Central Bank Weekly: US Dollar Could Care Less About A March Hike

MARCH RATE HIKE ODDS HIT 100%, US DOLLAR FALLS ANYWAY

Rate hike odds for the Federal Reserve's March have hit 100%, but the US Dollar doesn't care. This may be evidence of a 'regime change' taking place in financial markets, as outlined earlier this week. Whatever the true reason may be, the fact is that traders are no longer looking at a more aggressive rate hike path from the Fed as a de facto positive for the greenback.

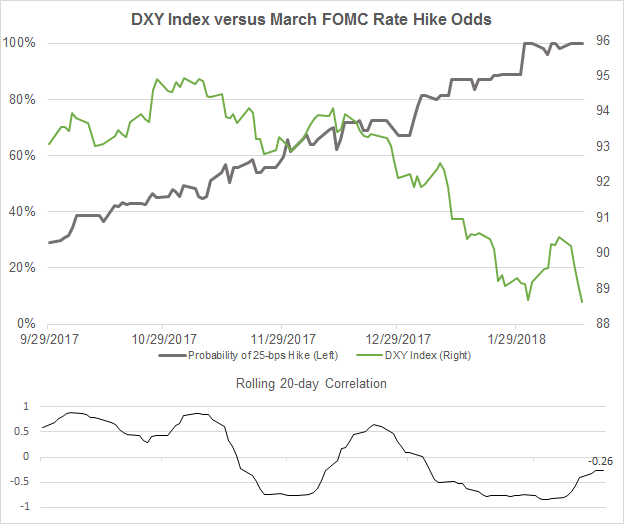

Chart 1: DXY Index versus March FOMC Rate Hike Odds (September 2017 to February 2018)

(Click on image to enlarge)

The US Dollar has ignored the climb in hike odds: when the implied probability of a hike hit 100% earlier this month, the correlation with the DXY Index was -0.84. The only reason why the correlation has turned less negative is because March hike odds have held at 100% while the DXY Index has continued to fall.

It's difficult to see how the market can view the Fed as a positive for the US Dollar moving forward given the lack of responsiveness to the climb in interest rates. It would thus appear that the US Dollar is taking on the role of a safe haven (rather than a growth currency) once more.

MAY RATE HIKE ODDS CLIMB FOR BOE

Last week, the Bank of England's Quarterly Inflation Report gave ample room for policymakers to begin talking up the possibility of a rate hike coming sooner than August. Despite the fact that Pound Sterling is up year-over-year, inflation remains stubbornly high near +3%, and policymakers believe that price pressures could remain elevated given the backdrop of rising energy prices.

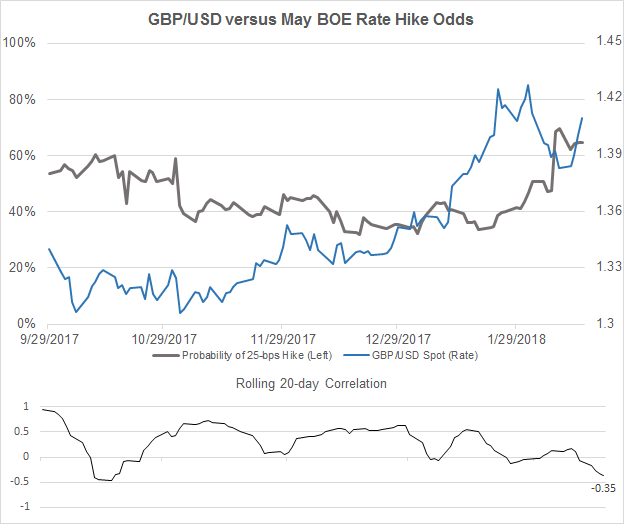

Chart 2: GBP/USD Spot versus May BOE Rate Hike Odds (September 2017 to February 2018)

(Click on image to enlarge)

Even though there is no significant correlation between hike odds and GBP/USD (20-day is -0.35), it appears that the Sterling priced in the jump in probability early: the 20-day correlation, factoring in a two-week lag in hike expectations, rises to +0.52.

The focus for traders should be on economic data developments in the near-term. Evidence that inflation readings will stay elevated over the next three-months should keep May rate hike odds pointing higher, supporting Pound Sterling. We're expecting one rate hike in 2018, and for the BOE to stay on hold no matter what after the August QIR is released, given the March 2019 deadline for the Brexit negotiations.

Comments

No Thumbs up yet!

No Thumbs up yet!