit risk.

Treasury futures are a sort of catchall for general, nonspecific uncertainty. The more this one market gets busy the more we have to be on the lookout for bad stuff. When open interest skyrockets, really bad stuff.

For the week of November 27, the CFTC reports that open interest in Treasury futures surpassed 1.1 million for the first time since the Asian flu in 1998. The last time the market had expanded to more seven-figure contracts? January through March 2008 – over a million right up until the week Bear failed.

Most people probably remember what happened after March 2008. Far fewer are likely aware of the summer in 1998. Lost amidst the otherwise dot-com bubble, that August (and September) was the most serious setback in it. Here’s how CNN described trading on the last day of that particular month:

Frantic selling pounded Wall Street Monday, sending the Dow industrials 512 points lower and the Nasdaq Composite into its worst one-day point loss in history as a global economic rout showed no signs of abating.

Sounds pretty familiar, doesn’t it? The “global economic rout”, or what today is called “overseas turmoil”, would spread and destructively push its way through Asia. That “flu” wasn’t really Asian, it was just where the disease caused the most problems. The specific symptom was a “rising dollar”, the malady itself eurodollar shortage.

The US economy at the time slowed precipitously, but fortunately for Alan Greenspan, it was actually robust and would skate by for a few more years (while corporate profits did not, thus bubble valuations). Jay Powell talks big like the “maestro” but this economy isn’t in the same league let alone ballpark.

But pieces of the Treasury futures market have been betting almost as he would want for them. The overall net contract position (long, which means short) has been moving decidedly back on the reflation side since August 2018 – especially after early September when the August payroll report came out with the illusion of the highest wage growth in a decade.

Before then, the aggregate positions, especially after the massive global collateral displacement at the end of May, were turning against the Fed; transposition for the end of reflation and the consequences (lower UST yields, for one thing) of a full arrival for Euro$ #4. Whether financial participants agreed with Powell or just agreed that Powell would agree with Powell isn’t clear.

The second week in December, however, the net position has reversed again. The CFTC won’t update the Commitment of Traders report for this week until Monday, but I’ll wage it shows a further collapse in it.

There have been times even in this market when it refers to the legend of Greenspan; the so-called Fed put in the Treasury market is more like fleeting visions of technocratic competence. Occasionally, people get to thinking these central bankers might actually have something. It has in the past usually involved shiny new programs that dazzle the imagination more than provide desperately required liquidity.

As I noted before, one of those instances was the first half of 2008. The market was enthralled by TAF auctions and dollar swaps without, it seems, really appreciating what those actually meant about the state of affairs. This was, as noted above, in stark contrast to the level of open interest.

It was, to be brief, a situation where even the Treasury futures market gave Bernanke the benefit of the doubt – he had been late to appreciate the danger, sure, but once awakened to it the Federal Reserve could possibly become effective through experimentation. The market finally came to its senses again by summer 2008 when it became clear the short run appearance of things getting better didn’t really equate to things getting better.

That does sound about the same as perhaps the past few months up until December. The wage data and unemployment rate might’ve given Powell some credibility with certain segments of the Treasury market (net short), but not the whole thing which grew more concerned (open interest) about all the other stuff Powell won’t talk about but reluctantly (“strong worldwide demand for safe assets”).

In a world of warnings, this one’s way back in the shadows because it relates more than anything visible to the intricate pieces contained and safely hidden within them. But it was a big one. When UST futures open interest gets near 1 million, bad things. Over 1 million? Buckle up.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more