A Tale Of Two Recoveries; And The Visible End Of One

If central banks are now almost exclusively on the defensive, we have no shortage of anecdotes and data to explain it. For a good long while economists and commentary managed to keep the US safely “decoupled” from the “overseas” maelstrom, but the deluge locally has become far too much to ignore. This is far, far deeper than just some indistinct weakness attending oil supply, as the chorus continues to swell toward the dreaded recessionary concepts.

Being flooded and overwhelmed by the “dollar” and its heavy presence is one thing, as much as it might be discarded and ignored as if some distant performance without tangibility. Instead, the “dollar’s” unwelcome financial intrusion presaged economic difficulties (true discounting quite beside what stocks do nowadays) that are just now crashing onshore. We have seen the bolt of manufacturing sentiment manifest in angry and ugly PMI’s, but now the true test.

Back in September, Challenger, Gray & Christmas tallied a flat expectation for temporary retail hiring. It seems as if retailers, already quite aware the current sales environment while also cognizant of all the ways last Christmas failed to live up to the hype, aren’t in a festive mood when it comes to managing their labor utilization this year. Most of the major retailers have already announced basically the same staffing levels as last year’s, which fell far short of initial estimates at the season’s outset. WalMart is sticking with just 60k, as Target is doing at 70k. UPS is looking for 90k to 95k, which is the same as last year though it should be pointed out that the firm ended up adding 100k by the time it was over. The only major retailer planning to add more staff is Amazon, increasing to 100k or 25% more than 2014.

With such a cautious labor tone, the next creep in departing from the “recovery” narrative is already beginning in the traffic of goods; or, specifically, the lack of traffic. This isn’t just China’s obvious industrial slowing, but rather companies already in the US wondering where this grand economy actually is (and has been). Again, this is not any financial dollar impact upon accounting statements, but the actual production and shipment of real goods:

From railroads to manufacturers to energy producers, businesses say they are facing a protracted slowdown in production, sales and employment that will spill into next year. Some of them say they are already experiencing a downturn.

“The industrial environment’s in a recession. I don’t care what anybody says,” Daniel Florness, chief financial officer of Fastenal Co., told investors and analysts earlier this month. A third of the top 100 customers for Fastenal’s nuts, bolts and other factory and construction supplies have cut their spending by more than 10% and nearly a fifth by more than 25%, Mr. Florness said.

And yet, economists remain completely undeterred, downplaying or engaging in duplicitousness where convenient. Even if you think manufacturing and the “goods economy” are unimportant to overall US function, what matters then is not that potential endpoint but the trajectory in how we got here. In other words, last year there was “going to be” no weakness at all, none, anywhere. It was supposed to be so immense that the Fed was to be worried far more so about “overheating” than anything else. Now, in sharp and cutting contrast, manufacturers are already speaking the “R-word.”

Economists, thinking only in straight lines, don’t seem capable of imagining the ripples; as if a manufacturing recession, if that is what turns out, occurs in a vacuum rather than as a waypoint for the “dollar’s” overall economic journey through the whole works – services and all. Ceteris paribus was one of the worst inventions in econometric pursuit:

Such strength suggests that the broader economy is unlikely to succumb to the industrial sector’s gloom, especially given robust profit margins, said Jeremy Zirin, chief U.S. equity strategist for wealth management at UBS. “The broad mosaic of data suggests that the U.S. economy is still doing OK,” Mr. Zirin said. “This isn’t a very bullish view, it’s just saying things aren’t as bad as feared.”

Others worry that the slowdown is spreading to consumer businesses. Wal-Mart recently warned its sales this year are likely to be flat, down from projection of as much as 2% growth, and cut its earnings forecast for next year as it raises wages. The retailer blamed the strong dollar for the weakening sales growth.

And truckload carriers have warned that they aren’t witnessing the usual uptick in retailer demand as the holiday season approaches, thanks to stubbornly high inventories, said Alex Vecchio, a transportation analyst at Morgan Stanley. “Transportation companies are typically a leading indicator, and our data is not good,” Mr. Vecchio said.

Again, it’s not just that manufacturing and shipping might be struggling, it is the way in which that occurred and where it suggests this all might be going. Wherever that might be, the “dollar” will already be there. The chronology shows that rather too clearly.

1. Dollar doesn’t matter, indicates strong economy relative to the world

2. Dollar matters for oil, but lower oil prices mean stronger consumer

3. Manufacturing slump doesn’t matter, only temporary

4. Manufacturing declines are consumer spending, but only a small part

5. Manufacturing declines are becoming serious, but only from overseas

6. Maybe domestic manufacturing recession too, but the rest of the economy is strong

7. Rest of the economy might not be as strong as thought, but only an “earnings recession.”

8. Maybe full recession, but only a small probability.

9. …

At each step, economists suggest how or why it doesn’t matter and therefore that is the end of the progression for them; meanwhile, the economy continues in exactly that same headway forcing a further retreat and new denial every time. Like entropy, the economic “arrow” is moving only in one direction. And even where we are now, with serious financial volatility mingling with rapidly sparking economic uncertainty, there remains the unmoved inventory pile. With the “dollar” working its way through “demand”, it is inventory that will eventually take on supply.

