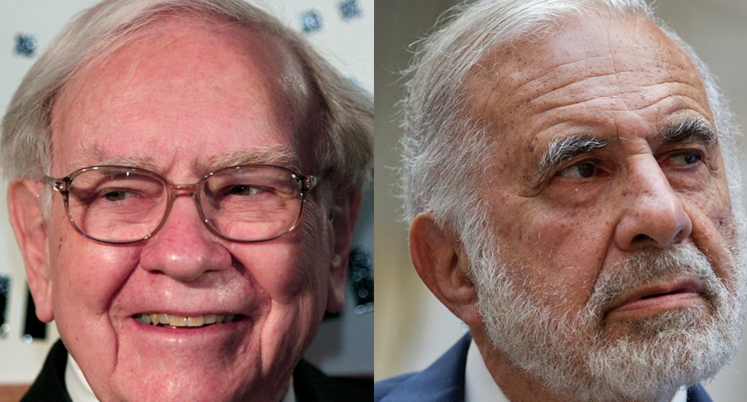

Buffett Versus Icahn: Who's Right? You Decide.

I have been developing a set of commentaries related to what I call “Wall Street Rules”, the rules by which many (most?) professional investors operate by. Rules such as “don’t fight the Fed”, the rule of 20, etc.

One aspect is the simplistic application of these rules among the most important being the inputs in the discounted cash flow (DCF) model, one of which includes interest rates.

In what I can only call a stunningly simplistic way of looking at interest rates and investing, Warren Buffett earlier today dismissed Carl Icahn’s concerns about the current exceptionally low interest rate environment. Buffett described interest rates in the context of a competing asset class to stocks (which it is) and as an input into the DCF (which it, also, is). But what frankly stunned me is how Buffett totally ignored why rates are this low.

Unless Mr. Buffett has some deep insight into other mitigating economic factors, to ignore why rates are so low (deflation, anyone?) is to ignore the potential economic consequences such a market signal is sending1.

Now, as the interview progressed2 Mr. Buffett acknowledges that when it comes to negative interest rates he has “no idea” what they mean and what the consequences might be. Yet, he goes to express his optimistic view on stocks and the economy despite stating that such a zero/negative interest rate environment is “uncharted territory”. If it is "unchartered territory" then why be dismissive of the dangers Mr. Icahn is concerned about?

Throughout the interview Mr. Buffett exhibits a profound lack of knowledge and understanding what zero and negative interest rates say about the global economic condition beyond how they enable higher stock market values3 – a Wall Street Rule in action.

You would think every thoughtful investor might want to know why rates are this low? And, therefore, does it not follow that one should treat the current stock market valuation model inputs with a degree of skepticism? In the case of this great investor, apparently not.

Here is the CNBC interview with Buffett – you judge for yourself:

1 This topic was the focus of my recent New York Society of Security Analysts event, which is discussed in part in my most recent Bloomberg radio segment. See my April 14th commentary, "Somethings Gotta Give"

2 It is posted in segments.

3 "If you had zero interest rates and you knew you were going to have them forever, stocks should sell at, you know, 100 times earnings or 200 times earnings."

Disclosure: Accounts managed by Blue Marble Research may presently hold a long/short position in the above mentioned issues and their inverse comparables.