BioDiesel Firm, Renewable Energy Group, Leads Our Upgrades For The Week

For today's edition of our upgrade list,we present you, UPGRADES to BUY or STRONG BUY* with complete forecast and valuation data. They are presented by one-month forecast return. Renewable Energy Group (REGI) is our top-rated upgrade this week.

|

Ticker |

Company Name |

Market Price |

Valuation |

Last 12-M Return |

1-M Forecast Return |

1-Yr Forecast Return |

P/E Ratio |

Sector Name |

|

RENEWABLE ENERG |

8.87 |

-23.78% |

4.72% |

0.82% |

9.84% |

3.45 |

Oils-Energy |

|

|

PROSPERITY BCSH |

54.39 |

-0.94% |

12.05% |

0.61% |

7.36% |

13.73 |

Finance |

|

|

ETHAN ALLEN INT |

29.66 |

-9.62% |

11.00% |

0.58% |

6.99% |

15.13 |

Retail-Wholesale |

|

|

FIRST INTST MT |

31.75 |

6.39% |

18.16% |

0.57% |

6.85% |

15.56 |

Finance |

|

|

JPMORGAN CHASE |

67.52 |

10.01% |

12.55% |

0.57% |

6.79% |

11.95 |

Finance |

*NOTE: These upgrades are all BUY rated, there are no STRONG BUY upgrades in our list this week.

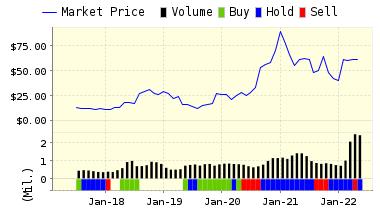

Below is today's data on Renewable Energy Group (REGI):

Renewable Energy Group Inc. is a biodiesel manufacturer and marketer. The Company is focused on converting natural fats, oils and greases into biodiesel. It sells REG-9000 biodiesel to distributors throughout the United States. Renewable Energy Group Inc. is headquartered in Ames, Iowa.

Recommendation: We updated our recommendation from HOLD to BUY for RENEWABLE ENERG on 2016-10-14. Based on the information we have gathered and our resulting research, we feel that RENEWABLE ENERG has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE P/E Ratio and Price Sales Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

8.94 | 0.82% |

|

3-Month |

8.97 | 1.12% |

|

6-Month |

8.93 | 0.69% |

|

1-Year |

9.74 | 9.84% |

|

2-Year |

8.72 | -1.74% |

|

3-Year |

6.21 | -30.00% |

Market Overview

|

Summary of VE Stock Universe |

|

|

Stocks Undervalued |

53.05% |

|

Stocks Overvalued |

46.95% |

|

Stocks Undervalued by 20% |

21.68% |

|

Stocks Overvalued by 20% |

15.16% |

Sector Overview

|

Sector |

Change |

MTD |

YTD |

Valuation |

Last 12-MReturn |

P/E Ratio |

|

Industrial Products |

0.10% |

-2.79% |

15.47% |

5.37% overvalued |

11.43% |

23.24 |

|

Utilities |

-0.09% |

-2.07% |

9.04% |

4.47% overvalued |

11.45% |

21.80 |

|

Oils-Energy |

-0.35% |

1.83% |

20.74% |

4.05% overvalued |

-8.47% |

26.57 |

|

Computer and Technology |

-0.09% |

-2.72% |

15.15% |

3.28% overvalued |

5.57% |

29.48 |

|

Multi-Sector Conglomerates |

0.06% |

-1.26% |

6.32% |

2.02% overvalued |

-0.86% |

20.79 |

|

Consumer Staples |

-0.21% |

-1.98% |

8.67% |

1.90% overvalued |

8.15% |

23.86 |

|

Finance |

0.21% |

-1.19% |

6.29% |

0.24% overvalued |

3.31% |

16.45 |

|

Basic Materials |

-0.22% |

-3.46% |

39.90% |

0.28% undervalued |

40.22% |

28.32 |

|

Aerospace |

0.12% |

-1.18% |

1.42% |

0.46% undervalued |

5.52% |

17.84 |

|

Business Services |

0.02% |

-2.25% |

12.19% |

1.66% undervalued |

-0.80% |

24.23 |

|

Consumer Discretionary |

0.17% |

-1.78% |

7.73% |

2.92% undervalued |

-0.07% |

23.78 |

|

Transportation |

-0.20% |

-1.43% |

9.60% |

3.85% undervalued |

-14.21% |

16.44 |

|

Construction |

0.32% |

-1.72% |

29.23% |

5.07% undervalued |

11.88% |

19.70 |

|

Retail-Wholesale |

-0.03% |

-0.96% |

-0.37% |

5.58% undervalued |

-1.97% |

21.94 |

|

Auto-Tires-Trucks |

0.08% |

-1.57% |

6.03% |

5.61% undervalued |

6.16% |

14.96 |

|

Medical |

-0.90% |

-2.45% |

0.62% |

6.50% undervalued |

-7.75% |

25.85 |

Valuation Watch: Overvalued stocks now make up 46.95% of our stocks assigned a valuation and 15.16% of those equities are calculated to be overvalued by 20% or more. Seven sectors are calculated to be overvalued.

Disclaimer: ValuEngine.com is an independent research ...

more