China RRR: Surprise But No Surprise

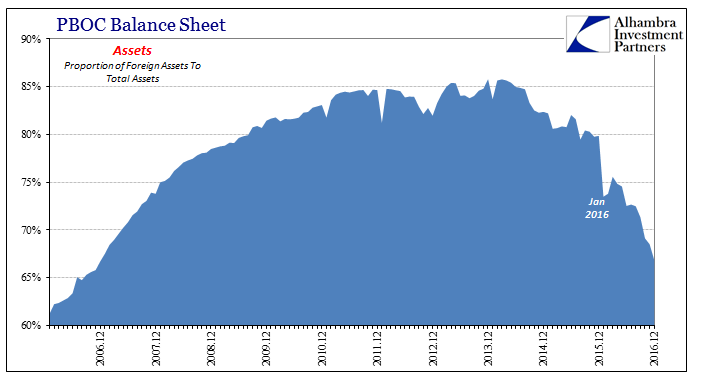

The amount of liquidity being added to the big Chinese banks has been astounding. The vast majority of it is coming from the PBOC itself. In July 2015, just before everything broke, PBOC funding of the Big 4 State-Owned Banks was less than RMB 100 billion. As of the latest figures for December 2016, it was RMB 1.17 trillion.

(Click on image to enlarge)

In the last six months of last year, total PBOC funding to these banks more than doubled. It has primarily been lent through the MLF, meaning funding in this manner is termed out, which should reduce pressure in the short-term money markets. The Chinese central bank had been heavy in this liquidity channel exclusively in 2016 in lieu of cuts to the rate of required reserves (RRR).

(Click on image to enlarge)

This has led to serious confusion in the mainstream as to what the PBOC is attempting to accomplish. The reason for that is primarily due to what appears to be inconsistent money market rates. With so much liquidity flowing through China’s version of the primary dealers, the media has been left to speculate that high money costs are the product of intentional policy, too. In offshore RMB markets, it has been suggested that monetary officials have been responsible for the ridiculous rates as a matter of speculators, trying to increase the costs of borrowing RMB in order to short CNH.

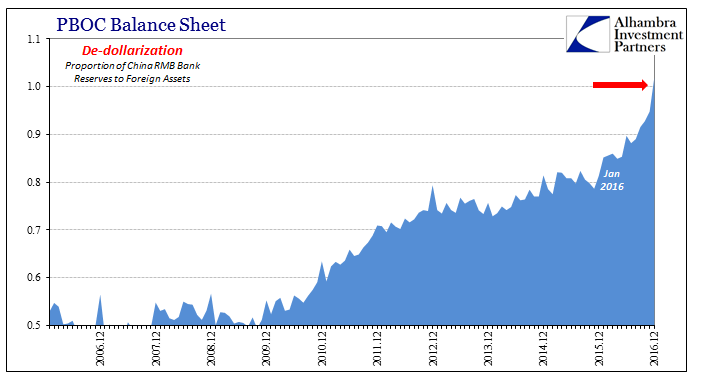

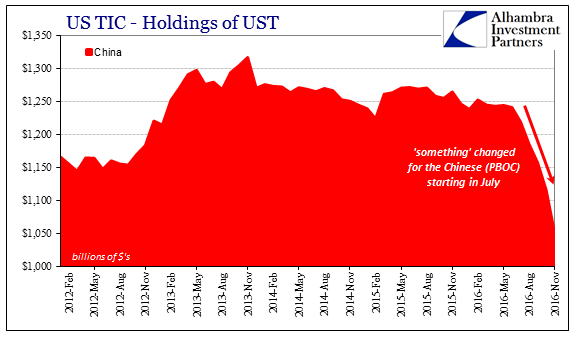

None of that is true. Despite massive RMB injections, truly outrageous proportions, it has been easily overwhelmed by “something” else. According to traditional orthodox economic doctrine, that “something” does not exist. Under the closed system approach, there is only China being China, therefore everything is attributed to the PBOC no matter how inconsistent, with explanations reverse engineered after the fact no matter how absurd that makes them.

In reality, the PBOC is growing desperate because of what the mainstream refuses to see and understand, even though it is literally included and stated on its balance sheet. I wrote two days ago (subscription required):

Given the steady to upward direction of CNY, it might propose that liquidity after end-of-year operations might be surprisingly bad. Sure enough, the overnight unsecured rate surged the past two days (including today). From a low of 2.10% four days ago, in the last two days alone the overnight rate has jumped by nearly 19 bps right back to about where it was before December 21.

Both unsecured and secured funding in onshore RMB took another bad turn this week, with the 1-day fixing repo rate surging even further to 2.72% yesterday and O/N SHIBOR above 2.37%. But that isn’t anything new, and it has been nearly a regular feature since August.

(Click on image to enlarge)

Because that is the same period where the PBOC has been most active in terms of funding through the big banks, it doesn’t seem to make sense. The RMB is flowing outward from the central bank, but money markets are increasingly starved of funds.

With the New Year holiday approaching, the PBOC stunned the mainstream by reducing the RRR for five of China’s largest banks today, and doing so by a full percentage point. The unconfirmed reports that I saw suggested this was only a temporary measure, in addition to another 28-day funding conduit that was just added for “major commercials”, but it doesn’t make any sense given the trillions in RMB already flowing unless you take account of that “something” else.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

The Chinese have a massive “dollar” problem that is beyond their capabilities to handle. And so the PBOC is left to try to fill the gap with what amounts to nothing more than growing desperation. They are printing fiat RMB to try to replace lost “dollars” but they just can’t keep up. The economics of the globe bear this out all-too-well, as I wrote earlier:

The major difference between the PBOC and the Fed is that the former has its “dollar” problem listed right on its balance sheet, while the latter denies there is even such a thing, or that such a thing is even possible. The Chinese are living the reality that the Fed will only ignore so long as it and its global orthodox kin are allowed to contemplate secular stagnation as an alternative explanation for that reality.

“Global turmoil” is supposed to have been past tense, something to concern historians studying what forced central bankers in 2016 to surrender rather than to concern them still in 2017 about downside risks that never drifted quite so far away. It certainly doesn’t make much sense if you are enthralled within “reflation” euphoria that is a touch less euphoric of late. And if that is the case, this is why. Nothing has changed except in many ways it might be worse.

Today’s RRR cut is neither a surprise nor is it inconsistent from the perspective of the whole PBOC balance sheet, where the “dollar” is perhaps at its most visibly disturbed.

(Click on image to enlarge)

Disclosure:

This material has been distributed fo or informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation ...

more