If the distance between that very real economic development and what economists are depending upon against it could be simply described, it is this:

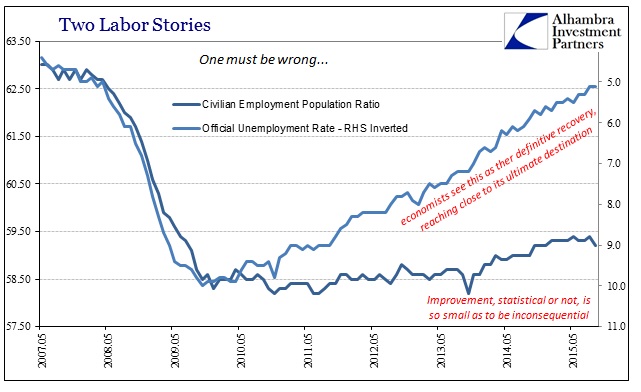

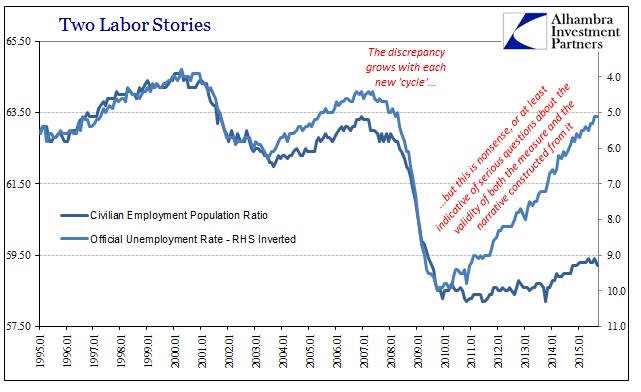

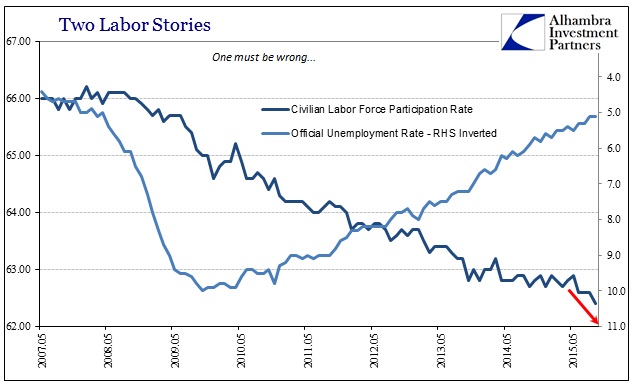

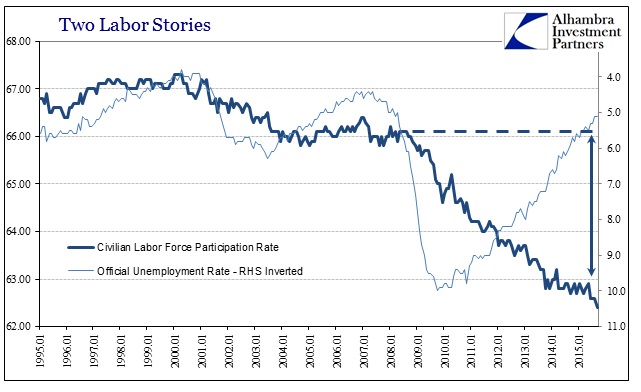

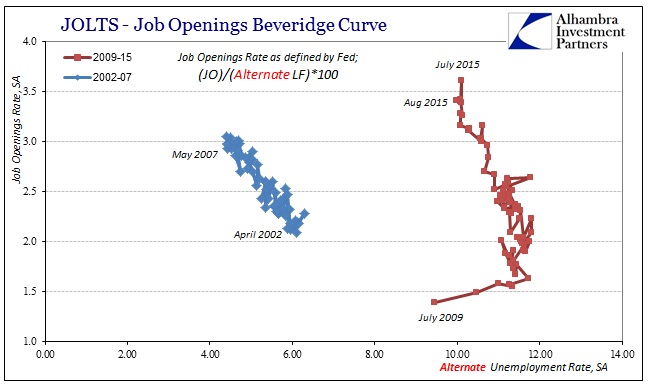

It is finally catching up, it seems, that the real economy’s function is not converging with the unemployment rate’s hopeful suggestions, yet economists are unflappable in converting that into the basis for all expectation. All the mysteries supposedly created by the unemployment rate are easily absorbed by viewing labor, and thus the economy, by the participation rates instead; the unemployment rate says that “slack” is gone or nearly so, yet wages are “somehow” stuck, a point even economists concede without incorporating the fateful discrepancy. So spending that should materialize as jobs are supposed to have been plentiful never shows up and leaves actual businesses holding inventory for all that, creating the conditions now for the “impossible” manufacturing collapse. If we are to use 2015 to decide the difference between those labor views, it is no contest in favor of the participation rates, as the unemployment rate (and the labor measures close to it) just doesn’t correlate with anything but self-reinforced and circular mainstream rhetoric.

In fact, it is much worse than even that view, as the labor forceparticipation rate suggests even less of a recovery and still less so recently. In past “cycles”, when jobs recede so does labor participation. Economists would have you think this one is highly different, as if Baby Boomers picked the Great Recession and its aftermath for retirement, but the mounting evidence unfortunately suggests that it is not; the labor force is shrinking again which would be far more consistent with the manufacturing and shipping environment stated above by the companies closest to the real economy rather than the ideal scenario pulled together from academic musings about mathematically-based subjective and ideological theory. The recovery, especially in 2015, is as QE; a carefully constructed story and legend that so completely falls apart when finally and directly challenged.

Disclosure: None.