China/Asia Economic Implosion On The Horizon?

Recent news of the US enacting $60 billion in economic tariffs on China as well as reactionary tactics from China have everyone spooked. The US stock markets and global markets tanked last week as this news hit the wires. We have been warning of a massive upside move in precious metals as well as global market concerns for the past 12+ months. Our recent research shows just how fragile the global markets are to external factors as well as strengths in the US and other established economies.

This multi-part special report will delve into the immediate and future risks that are associated with the fundamental and economic likelihoods of credit market contractions and economic rotations within the China, India, South East Asia markets in relation to recent news events. We hope to clearly illustrate the opportunities and risks that will likely play out over the next 12 to 48+ months for investors and traders. Let’s start by trying to keep it simple with some very clear examples of what has transpired over the past 4 to 5 years and how we believe things will change in the near future.

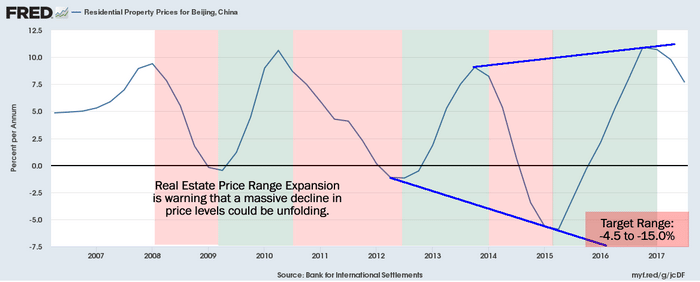

This chart of property price cycles (advancing price cycles vs. declining price cycles; highlighted for your convenience) in Beijing, China, clearly illustrates the expansion and contraction cycles experienced in the capital city/region of China. One can clearly see the expansion of the peaks vs. troughs as these price cycles have played out over the past 10 years.

What we find interesting about this chart is that the upper boundary appears to reside within the +8.5% or slightly greater expansion range, while the price contraction cycles continue to explore deeper and broader downside boundaries over this same range.

This leads one to consider the possibility that Real Estate prices and cycles in China may be much more speculative in nature than we may have considered in the past. It also points to the concept that the Global Credit Crisis (2008 through 2010) may have created a consumer mentality that wealth can be created by speculating on real property throughout these cycles.

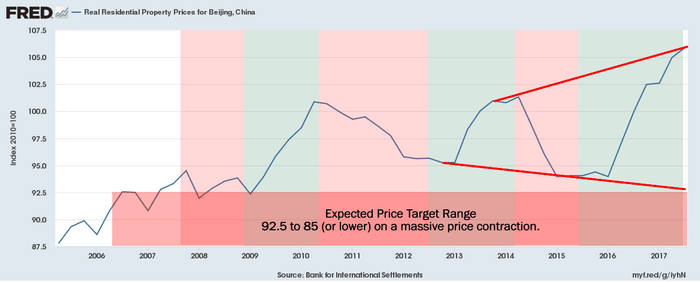

Additionally, we see some correlation to the real price valuations of Beijing property in the following chart. Any analyst can clearly see that prior to 2008, the rotational price levels were much narrower than after 2008 (roughly 2~3% in range vs. 7 to 15% in range). This volatility in pricing is one key factor that is leading us to our conclusion that the current downward price cycle (see the above chart) may lead to a substantially lower downside price target range in Beijing (and other areas of the world). Our analysis leads us to believe this early stage price rotation is an excellent opportunity for investors and traders to prepare for and begin to execute trades to attempt to profit from these events.

Recently, we posted an article regarding the massive increase in pre-foreclosures in most US metros. Our intent was to illustrate just how dynamically this price cycle is changing and to highlight the potential for investors to be prepared for a move. Our current research into the potential for a China/Asia market implosion is based on the assumption that the past years of easy money, quantitative easing, support for property markets across the globe and massive support for an expansion cycle are nearing an end event. If our analysis is correct, this end event cycle will present incredible opportunities for smart investors by attempting to capitalize on early and middle stage market events.

This current data, as shown above, clearly illustrates this price cycle event is very early in the rotational process and this presents a huge opportunity for investors. Our research team at Technical Traders Ltd. has been actively following these trends and global market indicators for years.

We specialize in developing advanced price modeling systems that assist us in determining what may happen in the future and we attempt to capitalize on these moves with our subscribers. These members ...

more